Key Highlights:

- DuPont shares gained 1.6% despite predicting Q2 earnings and revenue below expectations.

- The company reported a Q1 net loss of $589M due to a major impairment charge.

- Potential tariffs might affect annual earnings by $60 million.

DuPont's Recent Performance Overview

DuPont de Nemours Inc. (DD, Financial) experienced a 1.6% uptick in early trading, even as the company projected second-quarter earnings and revenues to fall short of market expectations. Despite reporting a first-quarter net loss of $589 million—attributable mainly to a substantial impairment charge—DuPont has maintained its full-year guidance above analyst projections. Nevertheless, looming tariffs pose a potential impact, possibly diminishing annual earnings by $60 million.

Wall Street Analyst Expectations

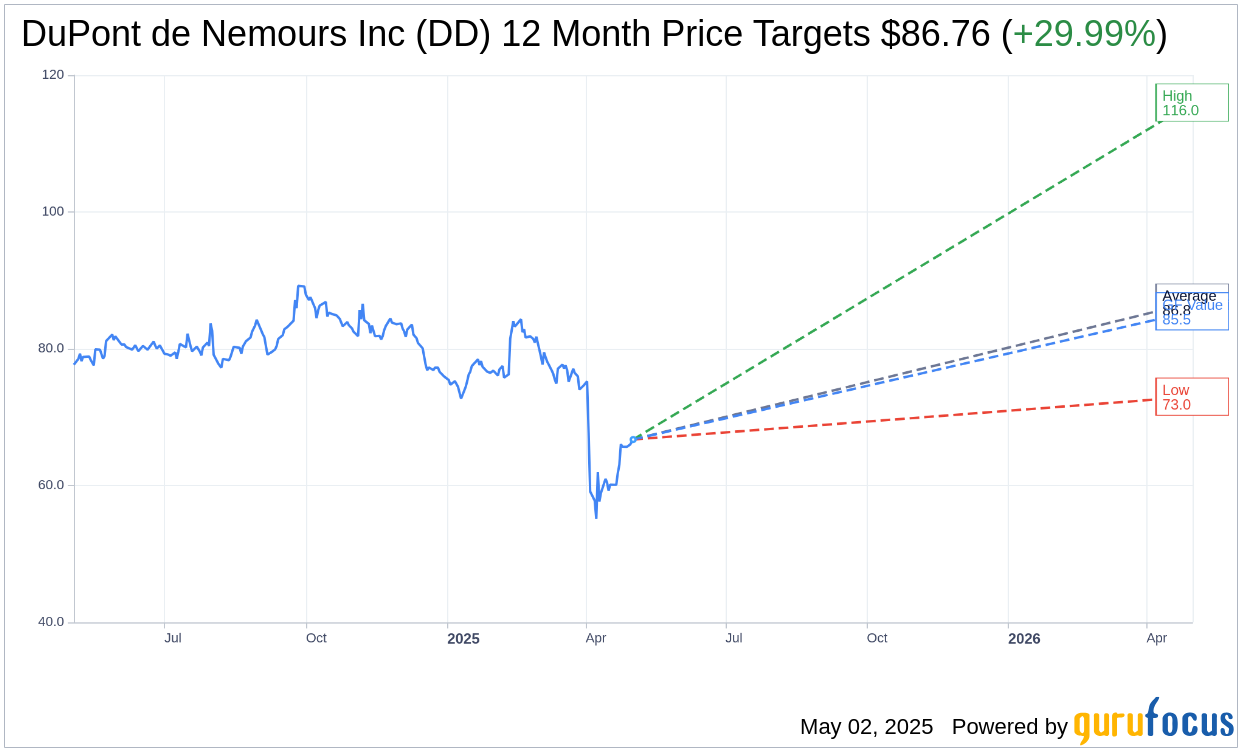

According to the one-year price targets provided by 15 seasoned analysts, the average target price for DuPont de Nemours Inc. (DD, Financial) stands at $86.76. The price estimates range from a high of $116.00 to a low of $73.00, indicating a potential upside of 29.99% from its current price of $66.74. Investors can explore more detailed estimation data by visiting the DuPont de Nemours Inc (DD) Forecast page.

Analyst Recommendations and Insights

Reflecting a consensus across 19 brokerage firms, DuPont de Nemours Inc.'s (DD, Financial) average brokerage recommendation is 2.1, which suggests a current "Outperform" status. The rating system ranges from 1 to 5, with 1 representing a Strong Buy and 5 signifying a Sell.

Assessing DuPont's Fair Value

From a valuation perspective, GuruFocus estimates the one-year GF Value for DuPont de Nemours Inc. (DD, Financial) at $85.48. This estimation suggests a potential upside of 28.08% from the current trading price of $66.74. The GF Value is deemed GuruFocus' fair value estimate for the stock, calculated based on the historical multiples at which the stock has traded, past business growth, and future performance estimates. For more comprehensive insights, investors are encouraged to visit the DuPont de Nemours Inc (DD) Summary page.