Key Takeaways:

- Park Hotels & Resorts (PK, Financial) exceeded first-quarter financial expectations with a notable FFO and revenue performance.

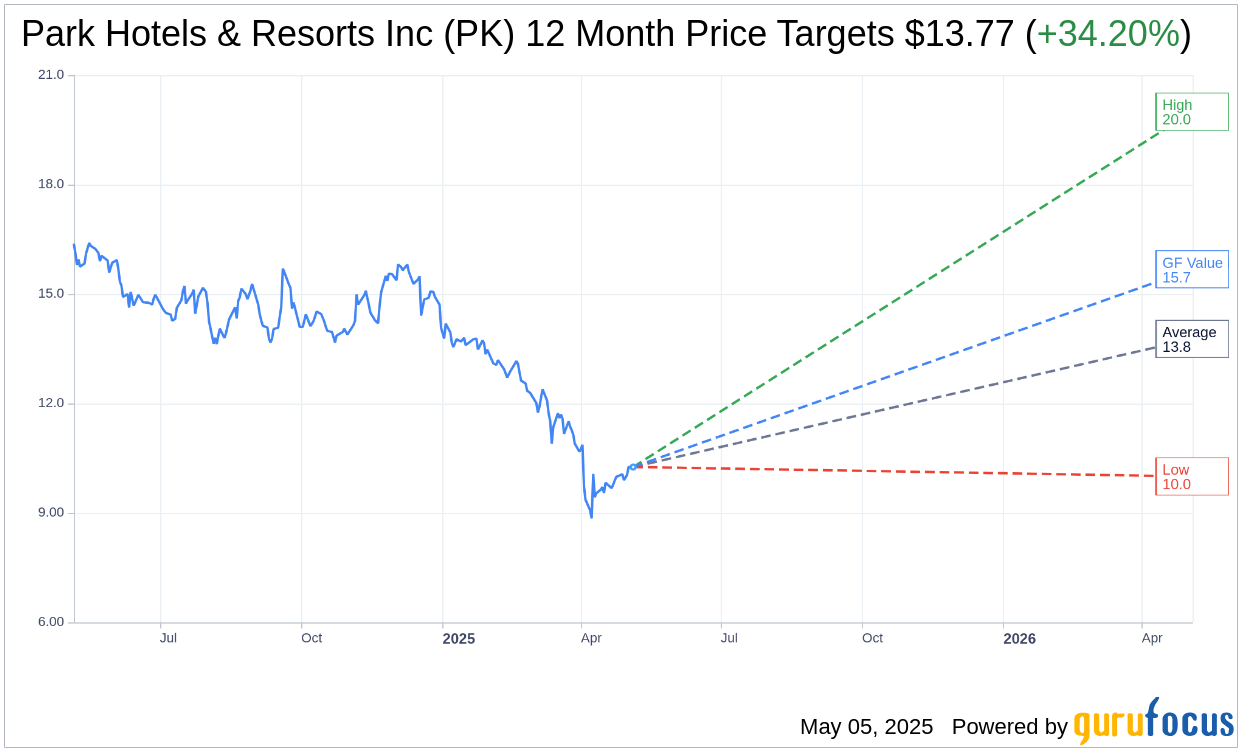

- Investment analysts see a significant upside potential for PK, with price targets projecting up to 34.20% growth.

- GuruFocus estimates indicate an even higher potential upside based on GF Value metrics.

Park Hotels & Resorts' Financial Highlights

Park Hotels & Resorts (PK) demonstrated a strong financial performance in the first quarter, reporting a Funds From Operations (FFO) of $0.46 per share, which exceeded market forecasts by $0.05. The company also achieved impressive revenue figures, bringing in $630 million, surpassing analyst expectations by $14.11 million. Looking forward, Park Hotels & Resorts is optimistic about a dynamic 2025, with strategic adjustments anticipated in Revenue Per Available Room (RevPAR) and operating income projections.

Analyst Price Targets and Recommendations

According to the price targets provided by 13 analysts over the next year, the average target price for Park Hotels & Resorts Inc (PK, Financial) is set at $13.77. This is with estimates ranging from a high of $20.00 to a low of $10.00. The average target presents a potential upside of 34.20% from the current share price of $10.26. For a more granular view, investors can explore the detailed data on the Park Hotels & Resorts Inc (PK) Forecast page.

Consensus ratings from 16 brokerage firms currently place Park Hotels & Resorts Inc (PK, Financial) at an average recommendation of 2.6, indicating a "Hold" status. This rating scale runs from 1 to 5, with 1 being a Strong Buy and 5 representing a Sell recommendation. Such a consensus suggests a neutral view from analysts, balancing both potential risks and rewards.

Evaluating GF Value Estimates

GuruFocus provides a compelling valuation metric called the GF Value, projecting Park Hotels & Resorts Inc (PK, Financial) to reach $15.68 within a year. This suggests a significant upside of 52.83% from the current trading price of $10.26. The GF Value is a proprietary estimate reflecting the fair value based on historical trading multiples, past business growth, and future performance estimates. Investors looking for a comprehensive understanding should visit the Park Hotels & Resorts Inc (PK) Summary page for more insights.