Key Takeaways:

- Monster Beverage (MNST, Financial) stock increased by 83% over five years, which lagged behind the market average.

- Analysts see a potential downside of 3.79% from the current price of $60.92.

- The GF Value projects a possible 14.59% upside for MNST, offering investors a glimpse of potential future growth.

Monster Beverage Corporation (MNST) has experienced an 83% increase in its stock price over the past five years. However, this performance has underperformed relative to the broader market average. Over the past year, MNST stock has appreciated by 9.2%. This gain aligns with an annual earnings per share growth of 8.7%, indicating a positive market sentiment toward the company.

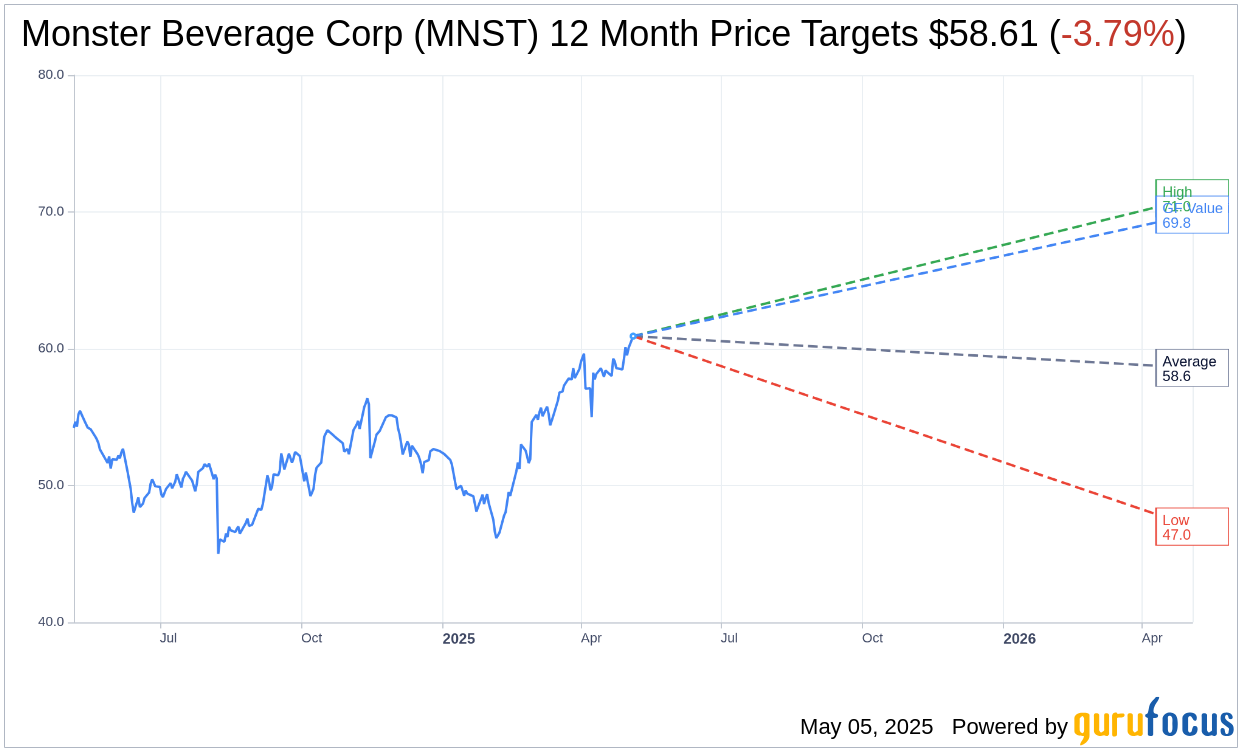

Wall Street Analysts' Projections

According to estimates from 22 Wall Street analysts, the average price target for Monster Beverage Corp (MNST, Financial) stands at $58.61. The highest estimate is $71.00, while the lowest is $47.00. Compared to the current stock price of $60.92, this suggests a potential downside of 3.79%. For more comprehensive projections, visit the Monster Beverage Corp (MNST) Forecast page.

The average brokerage recommendation for Monster Beverage Corp is 2.4, derived from 25 brokerage firms. This rating indicates an "Outperform" status, where the scale ranges from 1 (Strong Buy) to 5 (Sell).

Understanding GF Value Expectations

GuruFocus' estimated GF Value for Monster Beverage Corp (MNST, Financial) in the next year is $69.81. This projects a potential upside of 14.59% from the current price of $60.92. The GF Value represents GuruFocus' fair value estimate, calculated using the stock's historical trading multiples, past business growth, and future performance expectations. For further insights, check out the Monster Beverage Corp (MNST) Summary page.