Key Takeaways:

- Camden Property Trust beats expectations with a strong first quarter, hiking its full-year core FFO guidance.

- Analyst consensus points to a positive outlook, with a target price suggesting potential upside.

- GuruFocus estimates indicate a moderate increase in fair value over the next year.

Camden Property Trust (CPT, Financial) showcased robust performance in the first quarter, exceeding operating expectations by $0.04 per share. This achievement led the company to elevate its full-year core FFO guidance to $6.78 per share. The decision was bolstered by reduced interest expenses stemming from a strategic $600 million commercial paper program. Camden continues to focus its strategic initiatives on the lucrative Sunbelt markets, eyeing substantial growth prospects.

Wall Street Analysts Forecast

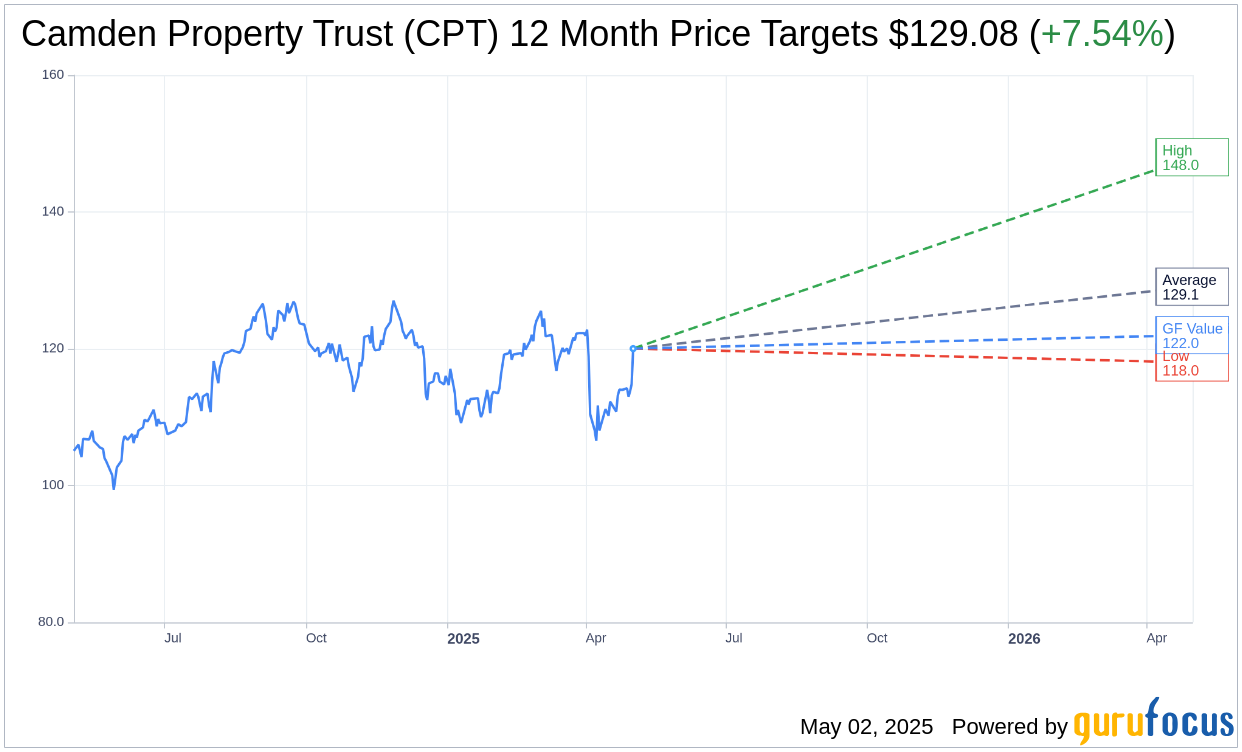

The sentiment among 21 analysts concerning Camden Property Trust (CPT, Financial) is one of cautious optimism. The average one-year price target is set at $129.08, flanked by a high projection of $148.00 and a low of $118.00. This average target indicates a potential upside of 7.54% from the current trading price of $120.03. For a more in-depth analysis, visit the Camden Property Trust (CPT) Forecast page.

Overall, the consensus from 25 brokerage firms places Camden Property Trust (CPT, Financial) with an average recommendation rating of 2.4, aligning with an "Outperform" status. This is based on a rating scale where 1 represents a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value for Camden Property Trust (CPT, Financial) in one year stands at $121.99. This suggests a potential increase of 1.63% from the current price of $120.03. The GF Value reflects GuruFocus' measure of the stock's fair trading value, determined by historic trading multiples, past business growth, and future performance forecasts. Access more detailed information on the Camden Property Trust (CPT) Summary page.