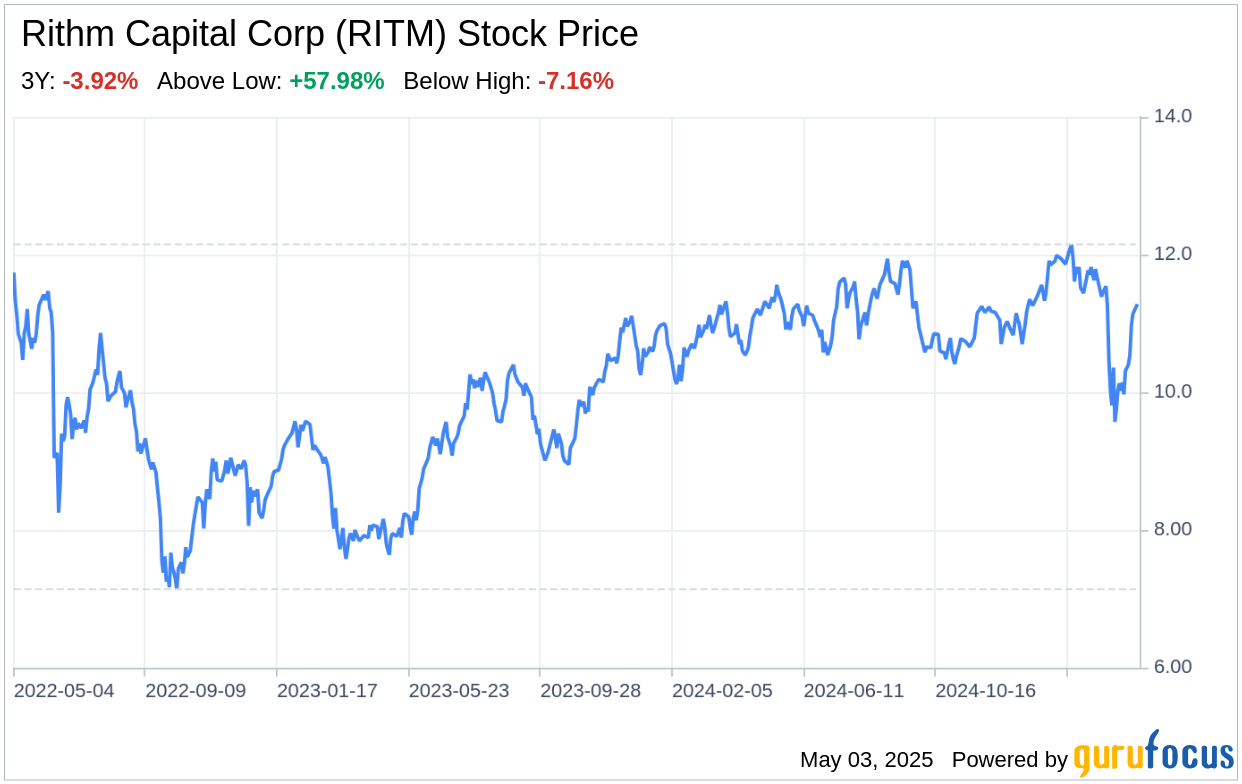

On May 2, 2025, Rithm Capital Corp, a real estate investment trust specializing in capital and services for the real estate and financial services industries, filed its 10-Q report. This SWOT analysis delves into the intricacies of the filing, providing a snapshot of the company's financial health and strategic positioning. For the three months ended March 31, 2025, Rithm Capital Corp reported net income attributable to common stockholders of $36.5 million, a significant decrease from $261.6 million in the same period last year. This decline was primarily due to a non-cash decrease in the fair value of mortgage servicing rights (MSRs), despite an increase in servicing fee revenue and interest income from MSRs. The company also declared dividends of $0.25 per share of common stock, maintaining its commitment to shareholder returns. This financial overview sets the stage for a deeper exploration of Rithm Capital Corp's strengths, weaknesses, opportunities, and threats.

