UBS has increased its price target for Amicus (FOLD, Financial) from $21 to $22, maintaining a Buy rating on the stock. Though projections for 2025 regarding Pompe disease have been adjusted downwards, the overall long-term outlook remains positive. Additionally, the analyst points out that the agreement with Dimerix is seen as a beneficial move for the company.

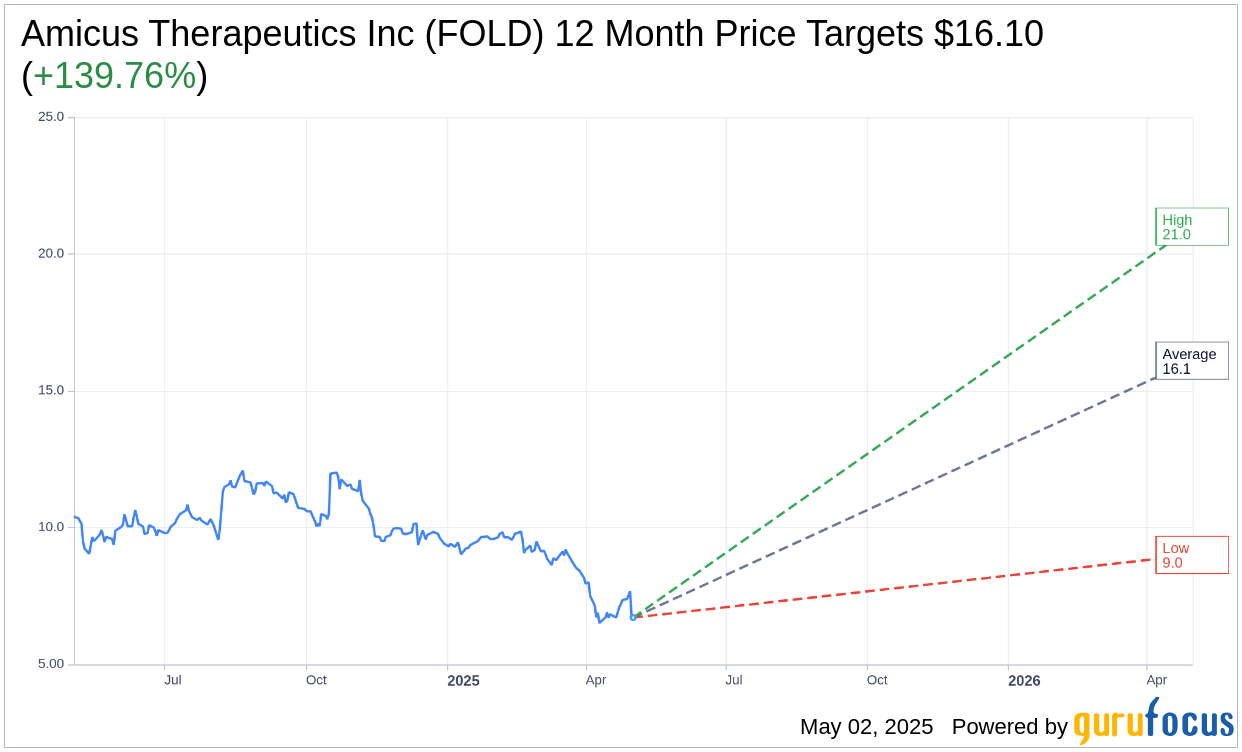

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Amicus Therapeutics Inc (FOLD, Financial) is $16.10 with a high estimate of $21.00 and a low estimate of $9.00. The average target implies an upside of 139.76% from the current price of $6.72. More detailed estimate data can be found on the Amicus Therapeutics Inc (FOLD) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Amicus Therapeutics Inc's (FOLD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Amicus Therapeutics Inc (FOLD, Financial) in one year is $20.36, suggesting a upside of 203.2% from the current price of $6.715. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Amicus Therapeutics Inc (FOLD) Summary page.

FOLD Key Business Developments

Release Date: February 19, 2025

- Total Revenue: $528 million for the full year 2024, a 32% increase year over year.

- Galafold Revenue: $458 million, representing 18% growth year over year.

- POMBILITI and OPFOLDA Revenue: Over $70 million globally for the full year 2024.

- Cost of Goods Sold: 10% of net sales for the full year 2024.

- GAAP Operating Expenses: $450 million in 2024, a 3% increase from 2023.

- Non-GAAP Operating Expenses: $348 million in 2024, a 2% increase from 2023.

- GAAP Net Loss: $56 million or $0.18 per share in 2024.

- Non-GAAP Net Income: $74 million or $0.24 per share in 2024.

- Cash, Cash Equivalents, and Marketable Securities: $250 million as of December 31, 2024.

- Projected Revenue Growth for 2025: 17% to 24% at constant exchange rates.

- Galafold Projected Revenue Growth for 2025: 10% to 15% at constant exchange rates.

- POMBILITI and OPFOLDA Projected Revenue Growth for 2025: 65% to 85% at constant exchange rates.

- Gross Margin: Expected to be in the mid-80s percent range for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Amicus Therapeutics Inc (FOLD, Financial) reported a significant revenue growth of 32% year-over-year, reaching $528 million for the full year 2024.

- Galafold, a key product for Amicus, achieved $458 million in revenue, marking an 18% growth year-over-year, driven by strong patient demand and market penetration.

- The company successfully launched POMBILITI and OPFOLDA for late-onset Pompe disease, generating over $70 million in revenue globally in their first year.

- Amicus achieved non-GAAP profitability for the full year 2024, demonstrating strong financial management and operational efficiency.

- The company is on track to surpass $1 billion in total sales by 2028, with a clear path to continued revenue growth and profitability in the coming years.

Negative Points

- Amicus Therapeutics Inc (FOLD) reported a GAAP net loss of $56 million for 2024, although this was an improvement from the previous year.

- The company faces significant foreign exchange exposure, with 60% of its revenue generated outside the United States, which could impact reported revenues.

- There is a risk of non-linear revenue growth within the year due to factors like uneven ordering patterns and FX fluctuations, particularly affecting Galafold sales.

- The launch of POMBILITI and OPFOLDA in new markets is subject to regulatory and reimbursement processes, which could delay revenue recognition in certain regions.

- Amicus is still working on establishing second-source manufacturing for PomOp, which could pose supply chain risks if not completed as planned.