On May 5, 2025, Tactile Systems Technology Inc (TCMD, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. Tactile Systems Technology Inc, a medical technology company, specializes in developing and providing medical devices for chronic disease treatment, including the Flexitouch system for lymphedema patients and the Actitouch system for chronic venous insufficiency patients.

Performance Overview and Challenges

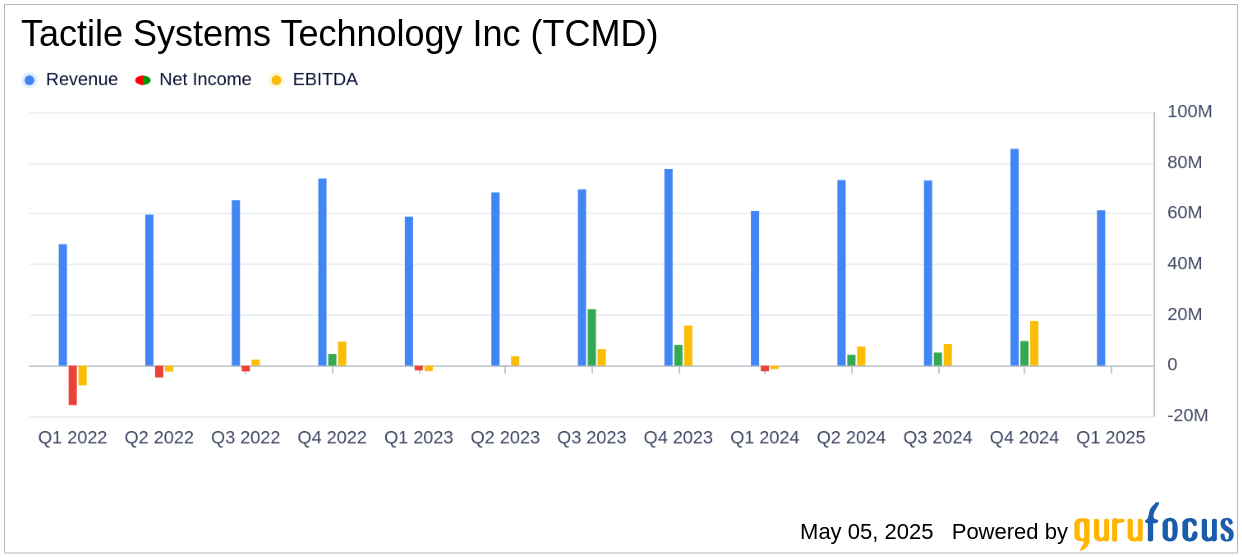

For the first quarter of 2025, Tactile Systems Technology Inc reported a total revenue of $61.3 million, a slight increase of 0.3% compared to the same period in 2024. This figure fell short of the analyst estimate of $63.28 million. The company's net loss widened to $3.0 million, or $(0.13) per diluted share, compared to a net loss of $2.2 million, or $(0.09) per diluted share, in the first quarter of 2024. The reported EPS was below the estimated EPS of -0.07.

The revenue increase was driven by a 22% rise in sales of the airway clearance product line, primarily due to increased placements of AffloVest among durable medical equipment partners. However, this was offset by a 3% decline in sales and rentals of the lymphedema product line, attributed to a decrease in field sales team headcount.

Financial Achievements and Industry Context

Despite the challenges, Tactile Systems Technology Inc achieved a gross margin of 74%, up from 71% in the first quarter of 2024, due to lower manufacturing and warranty costs. This improvement in gross margin is significant for the medical devices and instruments industry, where cost efficiency and product reliability are crucial for maintaining competitive advantage.

Key Financial Metrics

Operating expenses increased by 8% to $49.9 million, primarily due to planned strategic investments. The operating loss for the quarter was $4.5 million, compared to $3.0 million in the previous year. The company reported an adjusted EBITDA loss of $0.3 million, contrasting with a positive adjusted EBITDA of $1.0 million in Q1 2024.

On the balance sheet, Tactile Systems Technology Inc had $83.6 million in cash and $25.5 million in outstanding borrowings as of March 31, 2025. The company repurchased $10.0 million of its stock during the quarter, with $16.5 million remaining under its share repurchase program.

Strategic Initiatives and Outlook

The company expanded the launch of its Nimbl product to include patients with lower extremity conditions, aiming to capture a larger segment of the lymphedema market. CEO Sheri Dodd commented on the strategic initiatives, stating,

Through the first quarter our team executed on several highly strategic, growth-oriented priorities... Our underlying business fundamentals remain firmly in place and we are meaningfully advancing each of our three 2025 strategic priorities to remain the competitive market share leader in medical device lymphatic therapy."

Looking ahead, Tactile Systems Technology Inc has updated its 2025 financial outlook, now expecting full-year revenue between $309 million and $315 million, representing a growth of 5% to 8% year-over-year. This is a revision from the previous guidance of $316 million to $322 million. The company also anticipates full-year adjusted EBITDA in the range of $32 million to $34 million, down from the prior expectation of $35 million to $37 million.

Conclusion

Tactile Systems Technology Inc's first-quarter results highlight both the challenges and opportunities facing the company. While revenue growth was modest and earnings fell short of expectations, strategic initiatives and improvements in gross margin demonstrate the company's commitment to long-term growth and market leadership in the medical devices sector. Investors will be keen to see how these efforts translate into financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Tactile Systems Technology Inc for further details.