- Taiwan Semiconductor Manufacturing (TSM, Financial) experiences a 3% stock boost after Morgan Stanley names it a Top Pick.

- Analysts predict a potential 20.87% upside for TSM, with a target price of $216.58.

- The stock holds an "Outperform" consensus rating from major brokerage firms.

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) recently witnessed a notable increase in its share price, climbing approximately 3%, spurred by Morgan Stanley reinstating TSM as a Top Pick. This decision aligns with promising AI capital expenditure forecasts from key tech players like Meta Platforms and Microsoft. Morgan Stanley has assigned an Overweight rating to TSM, with a price target of NT$1,288, highlighting shifts in AI demand and supply dynamics as significant growth drivers.

Wall Street Analysts Forecast

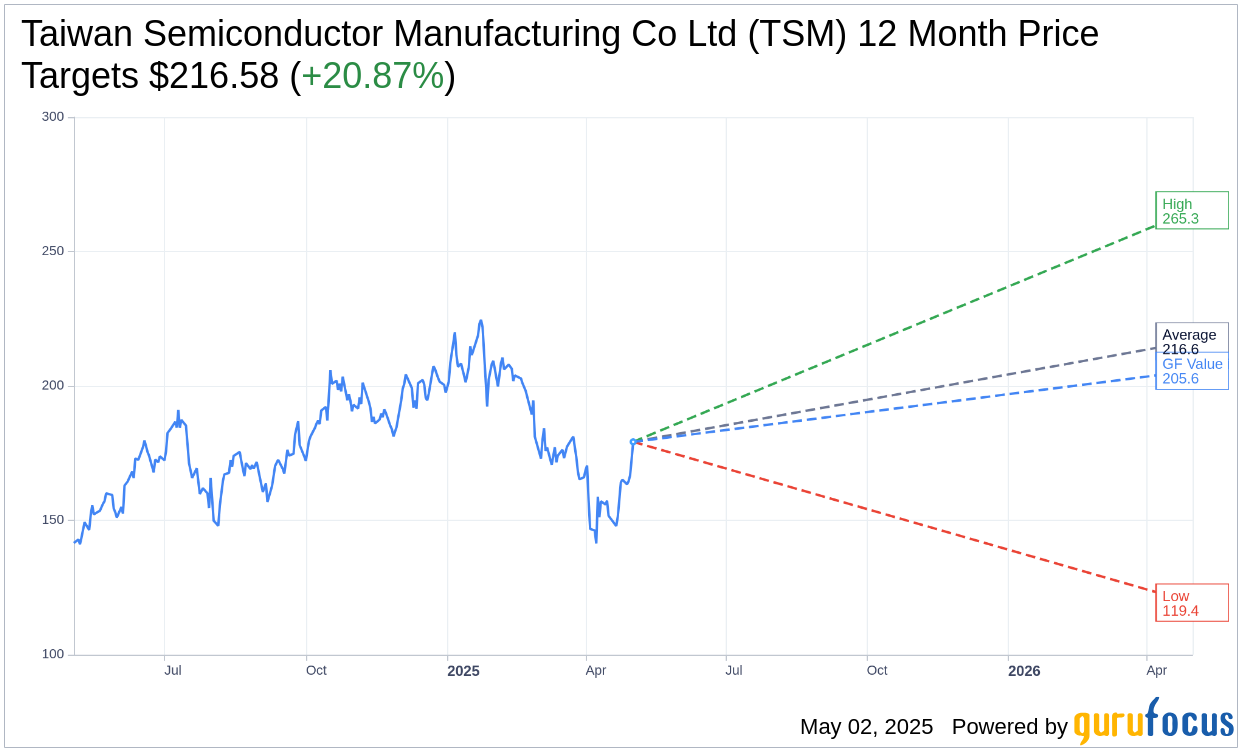

Delving into analyst perspectives, 15 industry experts have projected a one-year price target for TSM. The average estimate stands at $216.58, presenting a potential upside of 20.87% from its current market value of $179.19. These projections range from a high of $265.34 to a low of $119.37, reflecting diverse expectations regarding TSM's performance. For more in-depth analysis, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Forecast page.

The consensus among 18 brokerage firms labels TSM as an "Outperform," with an average recommendation score of 1.6. The scale used ranges from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell. This consensus underscores the positive sentiment surrounding TSM's market prospects.

According to estimates from GuruFocus, the GF Value for TSM over the next year is pegged at $205.63, forecasting a potential upside of 14.76% from the current trading price of $179.185. The GF Value is a proprietary metric by GuruFocus, deduced from historical trading multiples, previous business growth, and anticipated future performance. Detailed insights and data can be accessed on the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.