On May 2, 2025, analyst John Barnidge from Piper Sandler announced an updated outlook for Globe Life (GL, Financial), a key player on the NYSE. The firm maintains an "Overweight" rating on the stock, reflecting ongoing confidence in its performance.

However, Barnidge has adjusted the price target for Globe Life (GL, Financial) from the previous rate of $152.00 USD to a revised figure of $147.00 USD. This change marks a decline of approximately 3.29% in the price target. Despite this adjustment, the maintained "Overweight" rating signifies an expectation for the stock to perform better than the market average moving forward.

Investors in Globe Life (GL, Financial) should note this update from Piper Sandler, as it provides guidance on the firm's perceived valuation of the company. As the market conditions evolve, these insights could assist shareholders in making strategic decisions regarding their investments in Globe Life.

Wall Street Analysts Forecast

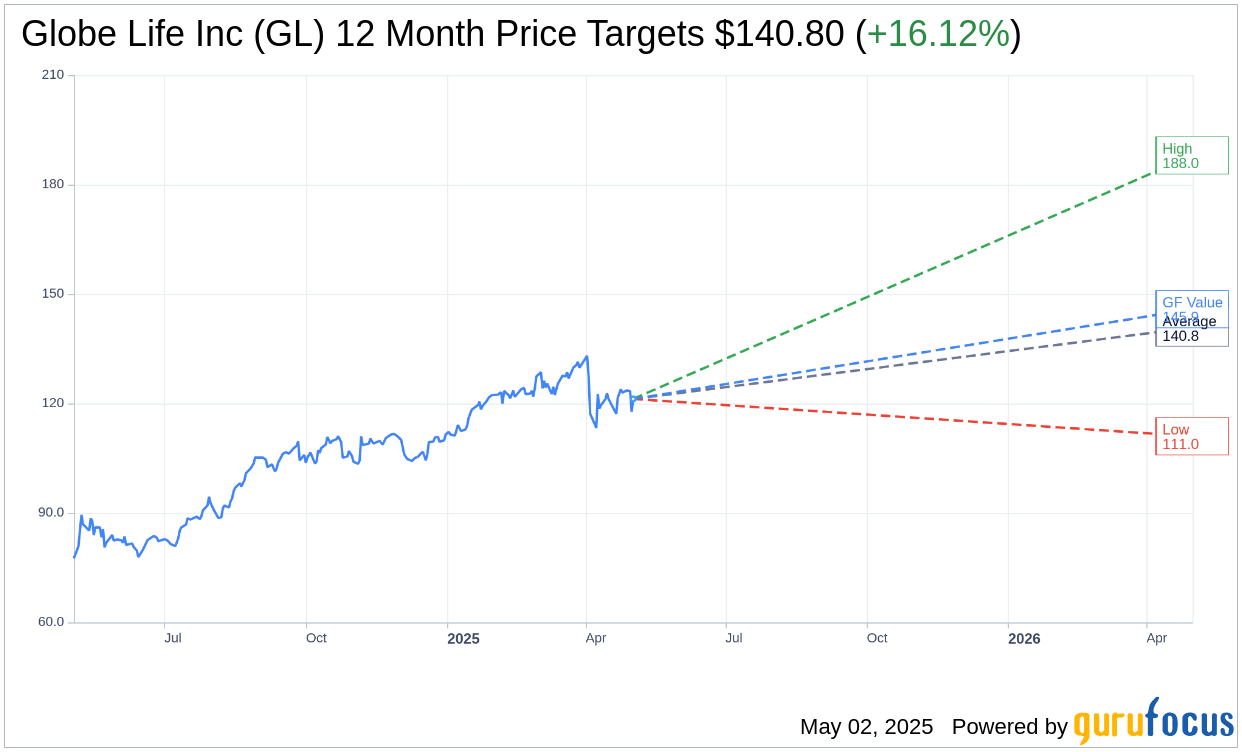

Based on the one-year price targets offered by 10 analysts, the average target price for Globe Life Inc (GL, Financial) is $140.80 with a high estimate of $188.00 and a low estimate of $111.00. The average target implies an upside of 16.12% from the current price of $121.25. More detailed estimate data can be found on the Globe Life Inc (GL) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Globe Life Inc's (GL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Globe Life Inc (GL, Financial) in one year is $145.86, suggesting a upside of 20.3% from the current price of $121.25. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Globe Life Inc (GL) Summary page.