Scotiabank has lifted its price target for Guardant Health (GH, Financial) from $52 to $57 while maintaining an Outperform rating on the stock. This decision follows the company's impressive first-quarter revenue results that surpassed forecasts, prompting an upward revision in its full-year revenue outlook. According to the firm, Guardant Health is poised for significant growth due to its robust market position, increasing average selling prices, and innovative real-world evidence platform.

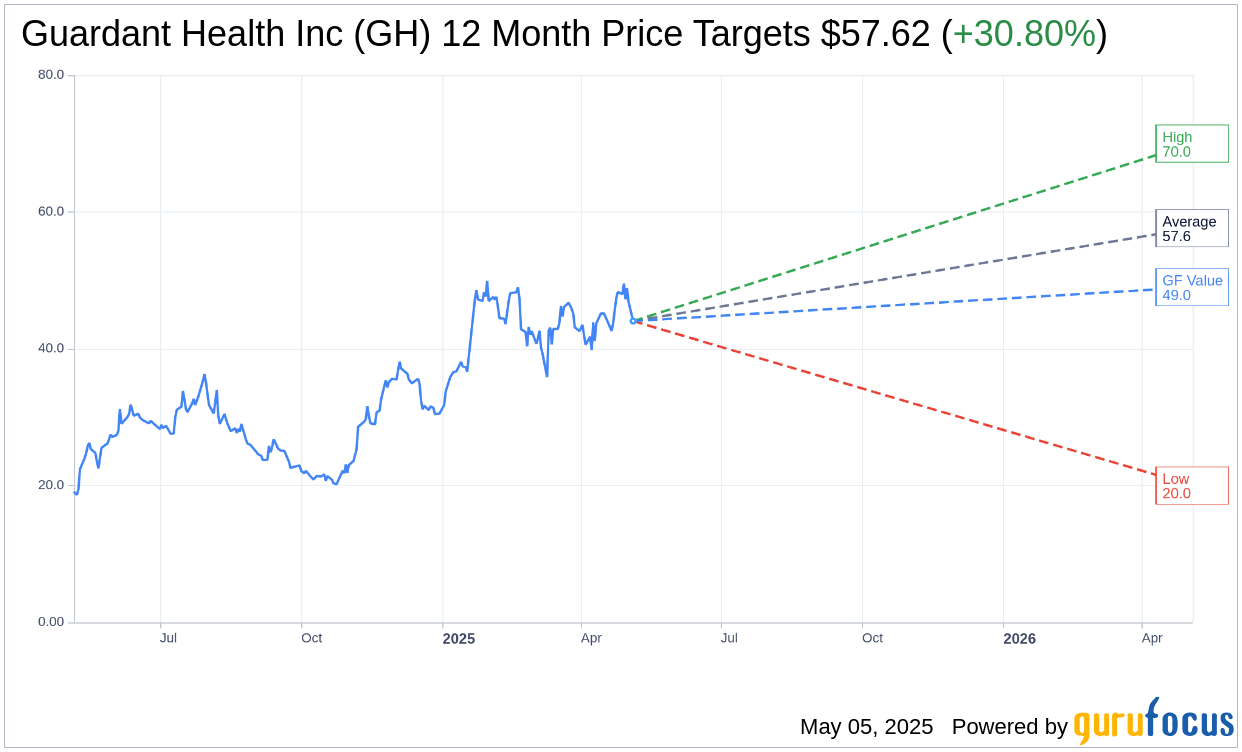

Wall Street Analysts Forecast

Based on the one-year price targets offered by 22 analysts, the average target price for Guardant Health Inc (GH, Financial) is $57.62 with a high estimate of $70.00 and a low estimate of $20.00. The average target implies an upside of 30.80% from the current price of $44.05. More detailed estimate data can be found on the Guardant Health Inc (GH) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Guardant Health Inc's (GH, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Guardant Health Inc (GH, Financial) in one year is $49.00, suggesting a upside of 11.24% from the current price of $44.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Guardant Health Inc (GH) Summary page.

GH Key Business Developments

Release Date: April 30, 2025

- Total Revenue: $203.5 million, up 21% year-over-year.

- Oncology Revenue: $150.6 million, up 20% year-over-year.

- Oncology Volume: Approximately 59,000 tests, up 25% year-over-year.

- Guardant360 ASP: Range of $3,000 to $3,100.

- Biopharma and Data Revenue: $45.4 million, up 21% year-over-year.

- Screening Revenue: $5.7 million from approximately 9,000 Shield tests.

- Licensing and Other Revenue: $1.9 million.

- Non-GAAP Gross Margin: 65%, up from 63% in the prior year.

- Non-GAAP Operating Expenses: $199.6 million, up 13% year-over-year.

- Adjusted EBITDA Loss: $58.5 million, an improvement of $2.6 million year-over-year.

- Free Cash Flow Burn: $67 million, impacted by timing of annual bonus payout.

- Cash and Equivalents: Approximately $804 million.

- Full Year 2025 Revenue Guidance: Increased to $880 million to $890 million.

- Shield Revenue Guidance: Raised to $40 million to $45 million.

- Non-GAAP Gross Margin Guidance: 62% to 63% for full year 2025.

- Non-GAAP Operating Expenses Guidance: $830 million to $840 million for full year 2025.

- Free Cash Flow Burn Guidance: $225 million to $235 million for full year 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Guardant Health Inc (GH, Financial) reported a strong start to the year with Q1 revenue growing 21% year-over-year to $203 million.

- The company achieved positive gross margins for both Reveal and Shield in Q1 2025, driven by significant cost reductions.

- Guardant360 ASP improved to the range of $3,000 to $3,100, supported by better Medicare Advantage and commercial reimbursement.

- The company announced a strategic collaboration with Pfizer, enhancing its long-term partnership and expanding its biopharma business.

- Shield received ADLT status, increasing the Medicare price from $920 to $1,495, which is expected to accelerate commercial infrastructure buildout.

Negative Points

- Despite the positive results, Guardant Health Inc (GH) continues to report an adjusted EBITDA loss, with a $58.5 million loss for Q1 2025.

- Free cash flow burn increased to $67 million in Q1 2025, compared to $37 million in the prior year period, due to timing of bonus payouts.

- The company faces challenges in scaling its Shield business, with a significant portion of its cash burn related to screening efforts.

- There is uncertainty regarding the timing of guideline inclusion for Shield, which could impact commercial adoption and volume growth.

- The company is still in the early stages of deploying its sales force for Shield, with full productivity expected to take 12 to 18 months.