On May 2, 2025, Keefe, Bruyette & Woods' analyst Jade Rahmani announced an update regarding NexPoint Real Estate (NREF, Financial). The firm's analyst has maintained the current rating of "Market Perform" for the company. This decision reflects the analyst's ongoing evaluation of the company's performance within the market.

Despite maintaining the same rating, Rahmani has adjusted the price target for NexPoint Real Estate (NREF, Financial) from its previous value. The price target has been lowered from $15.00 to $14.50. This adjustment signifies a decrease of 3.33 percent in the targeted stock price. Such a revision indicates a cautious stance on the part of the analyst concerning the company's future valuation.

NexPoint Real Estate (NREF, Financial) continues to be monitored closely by market analysts and investors alike. The company's recent performance and developments will remain under scrutiny as stakeholders assess the broader implications of the revised price target and maintained rating.

Wall Street Analysts Forecast

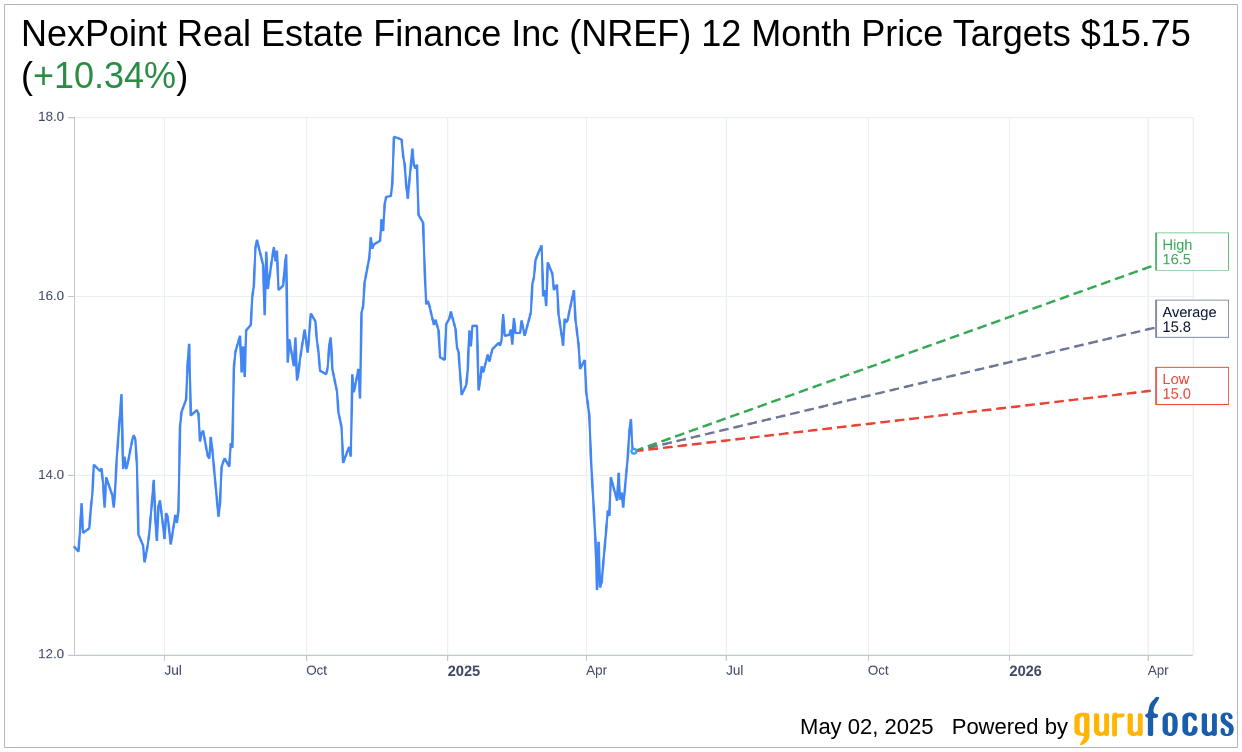

Based on the one-year price targets offered by 2 analysts, the average target price for NexPoint Real Estate Finance Inc (NREF, Financial) is $15.75 with a high estimate of $16.50 and a low estimate of $15.00. The average target implies an upside of 10.34% from the current price of $14.27. More detailed estimate data can be found on the NexPoint Real Estate Finance Inc (NREF) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, NexPoint Real Estate Finance Inc's (NREF, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.