Primoris Services Corporation (PRIM, Financial) reported an impressive first quarter revenue of $1.648 billion, surpassing the anticipated $1.49 billion. This achievement highlights the company's effective execution of its strategic initiatives aimed at enhancing profit margins and bolstering cash flow.

The leadership, under the guidance of David King, the Chairman and Interim President and CEO, remains committed to prioritizing customer satisfaction through dependable and high-quality services. King expressed gratitude towards the workforce whose dedication was pivotal in reaching the company's objectives in the initial quarter of 2025.

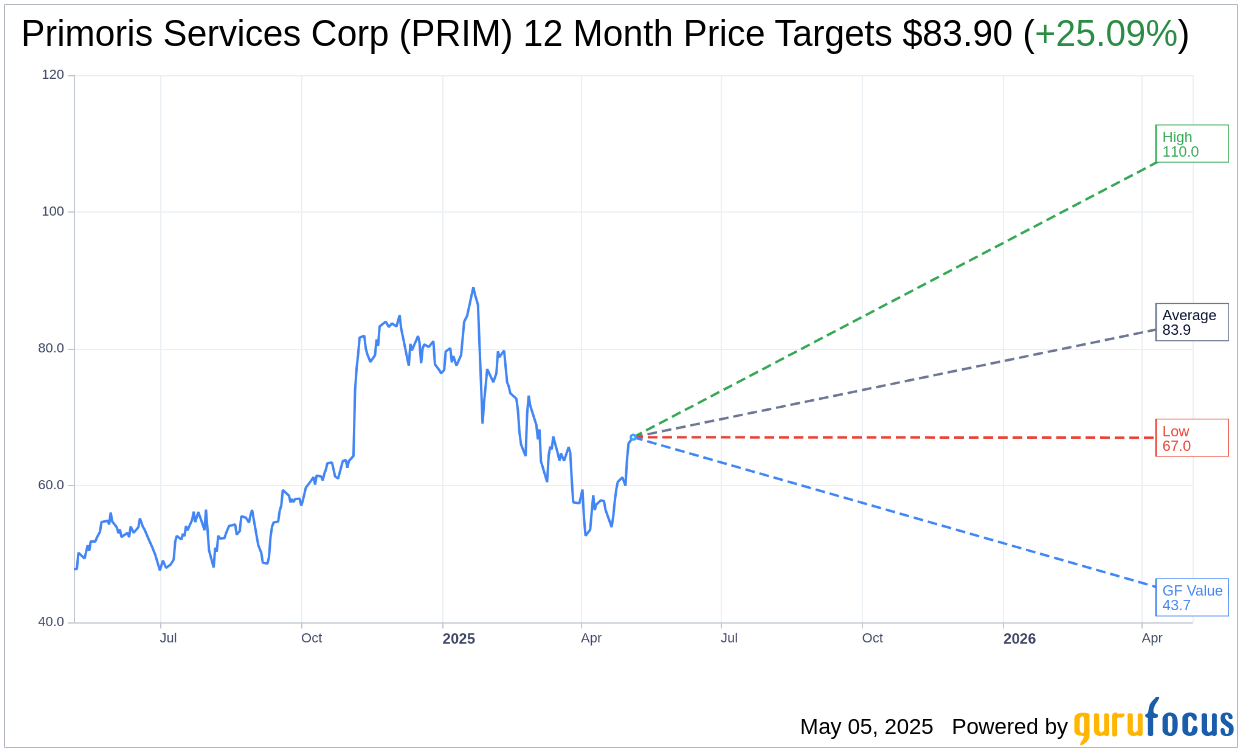

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Primoris Services Corp (PRIM, Financial) is $83.90 with a high estimate of $110.00 and a low estimate of $67.00. The average target implies an upside of 25.09% from the current price of $67.07. More detailed estimate data can be found on the Primoris Services Corp (PRIM) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Primoris Services Corp's (PRIM, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Primoris Services Corp (PRIM, Financial) in one year is $43.66, suggesting a downside of 34.9% from the current price of $67.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Primoris Services Corp (PRIM) Summary page.

PRIM Key Business Developments

Release Date: February 25, 2025

- Revenue: Fourth quarter revenue was $1.7 billion, a 15% increase compared to the prior year.

- Gross Profit: Improved by $28 million or 18% to approximately $185 million in the fourth quarter.

- Gross Margin: Increased to 10.6% from 10.3% in the prior year.

- Utility Segment Revenue: Increased by nearly $88 million compared to the prior year.

- Utility Segment Gross Margin: Improved to 12.1% from 7.4% in the prior year.

- Energy Segment Revenue: Increased by $148 million compared to the prior year.

- Energy Segment Gross Margin: Decreased to 9.5% from 12% in the prior year.

- Full Year Revenue: Approximately $6.4 billion, up $650 million from the prior year.

- Operating Cash Flow: Fourth quarter operating cash flows were approximately $298 million; full year operating cash flows exceeded $508 million.

- Capital Expenditures: $23.6 million in the fourth quarter and $126.6 million for the full year.

- Backlog: Total backlog increased to $11.9 billion, up nearly $1 billion from the prior year.

- Net Debt-to-EBITDA Ratio: Reduced to 0.7.

- 2025 Earnings Guidance: EPS expected between $3.70 and $3.90; adjusted EPS between $4.20 and $4.40.

- Adjusted EBITDA Guidance for 2025: $440 million to $460 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Primoris Services Corp (PRIM, Financial) achieved record revenue, earnings, backlog, and cash flow from operations in 2024, marking the best year in the company's history.

- The company successfully expanded into the solar power delivery and communications markets, contributing to its growth and diversification.

- Primoris Services Corp (PRIM) reported a significant increase in cash flow from operations, generating over $500 million in 2024.

- The Utilities segment saw improved margins due to favorable weather conditions and increased customer activity, particularly in gas and communications.

- The Energy segment experienced over 20% revenue growth, driven by strong performance in the renewables business.

Negative Points

- The Energy segment faced performance challenges that weighed on margins, particularly due to lower pipeline activity and weather impacts.

- Primoris Services Corp (PRIM) anticipates a $160 million revenue headwind in 2025 due to divestitures and unwinding of certain non-core businesses.

- The bidding market for pipeline projects remains low and extremely competitive, impacting potential growth in this area.

- There is uncertainty in the renewables market due to rapidly changing trade and regulatory environments, which could affect future bookings.

- The company expects cash flow from operations to normalize in 2025, with a projected decrease compared to the record levels achieved in 2024.