Key Takeaways:

- The Trump administration's FAST-41 initiative expedites permitting for Teck Resources' NorthMet project.

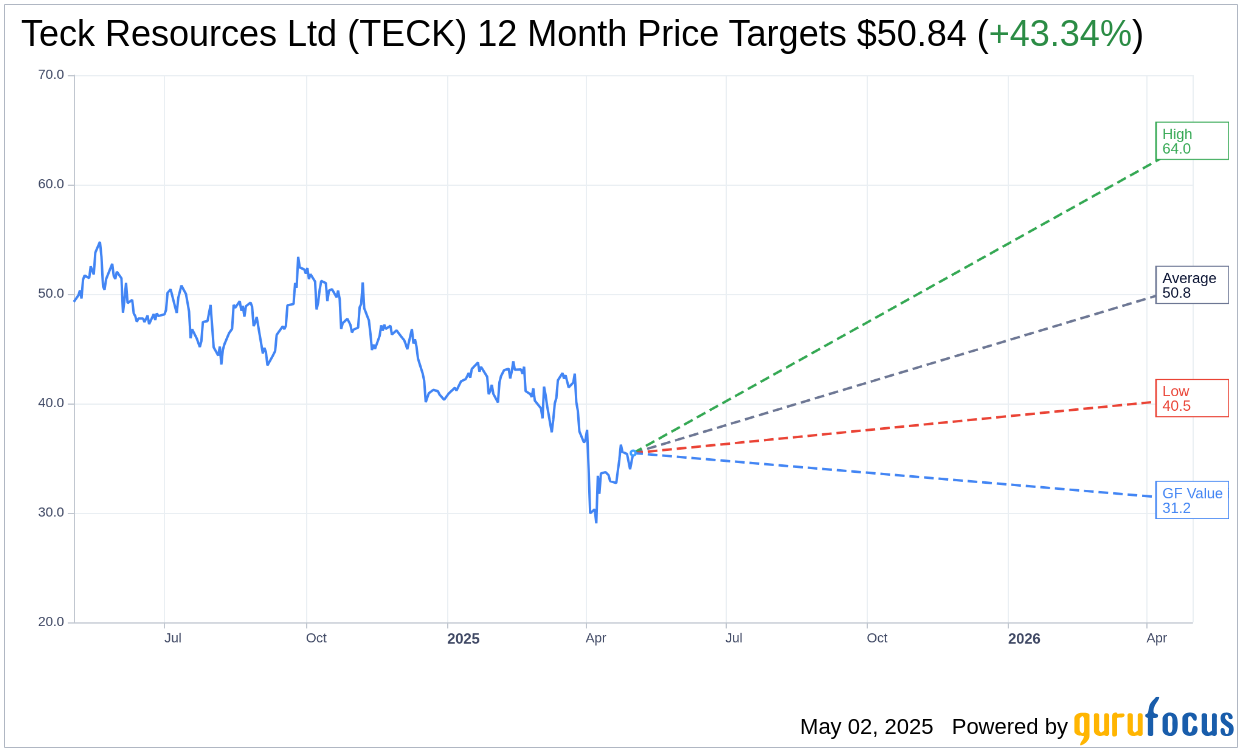

- Analysts project an average upside of 43.34% for Teck Resources Ltd (TECK, Financial), with a target price of $50.84.

- Teck Resources is rated "Outperform" by brokerage firms, though GuruFocus estimates a potential downside.

The Trump administration's decision to include Teck Resources' (TECK) NorthMet copper and nickel mine in its expedited permitting list under the FAST-41 initiative marks a significant step in enhancing critical mineral production. This strategic move aims to mitigate China's dominance in the sector, thereby fostering a more balanced global mineral market.

Wall Street Analysts' Insights

Top analysts have set a one-year price target for Teck Resources Ltd (TECK, Financial), resulting in an average target price of $50.84. This target represents an anticipated upside of 43.34% from TECK's current price of $35.47, demonstrating strong growth potential. Further analysis reveals a high estimate of $64.01 and a low estimate of $40.49. Investors can access more detailed forecast data on the Teck Resources Ltd (TECK) Forecast page.

With a consensus recommendation score of 1.8, derived from insights by 15 brokerage firms, TECK is currently rated as "Outperform." This score suggests that analysts perceive the stock as a favorable investment, with a scale ranging from 1 (Strong Buy) to 5 (Sell).

GuruFocus's Perspective on GF Value

According to GuruFocus metrics, the estimated GF Value for Teck Resources Ltd (TECK, Financial) over the next year is $31.19. This figure suggests a potential downside of 12.07% from its current price. The GF Value reflects GuruFocus' calculated fair value for the stock, considering historical trading multiples, past business growth, and projected future performance. Investors searching for more comprehensive data should visit the Teck Resources Ltd (TECK) Summary page.