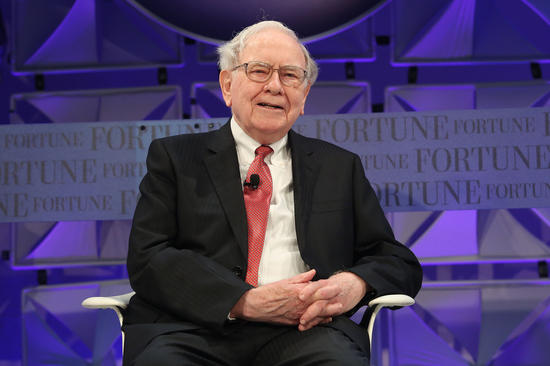

Warren Buffett (Trades, Portfolio) just dropped a bomb at Berkshire Hathaway's (BRK.A, Financial) (BRK.B, Financial) annual meeting—and it wasn't about interest rates, earnings, or China. It was about fiscal policy. “That's what scares me,” he admitted, pointing not just to the U.S. but to a global trend of governments spending too much, too carelessly. According to Buffett, political incentives are wired to overspend—and over time, that behavior chips away at the foundation of every investor's portfolio: currency stability.

He didn't stop there. Buffett warned that the value of paper money can evaporate if governments keep testing the limits. His exact words? “We don't have any great system for beating that.” And this isn't a new concern for him—it's something he's been writing about for years. In his latest shareholder letter, he noted that fixed-coupon bonds offer zero protection in a world where “fiscal folly prevails.” History agrees. We've seen entire currencies collapse before—not because of market crashes, but because of bad policy.

When one of the world’s most disciplined capital allocators raises red flags about fiscal excess and currency risk, it’s not just noise—it’s a reminder. Buffett’s message isn’t meant to spark fear, but reflection. In a world where financial systems evolve and policy decisions ripple far beyond headlines, staying alert and informed may be the most valuable position of all.

Also check out: