The U.S. Army Corps of Engineers anticipates making a decision this fall on Enbridge's (ENB, Financial) permit to construct a $750 million tunnel beneath the Great Lakes for its Line 5 oil pipeline. A draft environmental impact statement is due by May 30, with public feedback open through June.

Key Takeaways

- Enbridge is awaiting a crucial permit decision for its Line 5 pipeline project.

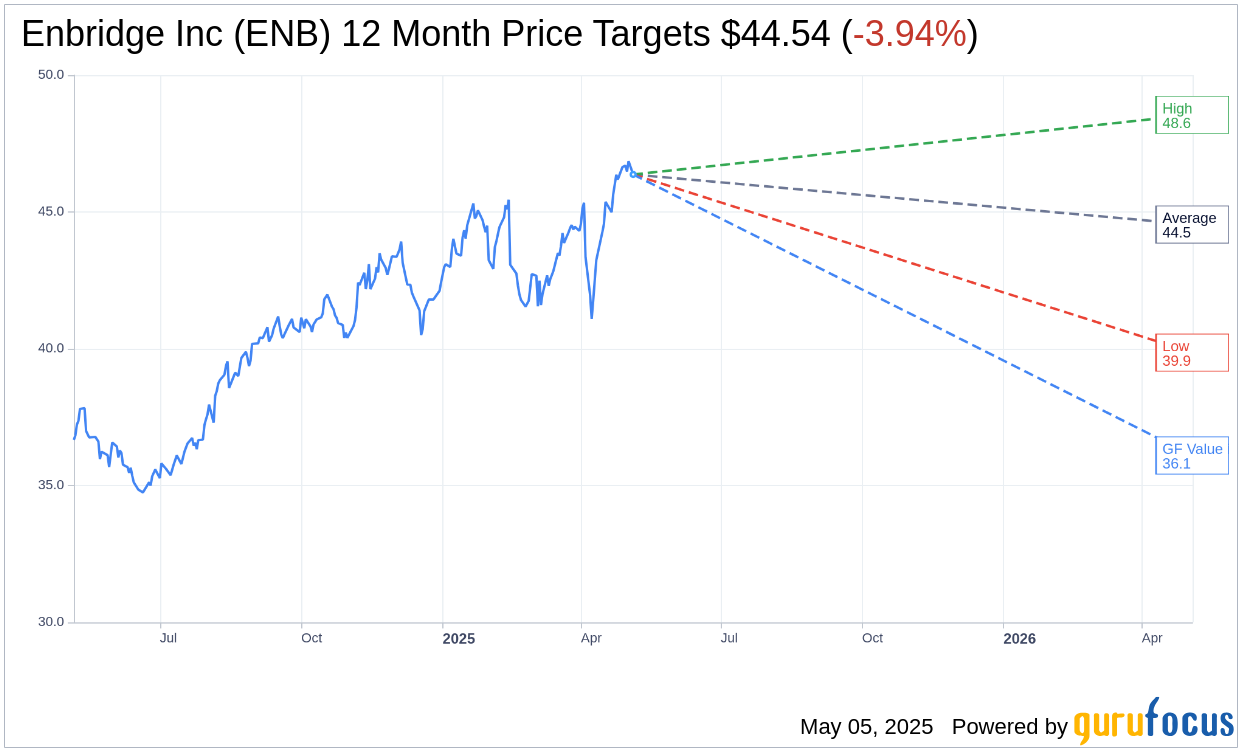

- Analysts foresee a potential downside for ENB stock, with an average price target of $44.54.

- The GF Value suggests a significant overvaluation of the stock at its current price.

Wall Street Analysts Forecast

According to projections from eight analysts, Enbridge Inc (ENB, Financial) is looking at an average price target of $44.54 over the next year. This estimate includes a high target of $48.55 and a low estimate of $39.86. As it stands, the average target indicates a potential downside of 3.94% from the current trading price of $46.37. For a more granular look at these estimates, visit the Enbridge Inc (ENB) Forecast page.

Furthermore, based on insights from 14 brokerage firms, Enbridge Inc's (ENB, Financial) current average brokerage recommendation sits at 2.6, signaling a "Hold" status. This rating is on a scale of 1 to 5, where 1 means Strong Buy and 5 means Sell.

Understanding GF Value Estimates

The GuruFocus indicators present an estimated GF Value of $36.10 for Enbridge Inc (ENB, Financial) one year from now. This suggests a downside of 22.15% from the current price point of $46.37. The GF Value is a predictive metric reflecting the intrinsic value the stock should theoretically trade at, calculated from historical trading multiples, prior business growth, and projected future performance. For further insights, check out the Enbridge Inc (ENB) Summary page.