Quick Highlights:

- Spotify Gains Ground: Apple's recent app approval marks a pivotal moment for Spotify, enhancing transparency and consumer choice.

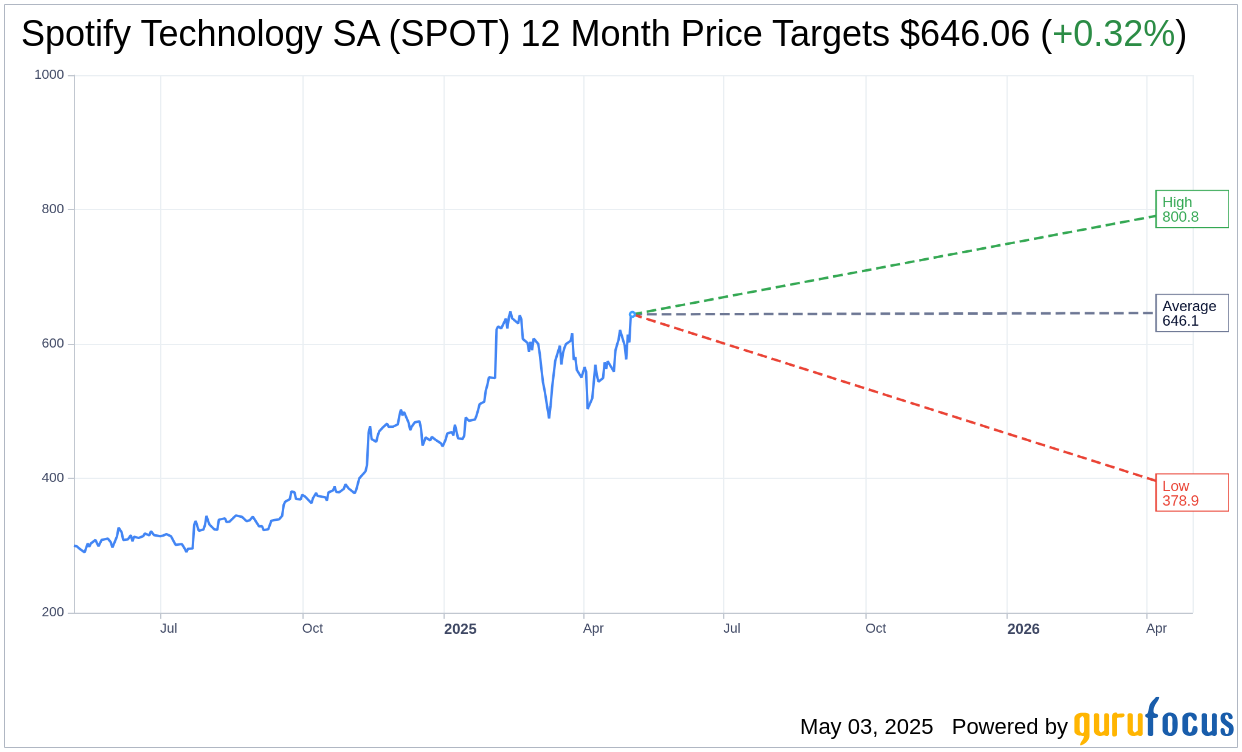

- Analyst Insights: Wall Street analysts have provided a forecast with varied price targets, signaling potential movements for Spotify.

- Valuation Metrics: GuruFocus estimates reveal potential valuation insights for discerning investors.

Spotify (SPOT, Financial) has received approval from Apple for an app update that enables the display of pricing details and purchase links, following a federal judge's mandate. This development represents a crucial advance for Spotify in promoting clearer transparency and greater consumer choice.

Wall Street Analyst Forecasts

According to 36 analysts' one-year price targets, Spotify Technology SA (SPOT, Financial) has an average target price set at $646.06. This includes projections ranging from a high of $800.77 to a low of $378.88. Notably, this average target suggests a modest upside of 0.32% from the present price of $644.00. For more in-depth data, investors are encouraged to visit the Spotify Technology SA (SPOT) Forecast page.

Moreover, the consensus recommendation compiled from 39 brokerage firms positions Spotify Technology SA (SPOT, Financial) at an average brokerage recommendation of 2.2, reflecting an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 denotes Strong Buy, and 5 signifies Sell.

Valuation Insights from GuruFocus

Based on GuruFocus' calculations, the estimated GF Value for Spotify Technology SA (SPOT, Financial) over the next year is $263.50. This suggests a potential downside of 59.08% from the current trading price of $644. The GF Value is a reflection of what GuruFocus believes to be the fair value of the stock, derived from historical multiples, previous business growth, and future business performance estimates. Investors seeking detailed valuation metrics can explore further on the Spotify Technology SA (SPOT) Summary page.