- Super Micro Computer (SMCI, Financial) shares dropped 12% due to disappointing Q3 fiscal 2025 results.

- Analysts see potential for recovery, citing temporary setbacks like GPU rollout delays.

- Price targets suggest a potential upside of 33.27%, despite the recent downturn.

Super Micro Computer's Challenging Quarter

Super Micro Computer (SMCI) recently faced a significant downturn, with shares plummeting nearly 12% following the release of its Q3 fiscal 2025 preliminary results, which fell short of market expectations. This sharp decline, driven by unforeseen circumstances such as GPU rollout delays, has prompted some analysts to view the dip as a strategic buying opportunity.

Analysts' Price Targets and Recommendations

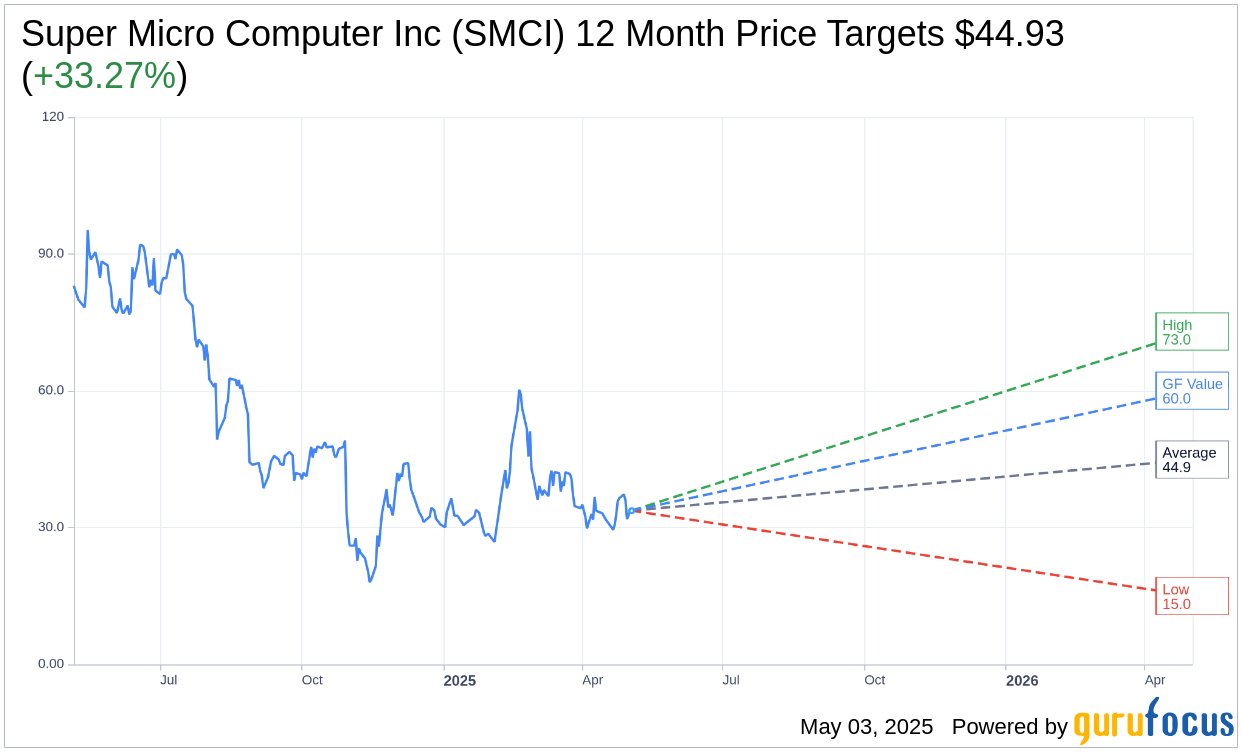

According to the latest one-year price targets from 12 analysts, Super Micro Computer Inc (SMCI, Financial) is projected to reach an average target price of $44.93. The estimates range from a high of $73.00 to a low of $15.00. This average target indicates a potential upside of 33.27% from the current trading price of $33.71. For more in-depth details, you can visit the Super Micro Computer Inc (SMCI) Forecast page.

The consensus recommendation from 15 brokerage firms places Super Micro Computer Inc's (SMCI, Financial) status at an average brokerage recommendation of 2.8, suggesting a "Hold" position. This rating falls within a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

Breaking Down GF Value Estimates

Expert analysts at GuruFocus provide an estimated GF Value for Super Micro Computer Inc (SMCI, Financial) of $60.03 for one year from now, pointing to a substantial upside of 78.08% from its current price of $33.71. The GF Value represents GuruFocus' assessment of what the stock's fair value should be, derived from its historical trading multiples, past performance metrics, and future business performance estimates. For additional information, refer to the Super Micro Computer Inc (SMCI) Summary page.