Dorman Products, Inc. (DORM, Financial) has announced its financial results for the first quarter, reporting revenue of $507.69 million, surpassing the anticipated $483.08 million. The company saw an 8.3% rise in total net sales, largely fueled by robust demand within its Light Duty segment. This strong performance contributed to a remarkable 78% surge in diluted earnings per share (EPS), along with a 54% increase in adjusted diluted EPS. These results affirm Dorman's confidence in sustaining growth in its core business through 2025.

Wall Street Analysts Forecast

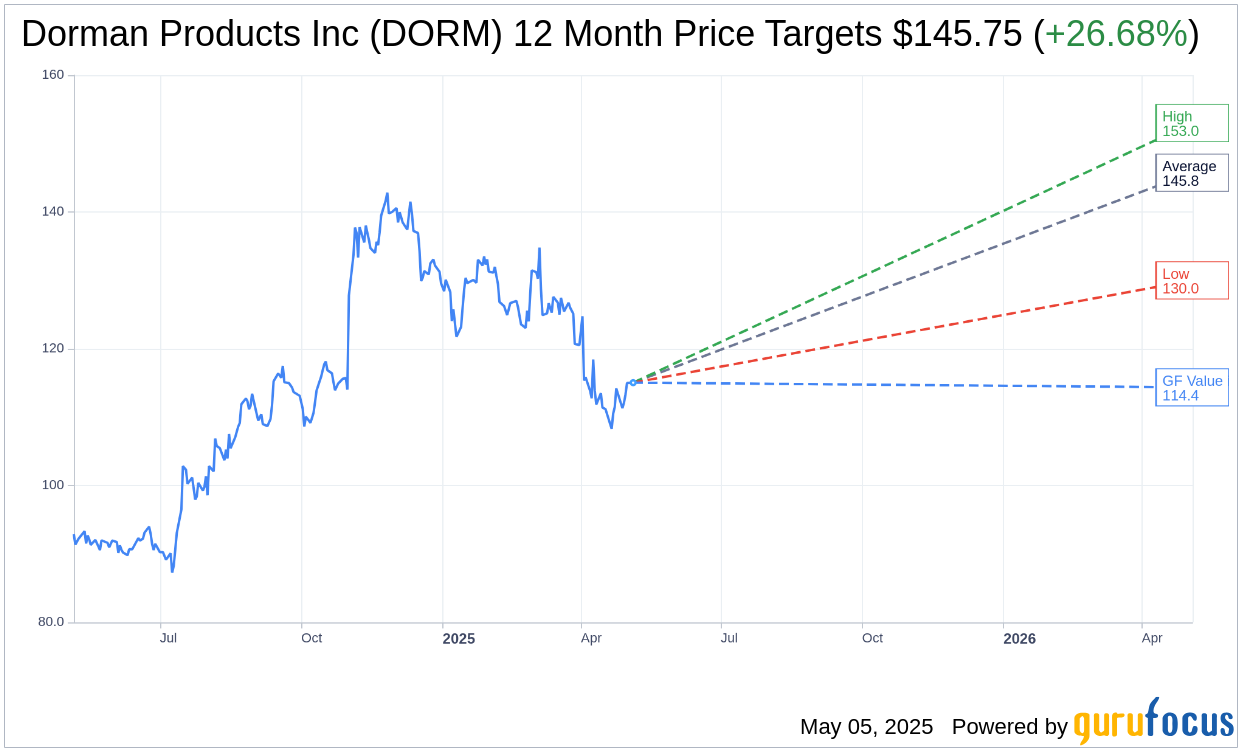

Based on the one-year price targets offered by 4 analysts, the average target price for Dorman Products Inc (DORM, Financial) is $145.75 with a high estimate of $153.00 and a low estimate of $130.00. The average target implies an upside of 26.68% from the current price of $115.05. More detailed estimate data can be found on the Dorman Products Inc (DORM) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Dorman Products Inc's (DORM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dorman Products Inc (DORM, Financial) in one year is $114.36, suggesting a downside of 0.6% from the current price of $115.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dorman Products Inc (DORM) Summary page.

DORM Key Business Developments

Release Date: February 27, 2025

- Annual Sales: Surpassed $2 billion for the first time, with a 4.1% year-over-year growth.

- Q4 Net Sales: $534 million, an 8% increase year over year.

- Adjusted Operating Margin: 17.5% for Q4, expanding 210 basis points from the previous year.

- Adjusted EPS: Increased 40% to $2.20 in Q4.

- Free Cash Flow: $63 million in Q4, allowing for $54 million debt repayment.

- Light Duty Segment Sales Growth: 11% increase in Q4.

- Heavy Duty Segment Sales: Down 8% year over year in Q4.

- Specialty Vehicle Segment Sales Growth: 5% increase in Q4.

- Adjusted Gross Margin: 41.7% in Q4, a 240 basis point increase year over year.

- Net Debt: $426 million as of December 31, 2024, with a net leverage ratio of 1.12 times adjusted EBITDA.

- 2025 Sales Growth Guidance: Expected to be in the range of 3% to 5% over 2024.

- 2025 Adjusted EPS Guidance: Expected to be between $7.05 and $7.85, representing 6% to 10% growth over 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dorman Products Inc (DORM, Financial) surpassed the $2 billion annual sales mark for the first time in its history, with a 4.1% year-over-year growth in net sales.

- The company achieved significant margin expansion and earnings growth, leading to strong cash flow generation.

- Dorman Products Inc (DORM) successfully diversified its supplier base, reducing country-specific concentration and enhancing supply chain flexibility.

- The light duty segment experienced strong customer demand and new product execution, driving above-market sales growth.

- Dorman Products Inc (DORM) has a robust acquisition pipeline and expects the M&A environment to improve, providing opportunities for strategic growth.

Negative Points

- The heavy duty segment faced ongoing market challenges, with net sales down 8% year over year due to soft market conditions.

- Uncertainty around tariffs and other macroeconomic factors poses potential risks to Dorman Products Inc (DORM)'s 2025 results.

- The specialty vehicle segment experienced sluggish new machine sales due to manufacturers' inventory destocking efforts.

- Interest rates and inflation remain high, impacting consumer sentiment and new machine acquisition prices in the specialty vehicle market.

- The heavy duty market remains unclear regarding the timing of a return to growth, with delayed repairs affecting sales performance.