Corebridge Financial Inc (CRBG, Financial) released its 8-K filing on May 5, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company, a prominent provider of retirement solutions and insurance products in the United States, operates through five segments: Individual Retirement, Group Retirement, Life Insurance, Institutional Markets, and Corporate and Other. The majority of its revenue is derived from the Individual Retirement segment.

Performance and Challenges

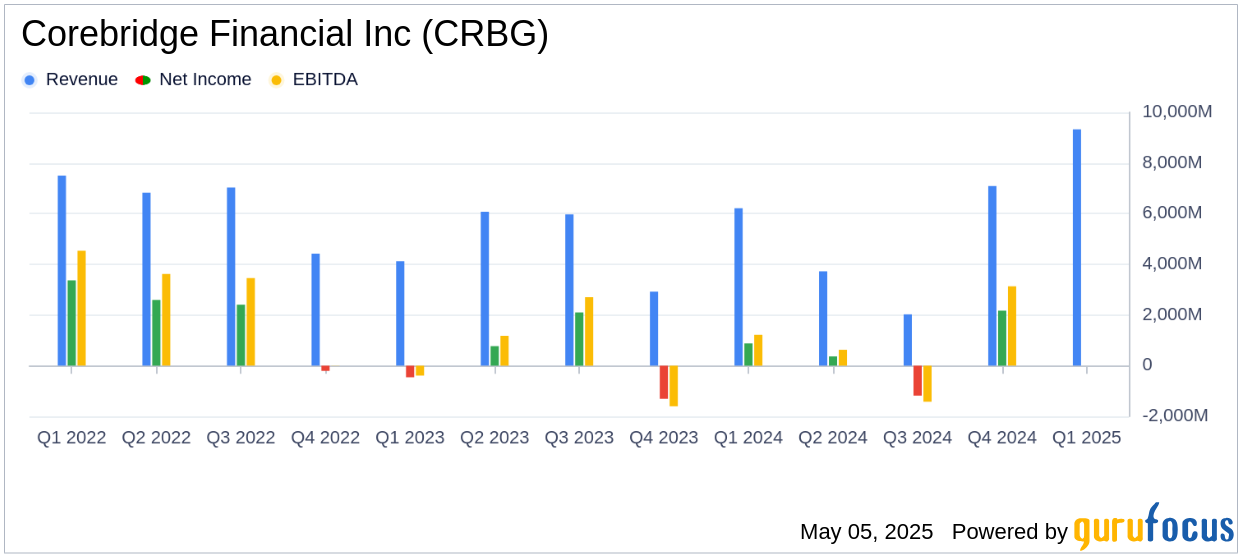

Corebridge Financial Inc (CRBG, Financial) reported a net loss of $664 million, or $1.19 per share, compared to a net income of $878 million in the same quarter last year. This significant variance was primarily due to higher realized losses, including the Fortitude Re funds withheld embedded derivative, and an unfavorable change in the fair value of market risk benefits. However, these were partially offset by higher net investment income.

Despite the net loss, the company achieved an adjusted after-tax operating income of $649 million, with an operating EPS of $1.16, surpassing the analyst estimate of $1.11. This performance underscores the resilience of Corebridge's diversified business model and strong balance sheet.

Financial Achievements

Corebridge Financial Inc (CRBG, Financial) returned $454 million to shareholders, including $321 million in share repurchases, reflecting an 18% increase year over year. The company maintained a holding company liquidity of $2.4 billion, positioning it well to navigate the current economic environment. The financial leverage ratio stood at 31.9%, impacted by the pre-funding of the April 2025 debt maturity.

Income Statement and Key Metrics

Adjusted pre-tax operating income (APTOI) was $810 million, a 3% decrease from the prior year quarter. Excluding variable investment income, notable items, and international businesses, APTOI decreased by 10% due to changes in short-term interest rates and higher interest expenses.

Core sources of income were $1.8 billion, a 3% decrease from the prior year quarter. However, excluding notable items and international businesses, core sources of income increased by 1%, driven by higher fee income and underwriting margin.

Segment Performance

| Segment | Premiums and Deposits (2025) | Premiums and Deposits (2024) | Change |

|---|---|---|---|

| Individual Retirement | $4,701 million | $4,861 million | -3% |

| Group Retirement | $2,000 million | $2,230 million | -11% |

| Life Insurance | $842 million | $1,080 million | -22% |

| Institutional Markets | $1,780 million | $2,424 million | -25% |

Premiums and deposits across segments saw a decline, with Individual Retirement and Group Retirement experiencing decreases of 3% and 11%, respectively. The Life Insurance segment saw a 22% decrease, primarily due to the sale of the international life business.

Analysis and Commentary

Kevin Hogan, President and CEO, commented,

Corebridge generated strong earnings and delivered attractive capital return over the first quarter, executing on our strategic priorities. Our capital, liquidity and financial flexibility position us well to navigate the current environment."

The company's ability to exceed EPS estimates despite a net loss highlights its operational efficiency and strategic focus. However, the challenges posed by market conditions and interest rate changes remain significant. The decrease in premiums and deposits across segments indicates potential headwinds in customer demand and market dynamics.

Overall, Corebridge Financial Inc (CRBG, Financial) demonstrates resilience in its core operations, with a focus on shareholder returns and maintaining liquidity. The company's strategic initiatives and diversified business model are crucial in navigating the current economic landscape.

Explore the complete 8-K earnings release (here) from Corebridge Financial Inc for further details.