- Cummins Inc. reports record-breaking Q1 2025 results in its Power Systems segment with $8.2 billion in revenue.

- Challenges from trade tariffs cause the company to withdraw its full-year guidance.

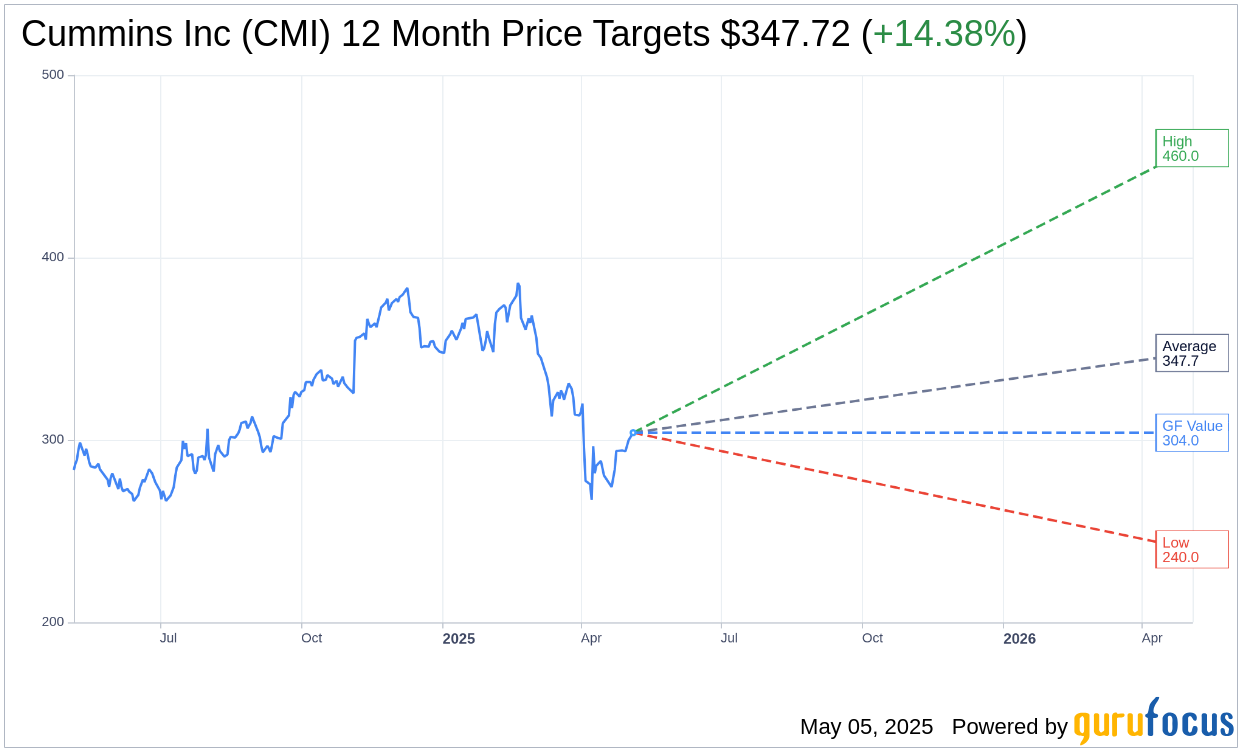

- Wall Street analysts set a price target with an upside potential of 14.38% from current levels.

Cummins Inc. (CMI, Financial) delivered a stellar performance in the first quarter of 2025, particularly in its Power Systems segment. The company announced an impressive $8.2 billion in revenue, alongside a robust EBITDA margin of 17.9%. However, despite exceptional operational efficiency, the introduction of trade tariffs has cast a shadow of uncertainty over future projections, prompting Cummins to withdraw its full-year guidance.

Among recent strategic advancements, Cummins has unveiled the state-of-the-art B7.2 diesel engine and finalized an acquisition aimed at enhancing its hybrid solutions for mining and rail sectors.

Wall Street Analysts' Forecast

Analyzing the insights from 16 Wall Street analysts, Cummins Inc. (CMI, Financial) has an average price target of $347.72. This reflects a potential upside of 14.38% from the current share price of $304.00. The price target spectrum ranges significantly, with estimates spreading from a high of $460.00 to a low of $240.00. For more detailed projections, visit the Cummins Inc (CMI) Forecast page.

Brokerage firms collectively rate Cummins Inc. (CMI, Financial) at an average of 2.5, which suggests an "Outperform" standing. This consensus rating falls on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 points to Sell.

According to GuruFocus estimates, the projected GF Value for Cummins Inc. (CMI, Financial) in one year aligns exactly with the current price of $304.00, indicating a downside of 0%. The GF Value is a reflection of GuruFocus' assessed fair value of the stock, rooted in historical trading multiples, business growth history, and anticipated future performance. For further data, navigate to the Cummins Inc (CMI) Summary page.