Summary:

- PayPal (PYPL, Financial) beats first-quarter earnings and revenue expectations.

- Active account growth drives performance despite high operating expenses.

- Analysts predict a potential upside of over 22% for PayPal stock.

PayPal Holdings Inc. (PYPL) recently announced its first-quarter earnings, surpassing Wall Street's projections. A key factor behind this performance was the notable rise in active accounts. Although the company succeeded in reducing operating expenses on both a quarterly and annual basis, these costs still exceeded average analyst expectations.

Wall Street Analysts Forecast

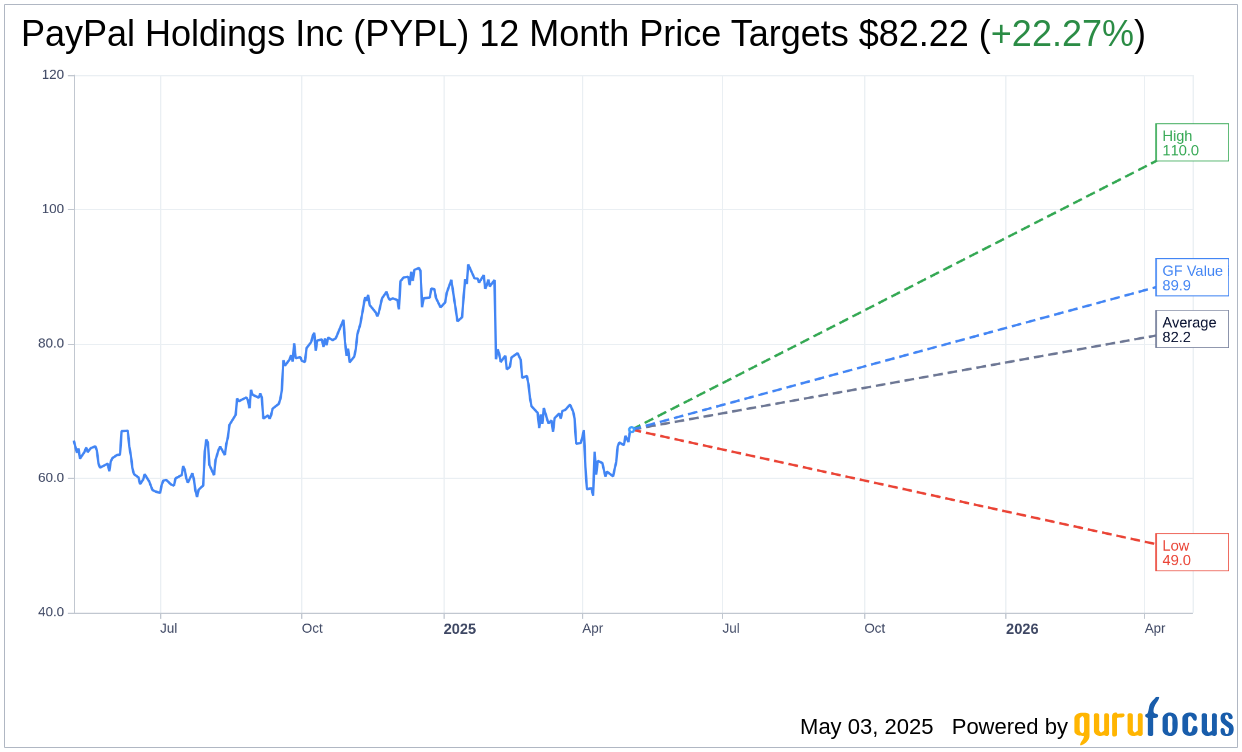

The one-year price targets from 37 analysts have placed PayPal Holdings Inc (PYPL, Financial) at an average target of $82.22. This figure includes a high estimate of $110.00 and a low estimate of $49.00. Notably, the average target represents a potential upside of 22.27% from the current stock price of $67.24. For more detailed projections and analysis, visit the PayPal Holdings Inc (PYPL) Forecast page.

Analyst Recommendations

The consensus among 47 brokerage firms indicates an "Outperform" status for PayPal Holdings Inc (PYPL, Financial), with an average brokerage recommendation score of 2.4. This score is part of a rating scale from 1 to 5, where a score of 1 suggests a "Strong Buy," and a score of 5 implies a "Sell."

GuruFocus GF Value Estimate

According to GuruFocus estimates, the projected GF Value for PayPal Holdings Inc (PYPL, Financial) is $89.92 over the next year. This estimation implies a 33.73% potential upside from its current price of $67.24. The GF Value is a proprietary calculation by GuruFocus that reflects the fair value at which the stock should trade, based on historical multiples, past business growth, and anticipated future performance. For further insights, refer to the PayPal Holdings Inc (PYPL) Summary page.