- Cummins Inc. (CMI, Financial) is preparing to announce its Q1 earnings, with projections indicating a potential year-over-year decline.

- Analysts have set an average one-year price target suggesting a notable upside from current levels.

- The stock holds an "Outperform" rating from multiple brokerage firms, with fair value estimates suggesting modest growth.

Anticipation Builds for Cummins' Q1 Earnings

Cummins Inc. (CMI) is gearing up to release its first-quarter earnings report on May 5. Analysts are predicting earnings per share (EPS) of $4.92 on revenues of $8.17 billion. Despite the company's history of exceeding expectations, the latest revisions reveal tempered views, hinting at possible year-over-year declines.

Wall Street's Projections for Cummins

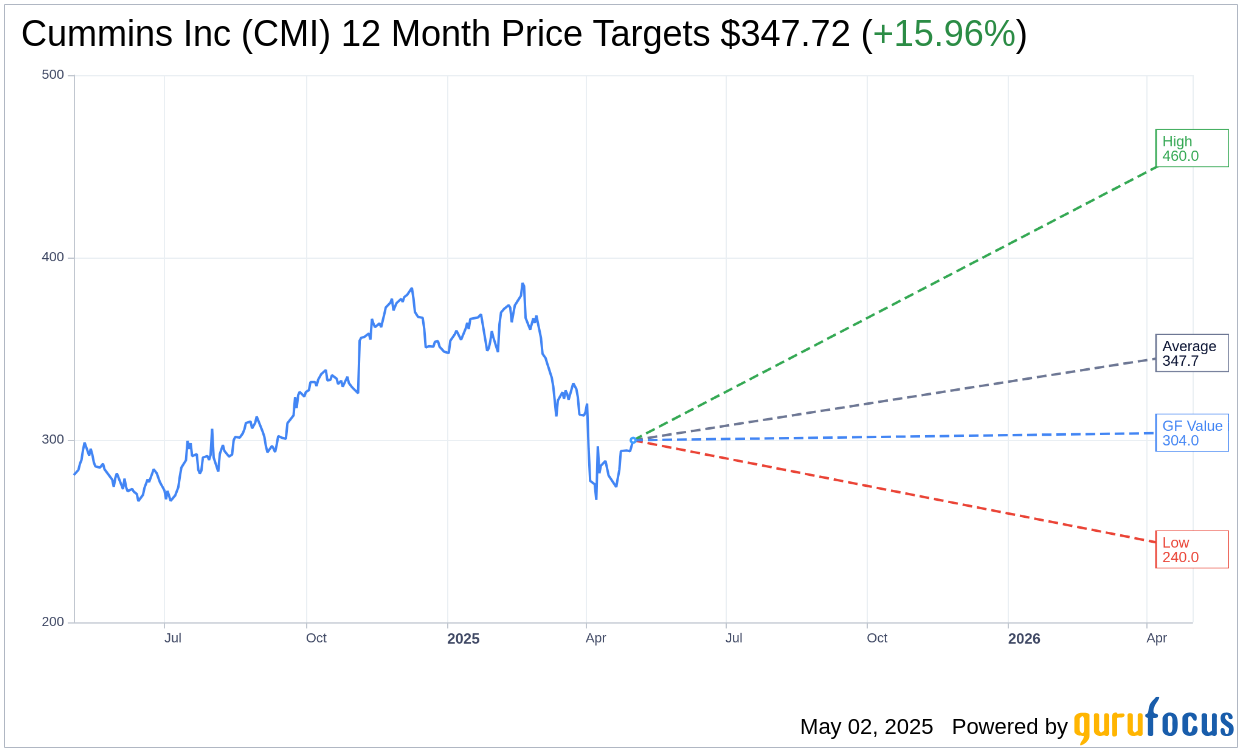

Currently, 16 analysts have issued one-year price targets for Cummins Inc. (CMI, Financial), with an average target price of $347.72. This reflects a potential upside of 15.96% from the present share price of $299.85. The targets range from a high of $460.00 to a low of $240.00. For further insights, visit the Cummins Inc. (CMI) Forecast page.

In terms of analyst sentiment, 24 brokerage firms collectively rate Cummins Inc. (CMI, Financial) with an average recommendation of 2.5, which translates to an "Outperform" rating. The scale used by analysts ranges from 1, denoting a Strong Buy, to 5, indicating a Sell.

Evaluating Cummins Through GuruFocus Metrics

According to GuruFocus, the projected GF Value for Cummins Inc. (CMI, Financial) over the next year is $304.00. This suggests a modest upside of 1.38% from the current market price of $299.85. The GF Value metric represents GuruFocus' estimation of a stock's fair value, calculated using historical trading multiples, past business growth, and anticipated future performance. For a deeper dive into these metrics, see the Cummins Inc. (CMI) Summary page.