Monolithic Power Systems (MPWR, Financial), a prominent name in the semiconductor industry, has recently received encouraging news from Citigroup in their latest analyst report. The firm's analyst, Kelsey Chia, has maintained a "Buy" rating for the stock, indicating continued confidence in its potential for investors.

In addition to maintaining the "Buy" rating, Citigroup has raised its price target for Monolithic Power Systems (MPWR, Financial) from $615.00 to $700.00. This adjustment represents a notable 13.82% increase from the prior target, signaling optimism about the company's future performance and potential market growth.

The updated price target and maintained rating underscore Citigroup's positive outlook on Monolithic Power Systems (MPWR, Financial), reflecting potential value for stakeholders and market watchers. Investors and analysts alike will likely keep a close eye on MPWR as it progresses in the competitive semiconductor sector.

Wall Street Analysts Forecast

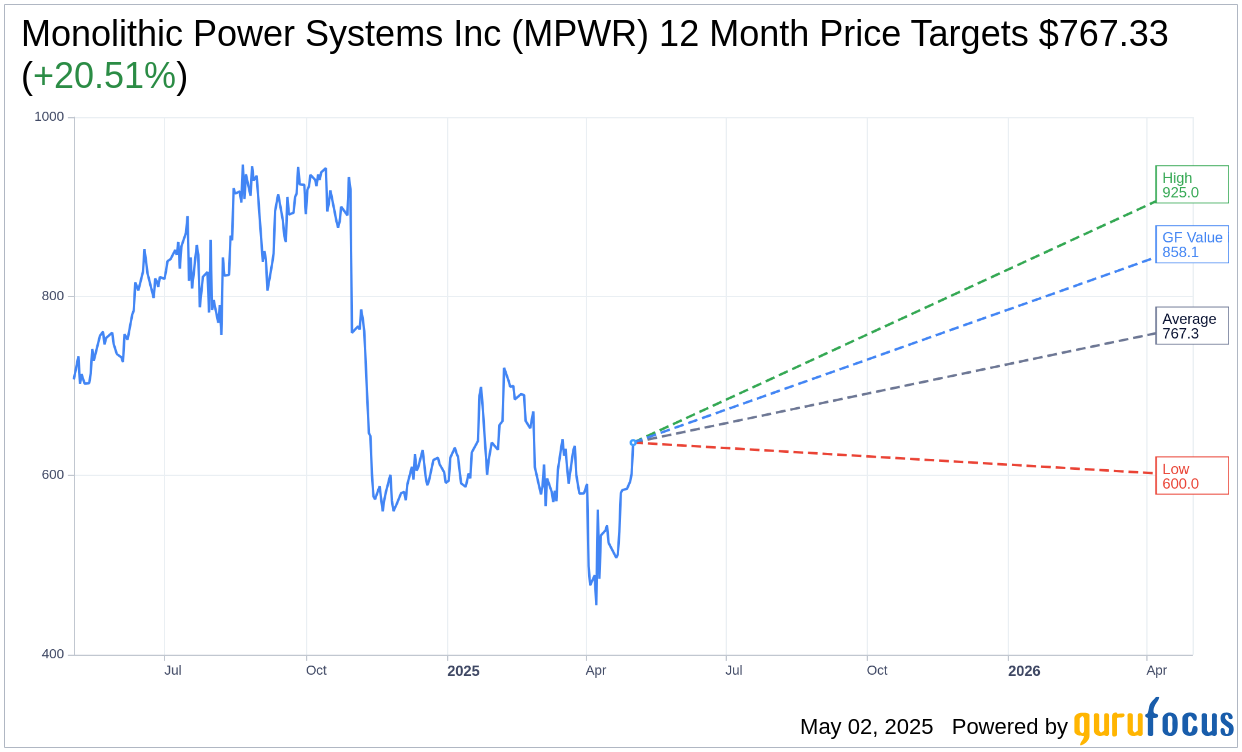

Based on the one-year price targets offered by 13 analysts, the average target price for Monolithic Power Systems Inc (MPWR, Financial) is $767.33 with a high estimate of $925.00 and a low estimate of $600.00. The average target implies an upside of 20.51% from the current price of $636.74. More detailed estimate data can be found on the Monolithic Power Systems Inc (MPWR) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Monolithic Power Systems Inc's (MPWR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Monolithic Power Systems Inc (MPWR, Financial) in one year is $858.12, suggesting a upside of 34.77% from the current price of $636.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Monolithic Power Systems Inc (MPWR) Summary page.