- Viper Energy Inc (VNOM, Financial) is preparing for its first-quarter earnings report, with key performance metrics in focus.

- Analysts predict an EPS of $0.47 and a significant revenue increase to $243.72 million.

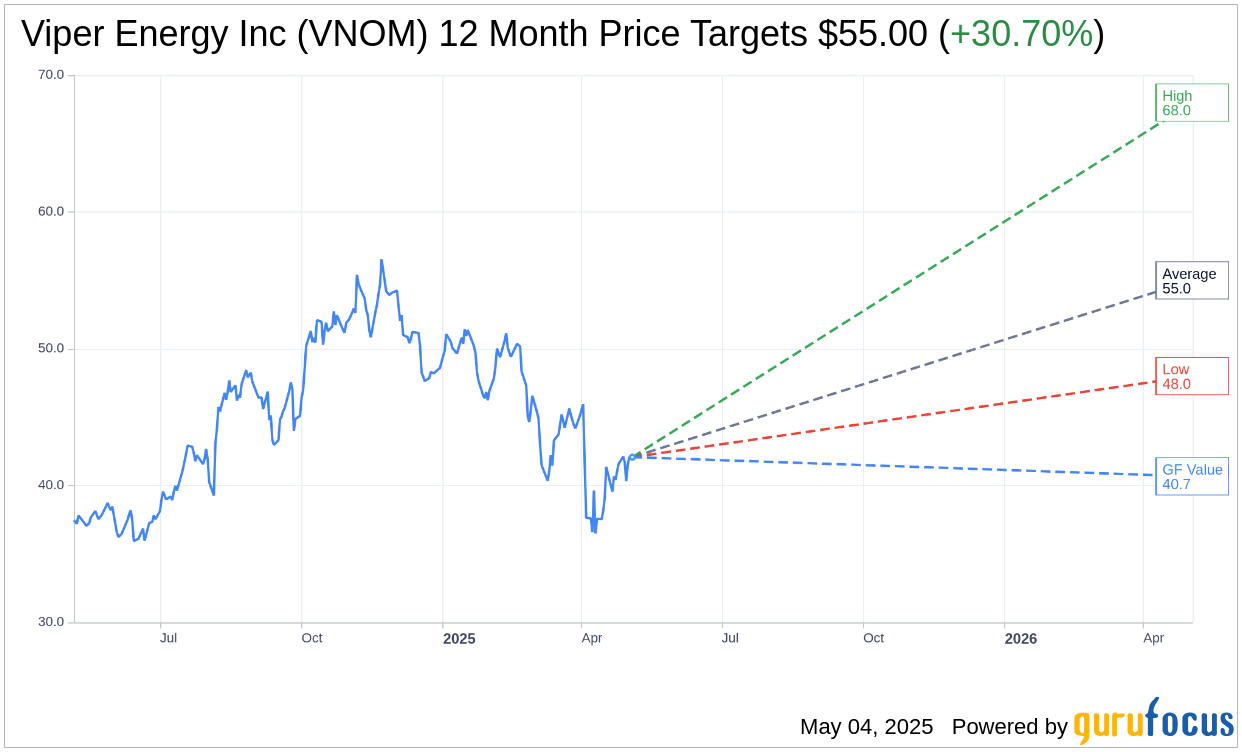

- Insights into price targets and recommendations present a forward-looking perspective for investors.

Viper Energy Inc. (VNOM) is poised to release its first-quarter earnings report on May 5th, post-market. Investors are focused on the expected earnings per share (EPS) of $0.47, which marks a 9.6% decline from last year. On the other hand, revenue is anticipated to rise by 18.7% to $243.72 million. Historically, VNOM has a strong track record of surpassing EPS forecasts 88% of the time and exceeding revenue predictions 75% of the time.

Wall Street Analysts' Expectations

The consensus among 15 financial analysts places the average one-year price target for Viper Energy Inc (VNOM, Financial) at $55.00. Projections range from a high of $68.00 to a low of $48.00, implying a substantial upside potential of 30.70% from the current trading price of $42.08. For more detailed analysts' estimates, you can visit our Viper Energy Inc (VNOM) Forecast page.

Brokerage Recommendations

Viper Energy Inc is rated by 16 brokerage firms with an average recommendation of 1.8, which translates to an "Outperform" status. This rating is part of a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell recommendation.

GF Value Estimates

According to GuruFocus estimates, the forecasted GF Value for Viper Energy Inc (VNOM, Financial) in a year's time is $40.67. This suggests a potential downside of 3.35% compared to the current price of $42.08. The GF Value is derived from the historical trading multiples of the stock, its past business growth, and future performance projections. For further details, visit the Viper Energy Inc (VNOM) Summary page.