Apple (AAPL, Financial) readies a China debut for its Apple Intelligence suite in iOS 18.6 after missing the feature in earlier iOS 18.5 betas, Bloomberg reports.

According to people familiar with the matter, Apple had aimed to include AI-powered writing, summarization and Siri enhancements in iOS 18.5 slated for mid-2025, but several developer previews showed no sign of the tools.

With iOS 18.6 now earmarked to bring Apple Intelligence to its largest smartphone market, the rollout could arrive as early as late summer. The news follows Apple's latest fiscal quarter, where Greater China revenue of $16.0 billion fell short of the StreetAccount estimate of $16.83 billion amid stiff competition from Huawei and local rivals.

To comply with Chinese regulations, Apple will partner with Alibaba for its content-filtering “censorship engine” and Baidu to power Siri and Visual Intelligence, sources said. In the U.S., Apple tapped OpenAI for conversational AI back-ends, a move that helped boost Siri usage by an estimated 20% in its domestic market last quarter. Analysts at Wedbush Securities note that local partnerships are critical: “Securing home-grown AI models is table stakes for any foreign tech entrant,” the firm wrote in a research note.

Why It Matters: Unlocking Apple Intelligence in China could bolster user engagement and app-store revenue in a region that accounts for nearly 20% of global iPhone sales yet has underperformed on services growth.

Investors will eye Apple's Worldwide Developers Conference in June for firm iOS 18.6 timing and look to China-region guidance when the company reports Q3 fiscal results in late July.

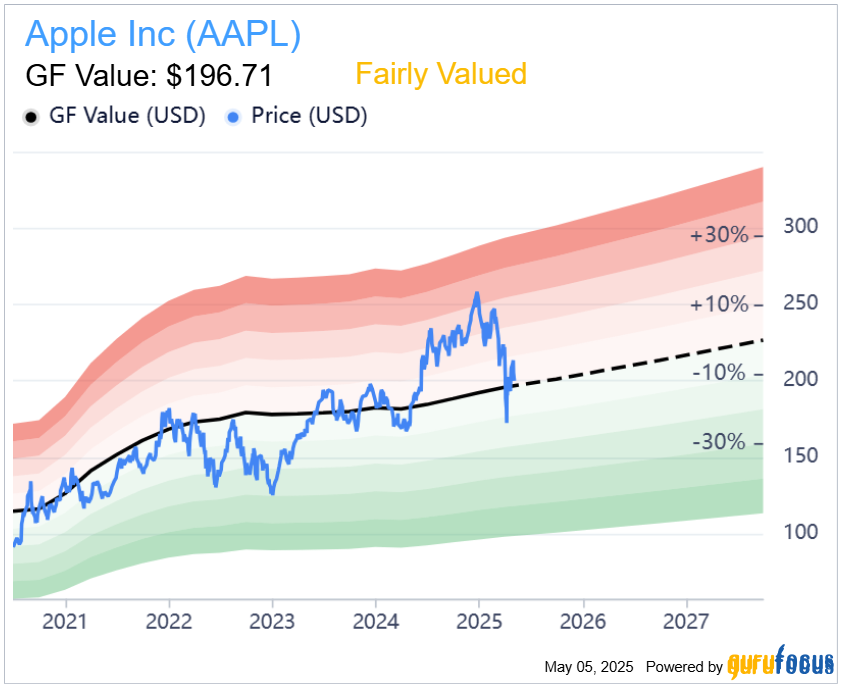

Apple (AAPL, Financial) is trading right around its GF Value of $196.71, signaling the market sees shares as fairly valued. After peaking near $250 in early 2025—well into the +10% fair‐value band—prices have retreated back to the black GF Value line. GuruFocus projects a modest climb to about $220 by mid-2026, reflecting steady Services and hardware revenue growth. The shaded bands suggest upside beyond $300 by 2027 is possible but capped, while a drop into the $140-$150 range would mark a -30% downside. That relatively tight valuation corridor highlights Apple's resilience but also underscores the need for new catalysts—such as AI integrations or next-gen product launches—to drive meaningful upside.