UBS analyst Alex Kramm has increased the price target for Cboe Global Markets (CBOE, Financial), setting it at $245, up from the previous $235. Despite maintaining a Neutral rating on the shares, the decision comes after CBOE's impressive first-quarter results, which demonstrated a reduction in expenses and robust ongoing trends. These factors prompted the analyst to reassess the company's potential and adjust the expected target accordingly.

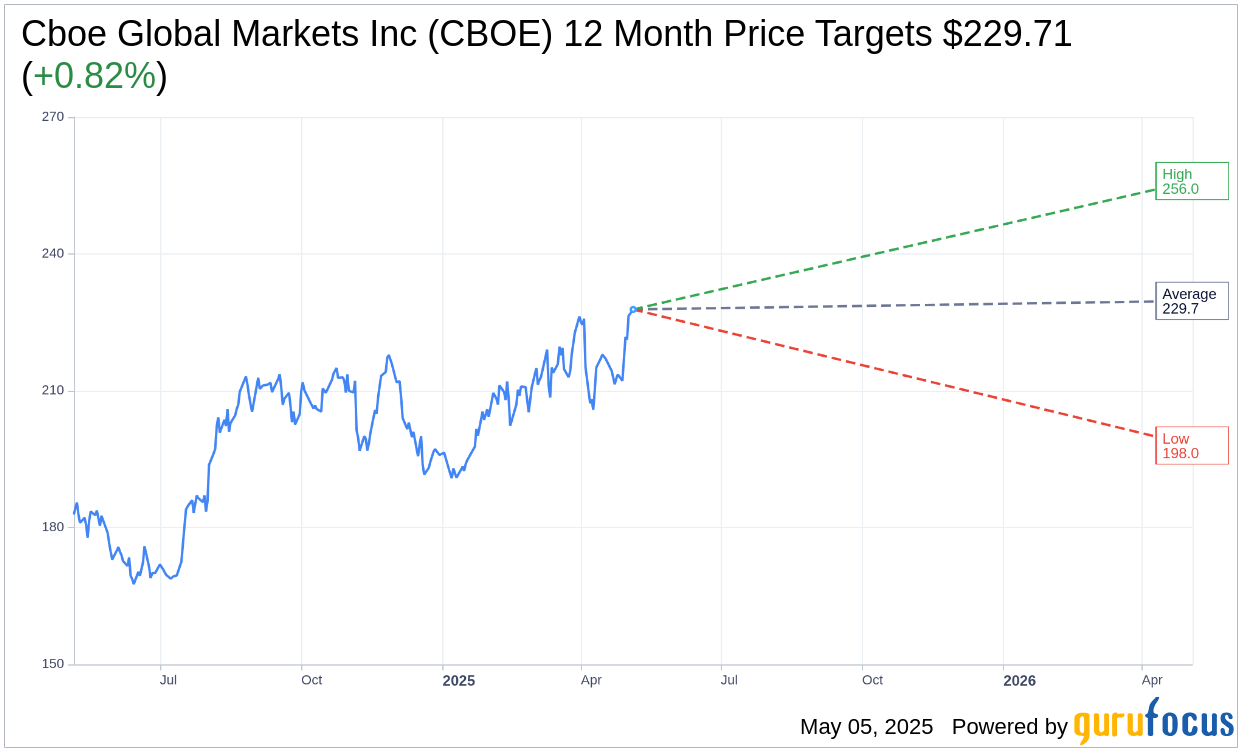

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Cboe Global Markets Inc (CBOE, Financial) is $229.71 with a high estimate of $256.00 and a low estimate of $198.00. The average target implies an upside of 0.82% from the current price of $227.84. More detailed estimate data can be found on the Cboe Global Markets Inc (CBOE) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Cboe Global Markets Inc's (CBOE, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cboe Global Markets Inc (CBOE, Financial) in one year is $87.86, suggesting a downside of 61.44% from the current price of $227.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cboe Global Markets Inc (CBOE) Summary page.

CBOE Key Business Developments

Release Date: May 02, 2025

- Net Revenue: Increased 13% year over year to $565 million.

- Adjusted Diluted Earnings Per Share: Increased 16% to $2.50.

- Derivatives Market Net Revenue: Grew 16% to $309 million.

- Cash and Spot Markets Net Revenue: Increased 10%.

- Data Vantage Net Revenue: Grew over 8% year over year.

- Adjusted Operating Expenses: $192 million, roughly flat year over year.

- Adjusted Operating EBITDA: Grew 20% to $385 million.

- Adjusted Operating EBITDA Margin: Expanded by 4.3 percentage points to 68.1%.

- Options Average Daily Volume (ADV): SPX options ADV increased 130% to 3.6 million contracts; VIX options ADV increased 33% to 948,000 contracts.

- Cash on Balance Sheet: Over $1 billion of adjusted cash.

- Share Repurchases: $30 million in shares repurchased during Q1; additional $5 million in April.

- Dividend: $66 million returned to shareholders with a $0.63 dividend.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cboe Global Markets Inc (CBOE, Financial) reported a record first-quarter net revenue of $565 million, a 13% increase year over year.

- Adjusted diluted earnings per share grew by 16% to a record $2.50, driven by strong volumes across derivatives and cash markets.

- The Derivatives business saw a 16% increase in organic net revenue, with significant growth in SPX and VIX options.

- Data Vantage business experienced an 8% organic net revenue increase, highlighting the durability and global expansion of this segment.

- Cboe's strategic focus on global expansion, particularly in the Asia Pacific region, is yielding positive results with new client onboarding in Korea and Taiwan.

Negative Points

- Despite strong revenue growth, North American equities net revenue only increased by 2%, partially offset by lower net transaction and clearing fees.

- The addressable market for Cboe in the US was smaller due to a higher percentage of total volume transacted off-exchange or during auctions.

- Cboe's expense guidance remains unchanged, indicating potential future increases in marketing and short-term incentive expenses.

- The competitive landscape in index options is evolving, with new products like prediction markets and leveraged ETFs posing potential challenges.

- Retail engagement, while disciplined, may not fully capitalize on extreme volatility spikes, potentially limiting volume increases during such periods.