- CVS Health (CVS, Financial) shares increased by 3.3%, reaching $67.46 after exceeding earnings expectations.

- Analysts project a 7.4% EPS growth by 2025, despite stable revenue forecasts.

- Consensus among analysts suggests a significant upside potential for CVS stock.

CVS Health (CVS) recently announced its quarterly results, which led to a 3.3% increase in its stock, lifting the price to $67.46. Impressively, the company reported earnings per share (EPS) of $1.41, surpassing projections by 11%. Looking ahead, analysts forecast a 7.4% EPS growth by 2025, achieving $4.48, even though revenue predictions remain steady at $387.5 billion.

Wall Street Analysts Forecast

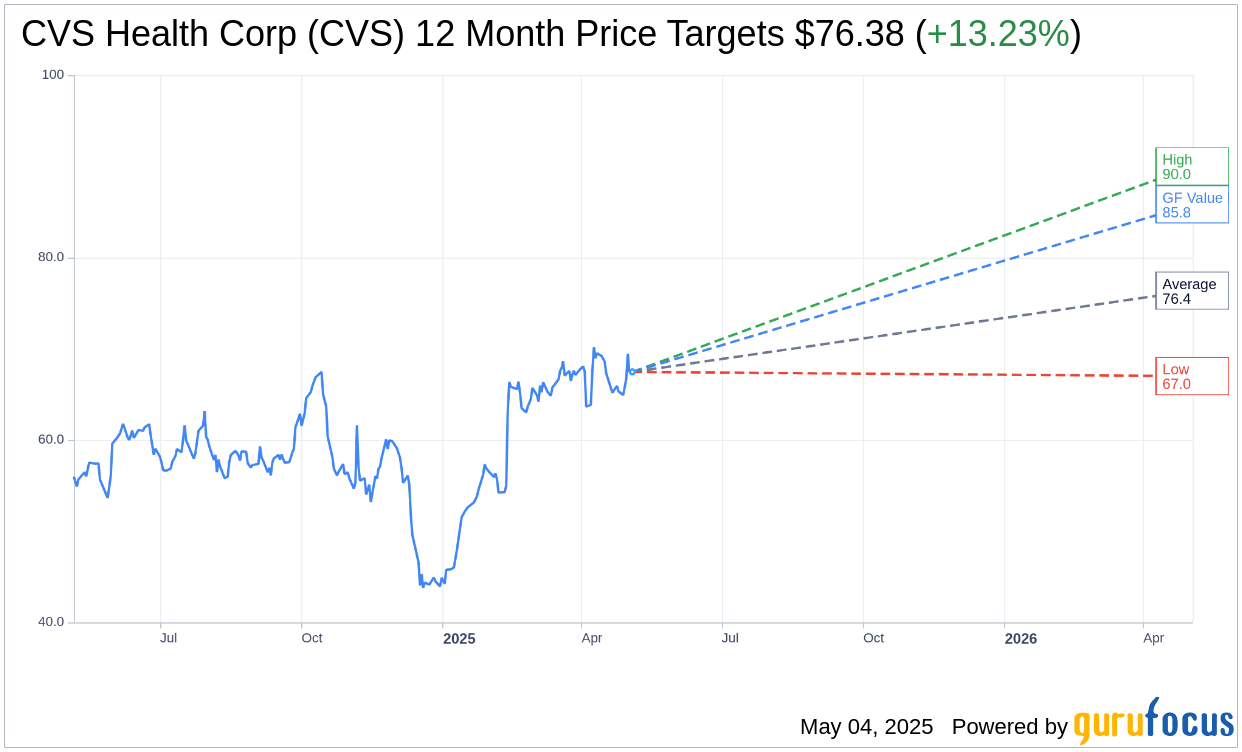

Wall Street analysts have released one-year price targets for CVS Health Corp (CVS, Financial), offering an average target price of $76.38. This includes a high estimate of $90.00 and a low of $67.00. This average target suggests a potential upside of 13.23% from its current trading price of $67.46. More in-depth estimate data can be accessed on the CVS Health Corp (CVS) Forecast page.

The consensus recommendation from 29 brokerage firms places CVS Health Corp's (CVS, Financial) average brokerage recommendation at 2.2. This indicates an "Outperform" rating on a scale from 1 to 5, where 1 denotes a Strong Buy and 5 indicates a Sell, highlighting positive analyst sentiment towards the stock.

GuruFocus's estimates project the GF Value for CVS Health Corp (CVS, Financial) in one year at $85.84, suggesting a potential upside of 27.25% from the current price of $67.46. The GF Value represents GuruFocus' assessment of what the stock's fair market value should be, calculated using historical trading multiples, past business growth, and projected future performance. For more detailed data, visit the CVS Health Corp (CVS) Summary page.