Wells Fargo's analyst, Michael Blum, highlights Kinder Morgan's (KMI, Financial) recent filing with the Arizona Corporation Commission. This move is aimed at increasing gas supplies to accommodate growing needs from data centers, industrial users, and the West Coast LNG market. Blum suggests that Kinder Morgan may emerge as a leading candidate to establish a significant gas pipeline in Arizona. The firm continues to hold an Overweight rating on the company's stock with a price target of $33.

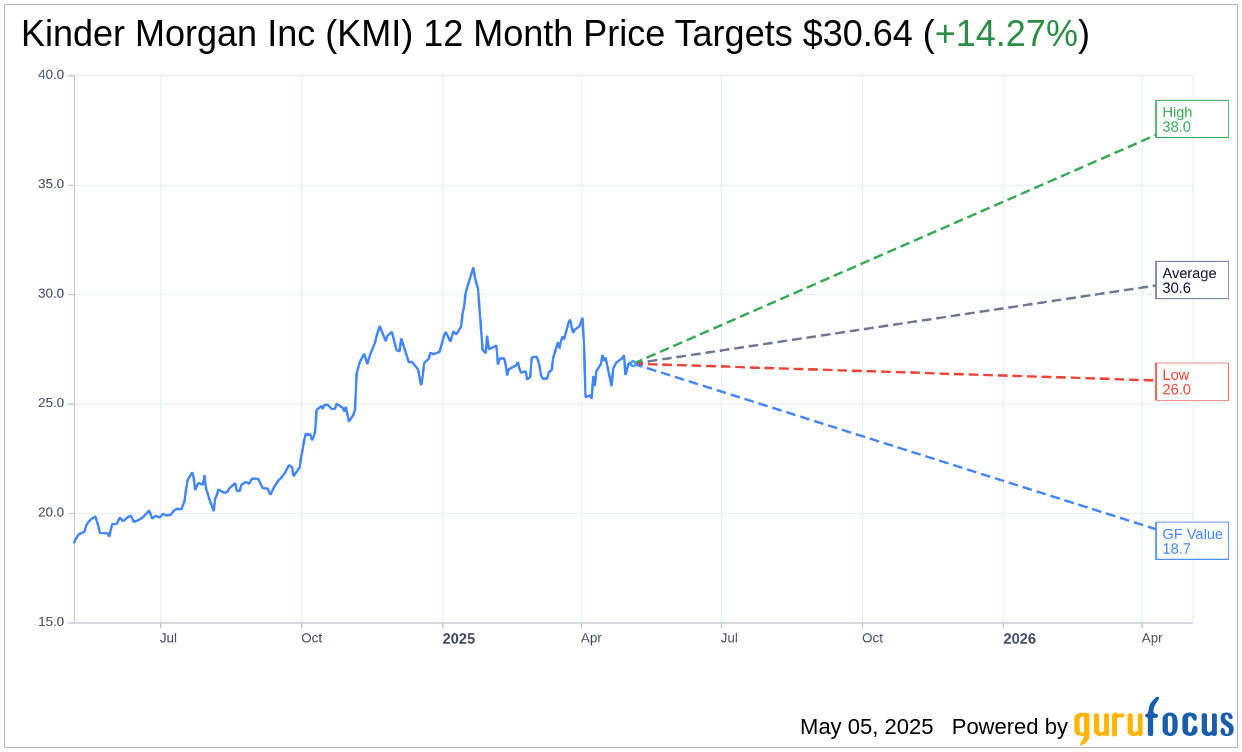

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Kinder Morgan Inc (KMI, Financial) is $30.65 with a high estimate of $38.00 and a low estimate of $26.00. The average target implies an upside of 14.27% from the current price of $26.82. More detailed estimate data can be found on the Kinder Morgan Inc (KMI) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Kinder Morgan Inc's (KMI, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kinder Morgan Inc (KMI, Financial) in one year is $18.73, suggesting a downside of 30.16% from the current price of $26.819. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kinder Morgan Inc (KMI) Summary page.

KMI Key Business Developments

Release Date: April 16, 2025

- Dividend: Declared at $0.2925 per share, annualized to $1.17, up 2% from last year.

- Net Income: $717 million, down 4% from the previous year.

- Earnings Per Share (EPS): $0.32, down $0.01 from last year.

- Adjusted Net Income: $766 million, up 1% from last year.

- Adjusted EPS: $0.34, flat compared to last year.

- Net Debt: $32.8 billion, with a net debt to adjusted EBITDA ratio of 4.1 times.

- Natural Gas Demand: Record demand with a 6.8 Bcf/day increase, driven by a 10% rise in residential and commercial demand and a 15% increase in LNG demand.

- Project Backlog: Increased by $900 million, totaling $8.8 billion.

- Transport Volumes: Up 3% compared to Q1 2024.

- Gathering Volumes: Down 6% compared to Q1 2024.

- Refined Products Volumes: Up 2% compared to Q1 2024.

- Crude and Condensate Volumes: Up 4% compared to Q1 2024.

- Liquids Lease Capacity: High at 94%.

- Jones Act Tanker Fleet: 97% leased through 2025.

- CO2 Segment Oil Production: Slightly lower by 1% compared to Q1 2024.

- Adjusted EBITDA Growth: Expected to increase to 5% with the Outrigger acquisition.

- Full-Year Net Debt to Adjusted EBITDA: Expected to end at 3.8 times.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Kinder Morgan Inc (KMI, Financial) reported strong natural gas performance, with record demand driven by a 10% increase in residential and commercial demand and a 15% increase in LNG demand.

- The company added approximately $900 million to its project backlog, with over 70% focused on serving power demand, indicating strong future growth potential.

- KMI's financial results were in line with expectations, and the company expects to exceed its budget for the year, partly due to the Outrigger acquisition.

- The company has a resilient business model, with almost two-thirds of EBITDA generated from take-or-pay contracts, providing stability amid market volatility.

- KMI's strategic positioning with 70,000 miles of gas pipelines and a significant presence in key demand areas like the Gulf Coast and Southeastern United States supports future expansion opportunities.

Negative Points

- There is uncertainty regarding the impact of tariffs on project economics, although KMI has taken steps to mitigate potential effects.

- Natural gas gathering volumes were down 6% in the quarter compared to the first quarter of 2024, primarily due to lower Haynesville production.

- The company experienced a 4% decline in net income attributable to KMI, partly due to unfavorable mark-to-market on hedges.

- KMI's gathering business, which is roughly 8% of its overall business, faces potential challenges if oil prices remain low, affecting producer activity.

- The company is cautious about the potential impact of economic volatility and commodity price fluctuations on its outlook for the year.