UBS has upgraded EQT Corporation (EQT, Financial) from Neutral to Buy, raising the price target from $54 to $64. This decision stems from EQT's enhanced operational performance following the Equitrans acquisition and a promising natural gas market outlook extending to 2026 and beyond.

The firm highlights EQT's favorable position with rising natural gas prices and the potential for substantial shareholder returns, which are expected to climb to 57% of free cash flow by 2026. Additionally, UBS identifies prospective acquisitions and power supply contracts as further catalysts for growth.

UBS anticipates that EQT's free cash flow and production forecasts are set to improve, suggesting that the current stock price does not fully capture these positive developments.

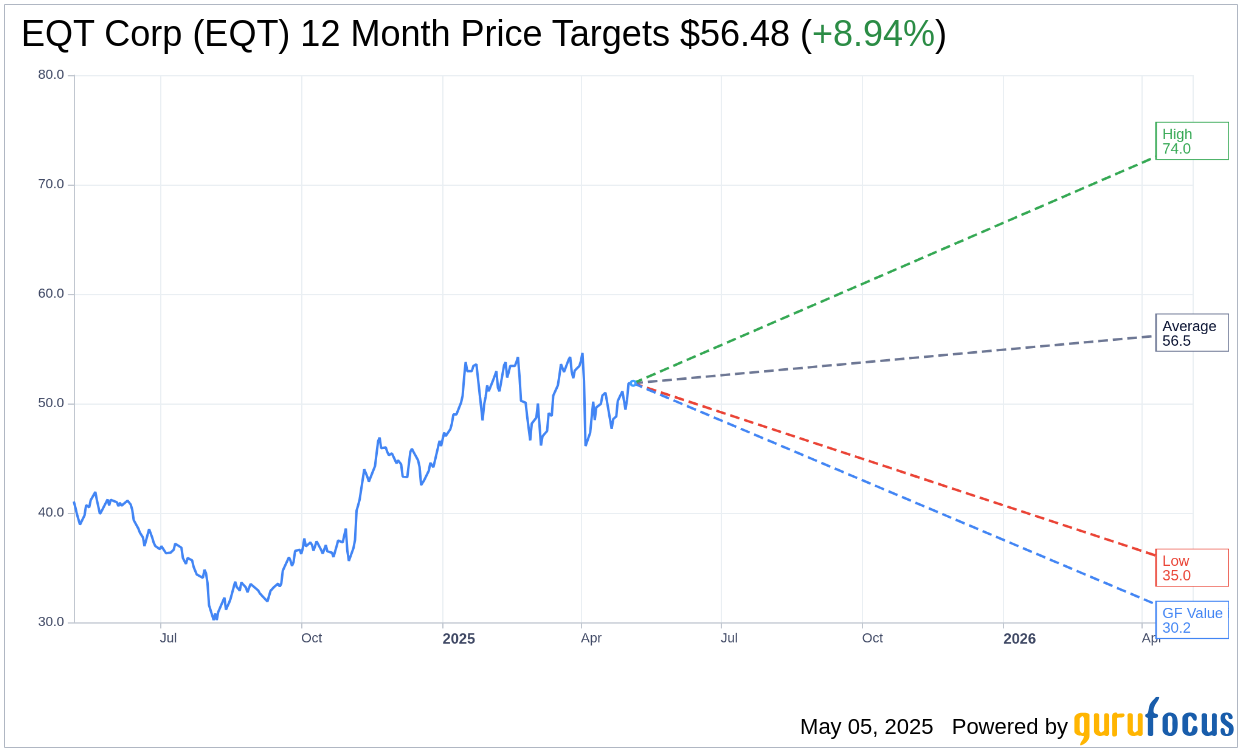

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for EQT Corp (EQT, Financial) is $56.48 with a high estimate of $74.00 and a low estimate of $35.00. The average target implies an upside of 8.94% from the current price of $51.85. More detailed estimate data can be found on the EQT Corp (EQT) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, EQT Corp's (EQT, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for EQT Corp (EQT, Financial) in one year is $30.23, suggesting a downside of 41.7% from the current price of $51.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the EQT Corp (EQT) Summary page.

EQT Key Business Developments

Release Date: April 23, 2025

- Free Cash Flow: Over $1 billion generated during Q1 2025.

- Net Debt: Reduced to $8.1 billion from $9.1 billion at year-end 2024.

- Production Surge: Increased by 300 million cubic feet per day during the quarter.

- Natural Gas Prices: Averaged $3.60 per million Btu.

- Olympus Energy Acquisition: $1.8 billion deal, 3.4x adjusted EBITDA multiple, 15% unlevered free cash flow yield.

- Pro Forma Net Debt Forecast: Approximately $7 billion by year-end 2025.

- Synergy Savings: $360 million annual savings from Equitrans acquisition.

- Capital Spending Guidance: Midpoint lowered by $25 million for 2025.

- Production Outlook Increase: Raised by 25 Bcfe for 2025.

- Debt to Free Cash Flow Metrics: Enhanced by Olympus acquisition.

- Hedging Position: No incremental hedges added; unhedged in 2026 and beyond.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- EQT Corp (EQT, Financial) reported the strongest financial results in its history for Q1 2025, with production at the high end of guidance and minimal winter impact.

- The company generated over $1 billion in free cash flow during the quarter, nearly double the consensus estimates for the next closest natural gas producer.

- EQT Corp (EQT) announced a highly accretive acquisition of Olympus Energy's assets, expected to enhance free cash flow and reduce leverage.

- The company raised its full-year production outlook by 25 Bcfe while lowering capital spending guidance by $25 million.

- EQT Corp (EQT) is well-positioned to capitalize on in-basin demand growth, with discussions underway for gas supply solutions to power projects in Appalachia.

Negative Points

- Despite strong results, EQT Corp (EQT) faces challenges from price volatility in the natural gas market.

- The company's net debt remains significant, forecasted to be approximately $7 billion by year-end 2025.

- EQT Corp (EQT) is unhedged for 2026 and beyond, which could expose it to price fluctuations.

- The acquisition of Olympus Energy increases net debt by 6%, although it is expected to enhance free cash flow.

- There is uncertainty regarding the required production growth to meet increasing LNG demand, with potential supply constraints in the Haynesville and Permian basins.