Howmet Aerospace's recent earnings report has created a buzz in the market, with shares making a significant leap. Investors are eager to understand the implications of these results and what lies ahead for this aerospace giant. Key highlights include:

- Howmet Aerospace (HWM, Financial) shares surged 13% following a robust earnings report.

- Analyst projections for 2025 have been raised, with price targets now sitting 11% higher.

- Current analyst recommendations suggest an "Outperform" status for the stock.

Strong Earnings Propel Howmet Aerospace Forward

Howmet Aerospace (HWM) recently reported an impressive earnings performance, with shares climbing 13% to $154. The company surpassed expectations with $1.9 billion in revenue and an EPS of $0.84, beating projections by 8.1%. This robust performance has led analysts to revise their 2025 revenue and EPS forecasts upward, resulting in a consensus price target increase of 11% to $156.

Wall Street Analysts Offer Mixed Forecasts

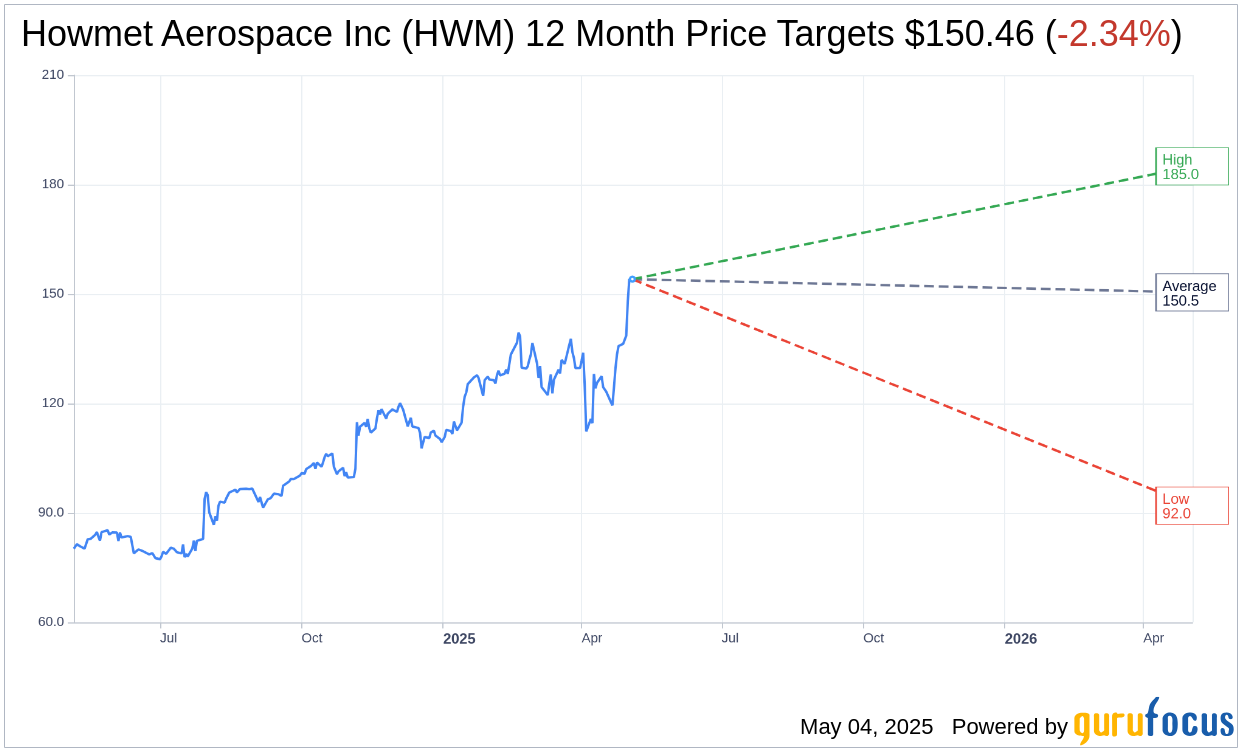

According to the latest one-year price targets from 22 analysts, the average target price for Howmet Aerospace Inc (HWM, Financial) stands at $150.46. The range varies from a high estimate of $185.00 to a low of $92.00, indicating a potential downside of 2.34% from the current price of $154.07. For a deeper dive into these estimates, visit the Howmet Aerospace Inc (HWM) Forecast page.

Consensus Rating Signals "Outperform"

The consensus from 26 brokerage firms positions Howmet Aerospace Inc (HWM, Financial) at a 2.0 rating, suggesting an "Outperform" status. The rating scale is designed from 1 to 5, where 1 denotes a Strong Buy and 5 signals a Sell recommendation. This positive consensus underscores confidence in Howmet's continued growth trajectory.

Evaluating GF Value Estimates

According to GuruFocus, the estimated GF Value for Howmet Aerospace Inc (HWM, Financial) within the next year is projected at $71.84. This estimate suggests a significant downside of 53.37% from the current stock price of $154.07. The GF Value is a representation of the stock's fair value, taking into account historical trading multiples, past growth, and future business performance estimates. For more detailed insights, explore the Howmet Aerospace Inc (HWM) Summary page.

As investors weigh these insights, Howmet Aerospace's future remains a topic of keen interest, with strong earnings and a mixed bag of analyst forecasts shaping the outlook.