• Sabra Health Care (SBRA, Financial) is set to announce its Q1 earnings on May 5th, with expectations of a 54.5% increase in EPS.

• Analysts have revised EPS estimates upwards while revenue projections have faced downgrades.

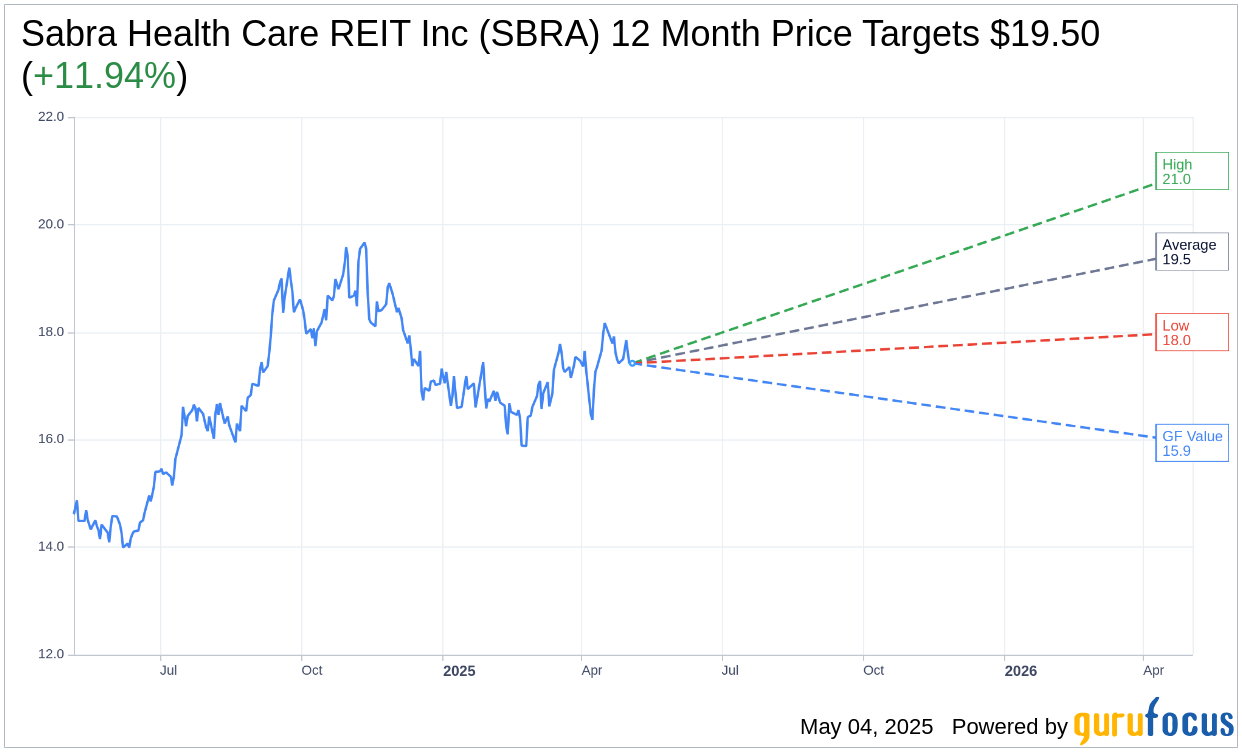

• The stock's average target price suggests a potential upside of 11.94%.

Anticipated First-Quarter Earnings Release

Sabra Health Care (SBRA, Financial) is on the brink of unveiling its first-quarter earnings report on May 5th after the market closes. Analysts have projected an earnings per share (EPS) of $0.17, reflecting a notable 54.5% increase compared to the same period last year. Additionally, the forecasted revenue stands at $180.23 million, marking an 8.1% year-over-year rise. Despite two recent upgrades in EPS estimates, revenue projections have encountered four downgrades, indicating mixed sentiment among analysts.

Wall Street Analysts' Price Targets and Ratings

According to the latest data from 12 analysts, the average one-year price target for Sabra Health Care REIT Inc (SBRA, Financial) is $19.50. The highest forecast reaches $21.00, while the lowest is $18.00. This average target price suggests a potential upside of 11.94% from the current trading price of $17.42. For more in-depth analysis, visit the Sabra Health Care REIT Inc (SBRA) Forecast page.

In terms of brokerage firm recommendations, Sabra Health Care REIT Inc (SBRA, Financial) holds an average rating of 2.2 from 14 brokerage firms, indicating an "Outperform" status. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), positioning SBRA favorably among analysts.

GF Value and Investment Considerations

According to GuruFocus estimates, the projected GF Value for Sabra Health Care REIT Inc (SBRA, Financial) in one year is $15.94. This estimation suggests a potential downside of 8.5% from the current price of $17.42. The GF Value is calculated based on the stock's historical trading multiples, its past growth trajectory, and anticipated future performance of the business. For more comprehensive data, please refer to the Sabra Health Care REIT Inc (SBRA) Summary page.