- CNA Financial's Q1 non-GAAP EPS aligns with market expectations, while net investment income shows mixed results.

- Wall Street analysts offer stable price targets, indicating a "Hold" recommendation for CNA Financial.

- GuruFocus suggests a potential upside in stock value, highlighting investment opportunities.

CNA Financial's Q1 Earnings Overview

CNA Financial (CNA, Financial) announced its first-quarter financial results, revealing a non-GAAP EPS of $1.03, which aligns with market predictions. The company's net investment income totaled $604 million before taxes, showcasing a decrease in limited partnerships that was balanced by gains in fixed income investments. Meanwhile, the property and casualty (P&C) combined ratio saw an increase, reaching 98.4%. Additionally, the book value per share was reported at $37.98, reflecting steady financial health.

Wall Street Analysts' Insights and Forecast

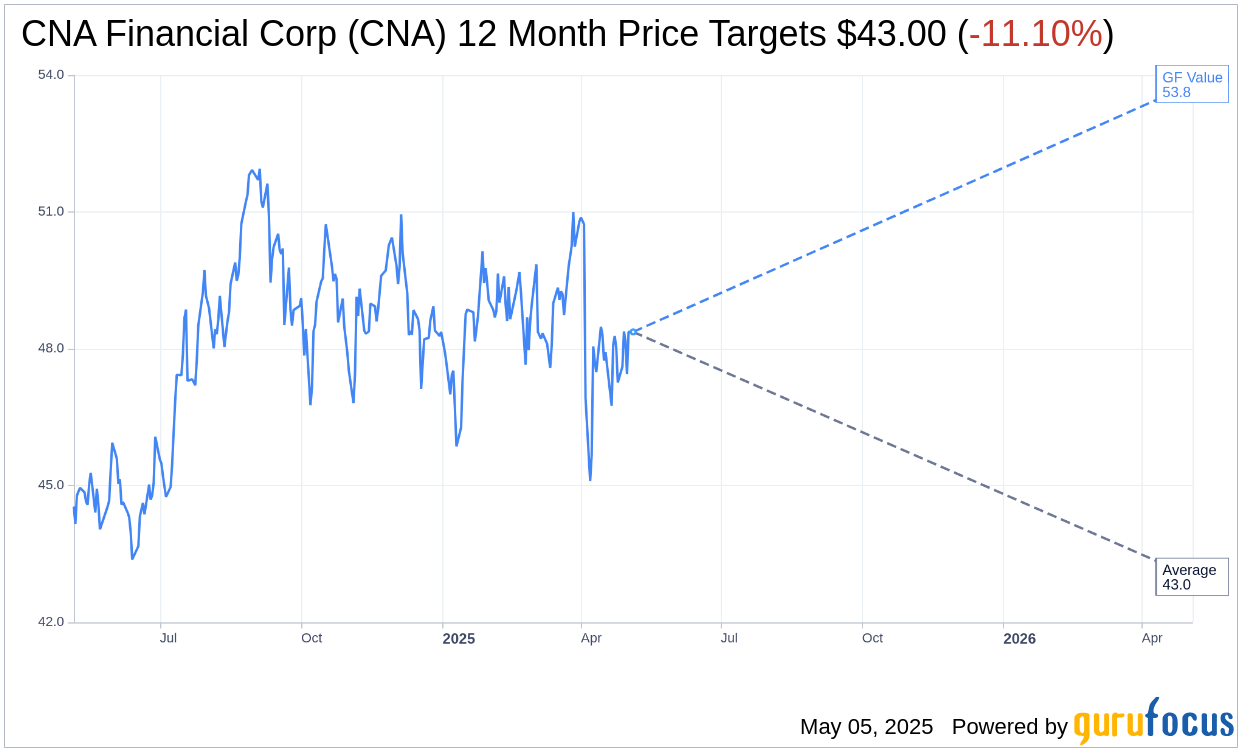

According to insights from one Wall Street analyst, the one-year price target for CNA Financial Corp (CNA, Financial) stands firm at an average of $43.00, with both high and low estimates set at the same price. This target translates to a projected downside of 11.10% from the present market price of $48.37. For a more detailed overview of these predictions, visit our CNA Financial Corp (CNA) Forecast page.

The consensus from two brokerage firms places CNA Financial Corp's (CNA, Financial) average recommendation at 3.5, signaling a "Hold" status. This rating is based on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies a Sell decision.

Potential Growth with GuruFocus GF Value

GuruFocus metrics project the GF Value for CNA Financial Corp (CNA, Financial) to be $53.81 in one year's time. This estimation presents a potential upside of 11.25% from the current trading price of $48.37. The GF Value is determined by past trading multiples, historical business growth, and future performance forecasts. For investors interested in more comprehensive data, the CNA Financial Corp (CNA) Summary page offers detailed analytics and insights.