Strengths

Diversified Investment Portfolio: Rithm Capital Corp's investment portfolio is a cornerstone of its strength, showcasing a diversified mix of mortgage servicing-related assets, residential securities, loans, and consumer loans. This diversification allows the company to mitigate risks associated with market volatility and interest rate fluctuations. The recent filing indicates a robust servicing fee revenue, net and interest income from MSRs, which increased to $570.8 million in 2025 from $469.9 million in 2024. This growth reflects the company's ability to generate stable cash flows from its core operations, underpinning its financial resilience.

Strong Origination and Servicing Segment: The Origination and Servicing segment of Rithm Capital Corp has demonstrated a solid performance, as evidenced by the gain on originated residential mortgage loans, held-for-sale, net, which rose to $159.8 million from $142.5 million year-over-year. This segment's success is attributed to the company's strategic partnerships and operational efficiency in mortgage loan origination and servicing, which contribute significantly to its overall profitability and position it well for future growth.

Weaknesses

Decline in Net Income: A notable weakness in Rithm Capital Corp's recent financial performance is the stark decline in net income attributable to common stockholders, which dropped to $36.5 million in 2025 from $261.6 million in the previous year. This decline was largely due to a significant non-cash decrease in the fair value of MSRs, which highlights the company's exposure to valuation changes in its servicing assets. This volatility in earnings could raise concerns among investors regarding the predictability of returns and the company's valuation.

Increased General and Administrative Expenses: The company's general and administrative expenses have risen to $237.5 million in 2025 from $205.1 million in 2024. This increase suggests a potential inefficiency in managing overhead costs, which could impact the company's operating margins and profitability if not addressed. As Rithm Capital Corp continues to grow, it will be crucial to streamline operations and control expenses to maintain competitive advantage.

Opportunities

Expansion of Asset Management Services: Rithm Capital Corp's Asset Management segment, which includes Sculptor Capital Management and its funds, presents significant growth opportunities. The company reported asset management revenues of $87.7 million, up from $70.9 million year-over-year. By capitalizing on the growing demand for asset management services and leveraging its existing platforms, Rithm Capital Corp can enhance its revenue streams and strengthen its market position.

Strategic Acquisitions and Partnerships: The company's proactive approach to exploring acquisitions and establishing strategic partnerships offers opportunities to create value for shareholders. Rithm Capital Corp's ability to identify and integrate complementary assets and businesses can drive long-term growth and diversification, further solidifying its presence in the real estate and financial services sectors.

Threats

Regulatory Risks and Compliance Costs: Rithm Capital Corp operates in a highly regulated environment, with regulations from entities such as the Consumer Financial Protection Bureau and other federal, state, and local authorities. Compliance with these regulations can result in increased costs and operational complexities. Additionally, any changes in regulatory frameworks or enforcement actions could adversely impact the company's business operations and profitability.

Market and Interest Rate Volatility: The company's performance is susceptible to market and interest rate fluctuations, which can affect the valuation of its investment portfolio, particularly MSRs. The recent decline in the fair value of MSRs underscores this vulnerability. Market volatility, coupled with potential interest rate changes, poses a threat to Rithm Capital Corp's financial stability and could impact its ability to achieve targeted returns on investments.

In conclusion, Rithm Capital Corp (RITM, Financial) exhibits a robust investment portfolio and a strong origination and servicing segment, which are key strengths that underpin its market position. However, the company faces challenges, including a significant decline in net income and rising general and administrative expenses. Opportunities for growth lie in the expansion of asset management services and strategic acquisitions, while regulatory risks and market volatility remain potential threats. By leveraging its strengths and addressing its weaknesses, Rithm Capital Corp can capitalize on opportunities and mitigate threats, positioning itself for sustainable growth in the dynamic real estate and financial services landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.