Key Highlights:

- ON Semiconductor shares tumble 8% despite surpassing Q1 expectations.

- Analyst price targets project a potential 39.34% upside.

- GuruFocus estimates suggest a 50.52% increase in fair stock value.

Shares of ON Semiconductor (ON, Financial) experienced a significant dip, falling approximately 8% after the company released its first-quarter results. Despite beating forecasts, the financials revealed a stark decline, with revenue dropping 22.3% year-over-year to $1.45 billion and non-GAAP EPS plummeting nearly 49% to $0.55.

Wall Street Analysts Forecast

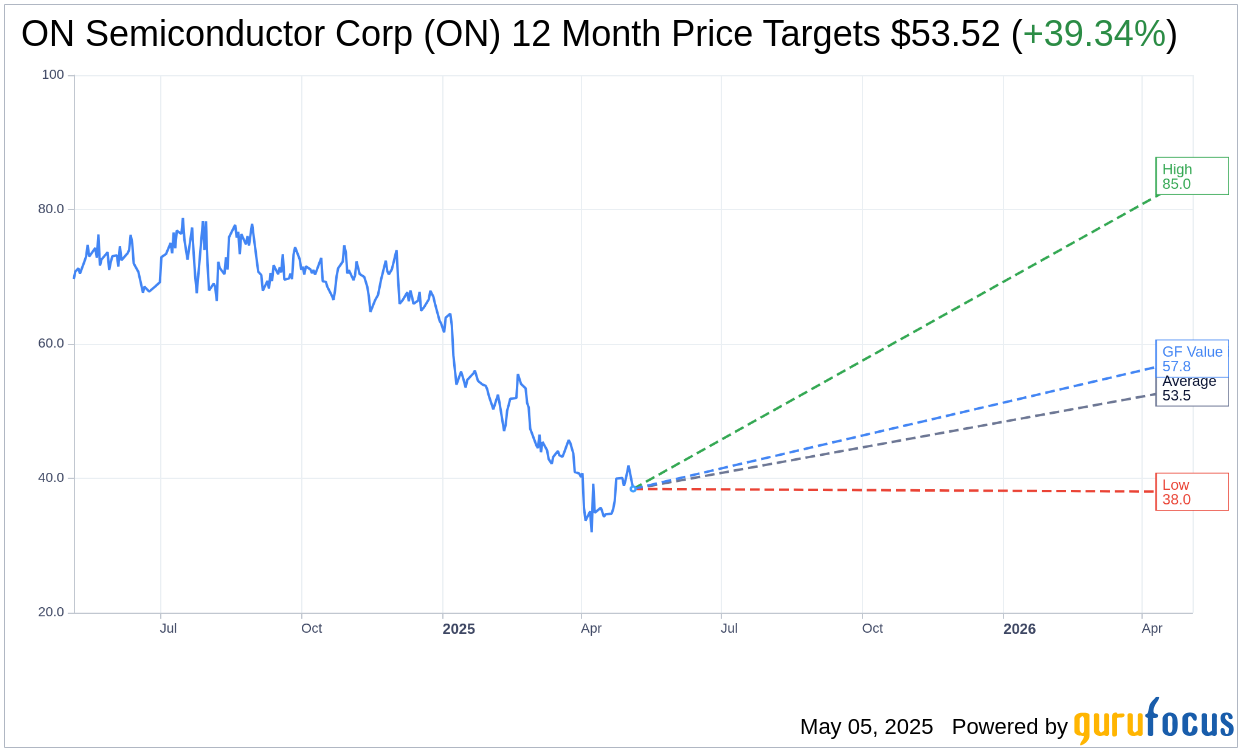

According to the projections provided by 25 analysts for the coming year, the average target price for ON Semiconductor Corp (ON, Financial) stands at $53.52, ranging from a high of $85.00 to a low of $38.00. This average target suggests a potential upside of 39.34% from the current trading price of $38.41. For more in-depth estimates, visit the ON Semiconductor Corp (ON) Forecast page.

The consensus recommendation from 32 brokerage firms places ON Semiconductor Corp (ON, Financial) at an average rating of 2.4, reflecting an "Outperform" status. This rating is part of a scale where 1 represents a Strong Buy and 5 indicates a Sell.

Using GuruFocus estimates, the projected GF Value for ON Semiconductor Corp (ON, Financial) in one year is $57.82. This projection indicates an impressive upside of 50.52% from the current price of $38.4125. GuruFocus calculates GF Value by considering historical trading multiples, past business growth, and future performance estimates. For a deeper dive into this data, please see the ON Semiconductor Corp (ON) Summary page.