On May 5, 2025, NAPCO Security Technologies Inc (NSSC, Financial) released its 8-K filing detailing its fiscal 2025 third-quarter results. The company, a prominent manufacturer of security products including access control systems, door-locking products, and intrusion and fire alarm systems, reported a mixed performance for the quarter.

Company Performance and Challenges

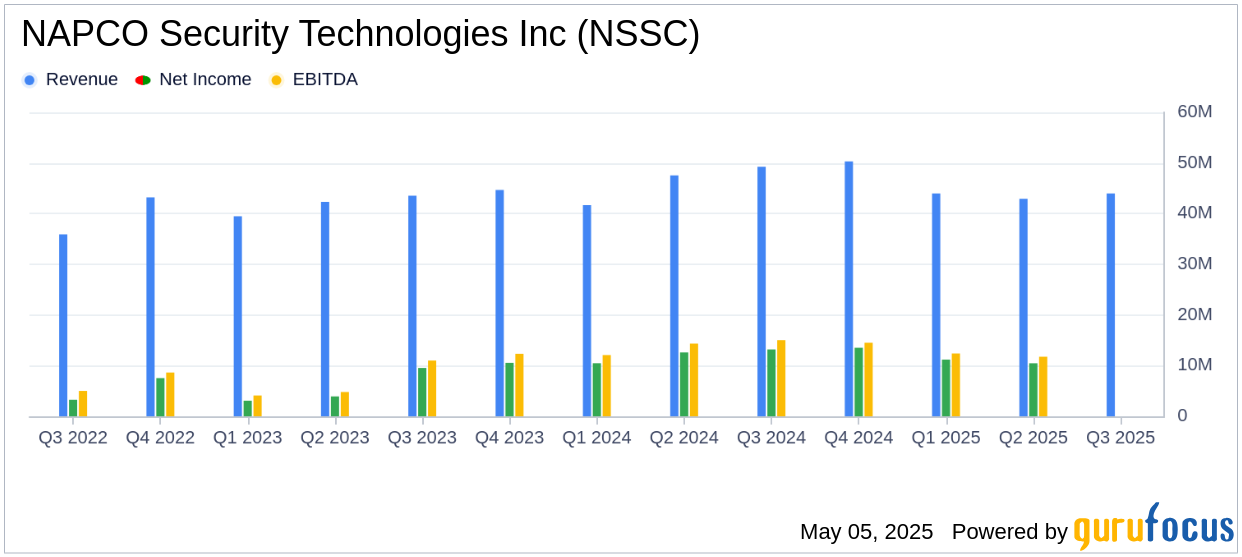

NAPCO Security Technologies Inc (NSSC, Financial) reported net sales of $44.0 million for the third quarter, marking a 10.8% decrease year-over-year. This decline was primarily attributed to a significant drop in equipment sales, which fell by 24.8% to $22.4 million. The company faced challenges with reduced sales to three major distributors, two of which were managing existing inventory levels, while the third was affected by project timing issues.

Despite these challenges, the company saw a 10.6% increase in recurring service revenue (RSR), reaching $21.6 million. This segment now represents 49% of total revenue, highlighting its growing importance to the company's financial health.

Financial Achievements and Industry Context

NAPCO Security Technologies Inc (NSSC, Financial) achieved a gross profit margin of 57.2%, up from 53.8% in the prior year quarter. This improvement underscores the company's ability to maintain profitability despite declining sales. The company's focus on recurring revenue streams is crucial in the business services industry, where consistent income can provide stability amidst fluctuating equipment sales.

Key Financial Metrics

The company's diluted earnings per share (EPS) for the quarter was $0.28, falling short of the analyst estimate of $0.30. This decline from the previous year's EPS of $0.36 reflects the challenges faced in equipment sales. However, the company's adjusted EBITDA return of 30% and strong cash flow position it well for future growth.

NAPCO Security Technologies Inc (NSSC, Financial) declared a quarterly dividend of $0.14 per share, payable on July 3, 2025, representing an increase over the previous dividend of $0.125 per share. This decision reflects the company's confidence in its financial stability and commitment to returning value to shareholders.

Management Commentary

Richard Soloway, Chairman and CEO, commented, “With the completion of our third quarter of Fiscal 2025, we are pleased with our 30% adjusted EBITDA return and the continued strong gross margin of 91% of our RSR and the increase of 10.6% to $21.6 million. RSR represents 49% of total revenue in Q3 and our RSR had a prospective run rate of approximately $89 million based on our April 2025 recurring service revenue.”

Analysis and Outlook

While NAPCO Security Technologies Inc (NSSC, Financial) faced challenges in equipment sales, its strategic focus on recurring service revenue has proven beneficial. The introduction of new products, such as the cloud-based MVP Access platform, is expected to bolster future recurring revenue streams. However, the company must navigate the uncertainties of tariffs and adjust pricing strategies accordingly.

Overall, NAPCO Security Technologies Inc (NSSC, Financial) remains well-positioned in the electronic security market, with its strong recurring revenue base and commitment to innovation and financial strength. Investors will be keen to see how the company leverages these strengths in the coming quarters.

Explore the complete 8-K earnings release (here) from NAPCO Security Technologies Inc for further details.