Key Takeaways:

- ManpowerGroup (MAN, Financial) declares a semi-annual dividend with an upcoming payout.

- Analysts predict a potential upside of over 17% based on their average price target.

- GuruFocus places the estimated GF Value significantly higher, indicating a 65% upside potential.

Dividend Announcement and Financial Outlook

ManpowerGroup Inc. (MAN) has exciting news for income-focused investors: a semi-annual dividend of $0.72 per share is slated for distribution on June 16. To qualify for this dividend, shareholders must be recorded by June 2, aligning with the ex-dividend date.

As we look ahead, ManpowerGroup’s financial projections for the second quarter of 2025 anticipate earnings per share (EPS) ranging between $0.65 and $0.75. This forecast provides an intriguing context for the company's ongoing financial performance.

Analyst Insights and Price Targets

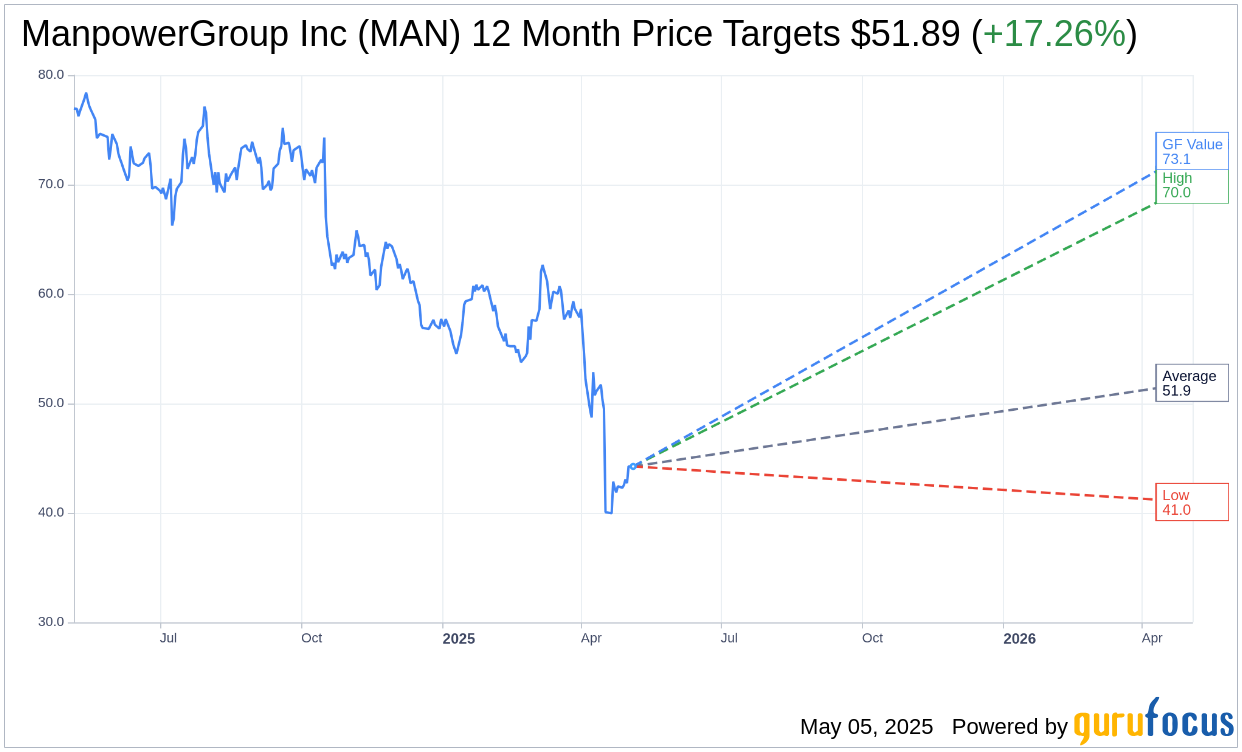

The latest insights from Wall Street reveal that nine analysts have set a one-year average price target of $51.89 for ManpowerGroup Inc. (MAN), with projections spanning from a low of $41.00 to a high of $70.00. With the current stock price at $44.25, this average price target suggests a potential upside of 17.26%. For a deeper dive into these estimates, visit the ManpowerGroup Inc (MAN, Financial) Forecast page.

The brokerage consensus based on 13 firms indicates a "Hold" rating, with an average recommendation score of 2.8 on a scale where 1 is a strong buy and 5 is a sell.

GuruFocus Metrics: GF Value Assessment

According to GuruFocus calculations, the GF Value of ManpowerGroup Inc. (MAN) in a year's time is estimated at $73.08. This valuation translates to a remarkable upside potential of 65.15% from the current price of $44.25. The GF Value is a proprietary measure that reflects the stock’s fair trading value, derived from historical trading multiples, previous business growth, and future performance forecasts. For more comprehensive data, refer to the ManpowerGroup Inc (MAN, Financial) Summary page.