Algorhythm (RIME, Financial) has broadened its international footprint by acquiring SMCB Solutions Private, SemiCab India. This deal follows their previous acquisition of SemiCab, Inc.'s U.S. business in July 2024. Through this transaction, Algorhythm’s subsidiary, SemiCab Holdings, obtained 9,999 out of 10,000 outstanding equity shares of SemiCab India.

To finalize the acquisition, Algorhythm issued a promissory note worth $1.75 million along with 119,742 shares of its common stock to SemiCab, Inc. The acquisition of SemiCab's Indian operations is seen as a strategic move, as India offers significant logistics opportunities due to its dense geography, strong institutional alliances, and increasing infrastructure investments. This acquisition grants Algorhythm direct access to major multinational clients and a fast-growing AI platform that is set to make waves in the global freight industry.

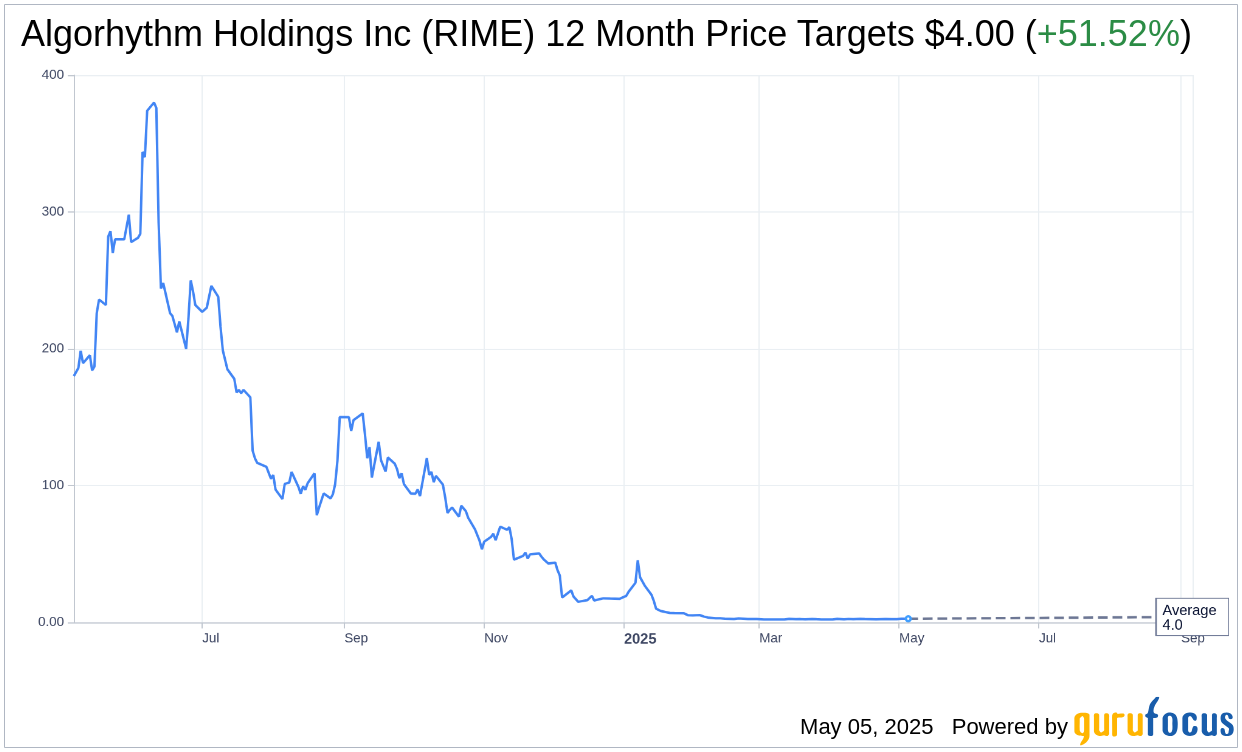

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Algorhythm Holdings Inc (RIME, Financial) is $4.00 with a high estimate of $4.00 and a low estimate of $4.00. The average target implies an upside of 51.52% from the current price of $2.64. More detailed estimate data can be found on the Algorhythm Holdings Inc (RIME) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Algorhythm Holdings Inc's (RIME, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Algorhythm Holdings Inc (RIME, Financial) in one year is $39.33, suggesting a upside of 1389.77% from the current price of $2.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Algorhythm Holdings Inc (RIME) Summary page.