Barclays has revised its price target for Fortive (FTV, Financial), decreasing it to $84 from the previous $85. Despite this adjustment, the firm maintains an Overweight rating on Fortive's shares. Analysts at Barclays observed that Fortive's total company estimates were positioned at the lower end of the prior FY25 EPS guidance. The new forecasts are considered more realistic, although not without challenges, especially given a greater-than-anticipated 10-cent net tariff setback.

Following a less-than-ideal earnings report, Barclays anticipates that Fortive's upcoming Capital Markets Day on June 10, along with the planned spin-off of Ralliant by the end of the second quarter, will act as positive catalysts to elevate the stock's performance in the coming months.

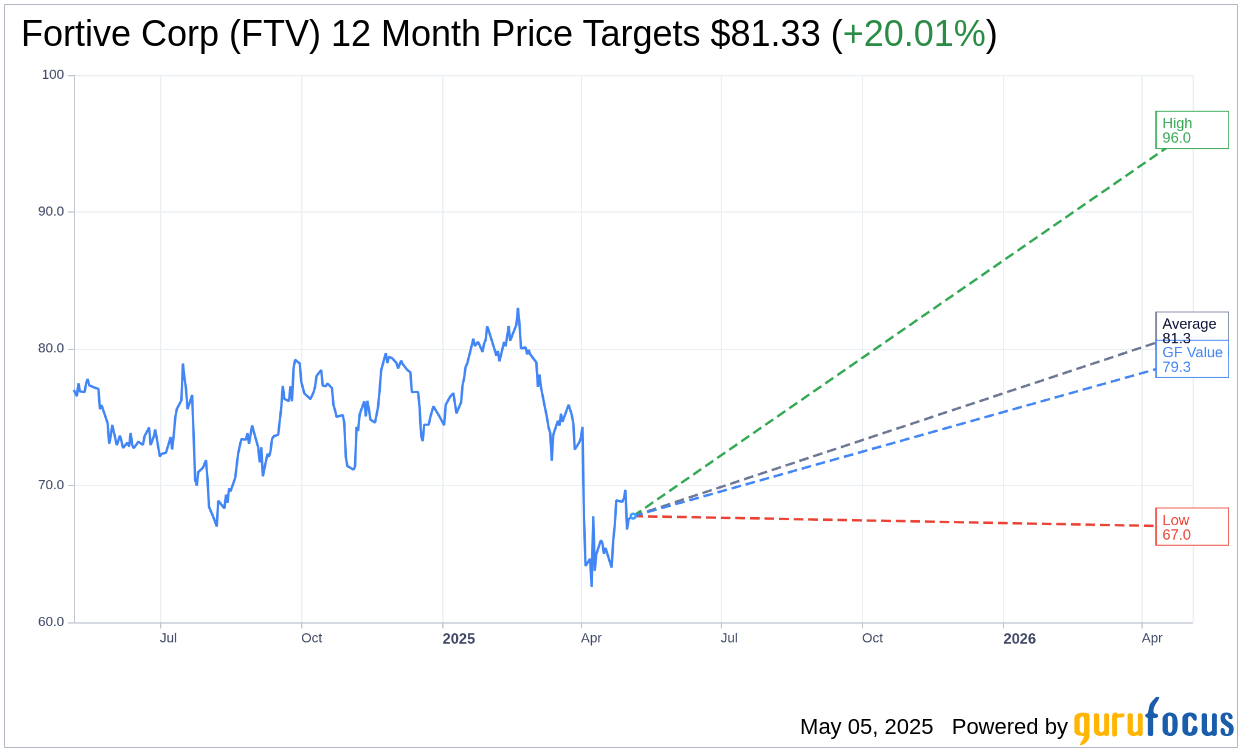

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Fortive Corp (FTV, Financial) is $81.33 with a high estimate of $96.00 and a low estimate of $67.00. The average target implies an upside of 20.01% from the current price of $67.77. More detailed estimate data can be found on the Fortive Corp (FTV) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Fortive Corp's (FTV, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fortive Corp (FTV, Financial) in one year is $79.26, suggesting a upside of 16.95% from the current price of $67.77. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fortive Corp (FTV) Summary page.

FTV Key Business Developments

Release Date: May 01, 2025

- Adjusted Earnings Per Share (EPS): $0.85, in line with expectations.

- Core Revenue Decline: 2% in the quarter.

- Total Revenue Decline: 3%, impacted by FX headwinds.

- Adjusted Operating Profit: $373 million.

- Adjusted Operating Margin Expansion: 20 basis points.

- Adjusted Free Cash Flow: $222 million, better than expected.

- Share Repurchases: 2.5 million shares in the first quarter.

- Intelligent Operating Solutions Core Revenue Growth: 2%.

- Advanced Healthcare Solutions Core Revenue Growth: 2.5%.

- Precision Technologies Core Revenue Decline: 8.4%.

- Adjusted Operating Margin Contraction in Precision Technologies: 260 basis points.

- Second Quarter Adjusted EPS Guidance: $0.85 to $0.90.

- Full Year 2025 Adjusted EPS Guidance: $3.80 to $4.00.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fortive Corp (FTV, Financial) delivered a solid first quarter performance with adjusted earnings per share of $0.85, in line with expectations.

- The company expanded both adjusted gross and operating margins despite slightly lower-than-expected revenues.

- Fortive Corp (FTV) demonstrated strong cash flow generation and continued share repurchases, reflecting a commitment to value-enhancing capital deployment.

- The Intelligent Operating Solutions and Advanced Healthcare Solutions segments showed sustained top-line momentum.

- Fortive Corp (FTV) has reduced its exposure to imports from China by 70% since 2018, enhancing supply chain and manufacturing resilience.

Negative Points

- Core revenue declined by 2% in the quarter, slightly below expectations, with total revenue down 3% due to FX headwinds.

- Precision Technologies segment experienced an 8.4% core decline, driven by lower-than-expected orders and shipment delays.

- The company faces challenges from newly announced tariffs, with an estimated gross impact of $190 million to $220 million.

- Test and Measurement core revenue declined by high teens, with significant declines in Western Europe and China.

- Adjusted operating profit margins contracted by 260 basis points in the Precision Technologies segment due to lower volumes and unfavorable mix.