Hyperscale Data (GPUS, Financial) has shared its preliminary financial outcomes for the first quarter of 2025, ending March 31, reporting revenues exceeding $25 million. Looking ahead, the company has set its full-year 2025 revenue expectations between $115 million and $125 million. The company's subsidiaries, including Ault Global Real Estate Equities, Circle 8 Crane Services, and TurnOnGreen, all experienced year-over-year growth.

During the first quarter, Hyperscale Data registered a significant one-time gain of about $9.7 million, attributed to the deconsolidation of Avalanche International, Corp. Additionally, the firm is advancing its Michigan data center towards becoming a leading artificial intelligence data center, aiming to enhance its position in the AI infrastructure and services sector.

The CEO, William Horne, remarked on the promising start to 2025, emphasizing the importance of the Michigan facility's transformation to an AI data center and the divestment of non-core assets as strategic steps towards ensuring long-term success for Hyperscale Data.

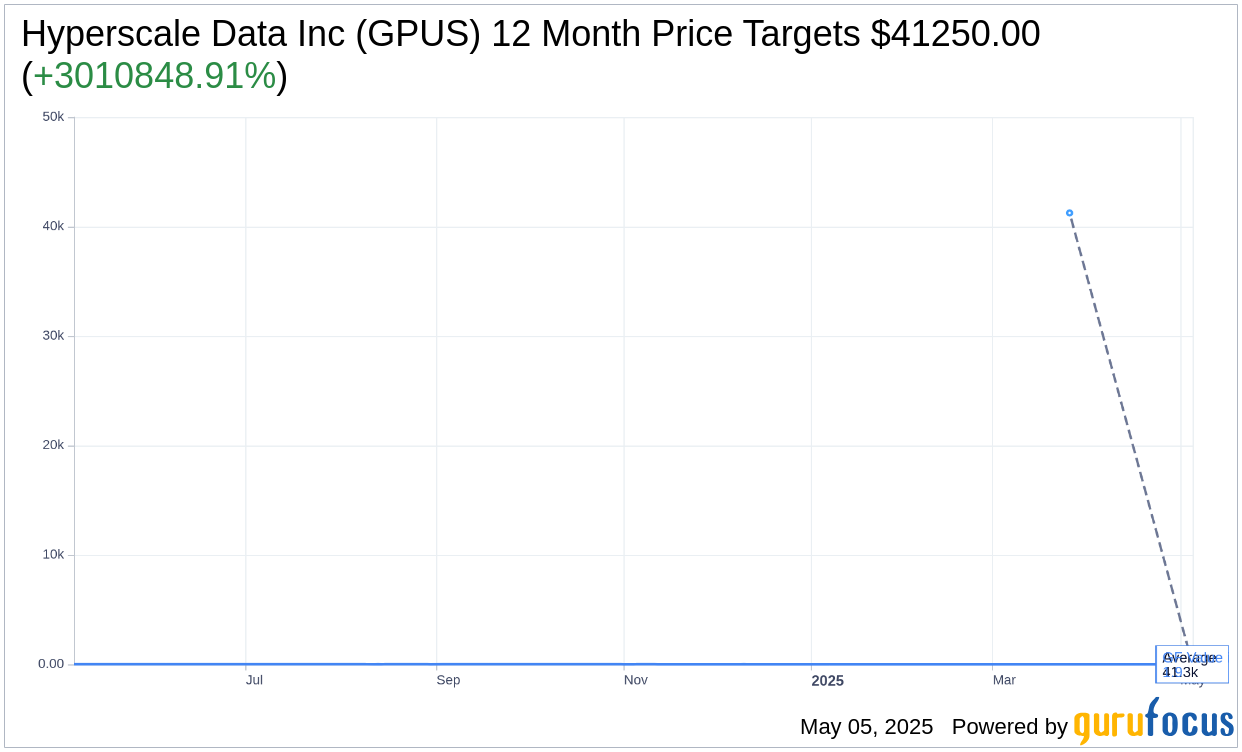

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Hyperscale Data Inc (GPUS, Financial) is $41,250.00 with a high estimate of $41,250.00 and a low estimate of $41,250.00. The average target implies an upside of 3,010,848.91% from the current price of $1.37. More detailed estimate data can be found on the Hyperscale Data Inc (GPUS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Hyperscale Data Inc's (GPUS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hyperscale Data Inc (GPUS, Financial) in one year is $1.89, suggesting a upside of 37.96% from the current price of $1.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hyperscale Data Inc (GPUS) Summary page.