Key Highlights:

- Palantir Technologies reports solid growth, exceeding both revenue forecasts and future outlook.

- Investment analysts provide mixed reviews with a consensus "Hold" rating.

- GuruFocus estimates suggest a potential downside relative to the stock's current trading price.

Shares of Palantir Technologies (PLTR, Financial) experienced a 3% dip in after-hours trading, despite the company outperforming first-quarter expectations. Notably, Palantir has revised its full-year revenue guidance upward, now anticipating annual earnings between $3.89 billion and $3.9 billion, surpassing analysts' estimates of $3.75 billion. Furthermore, the company reported considerable annual growth in U.S. commercial and government revenues, which continues to be a significant revenue driver.

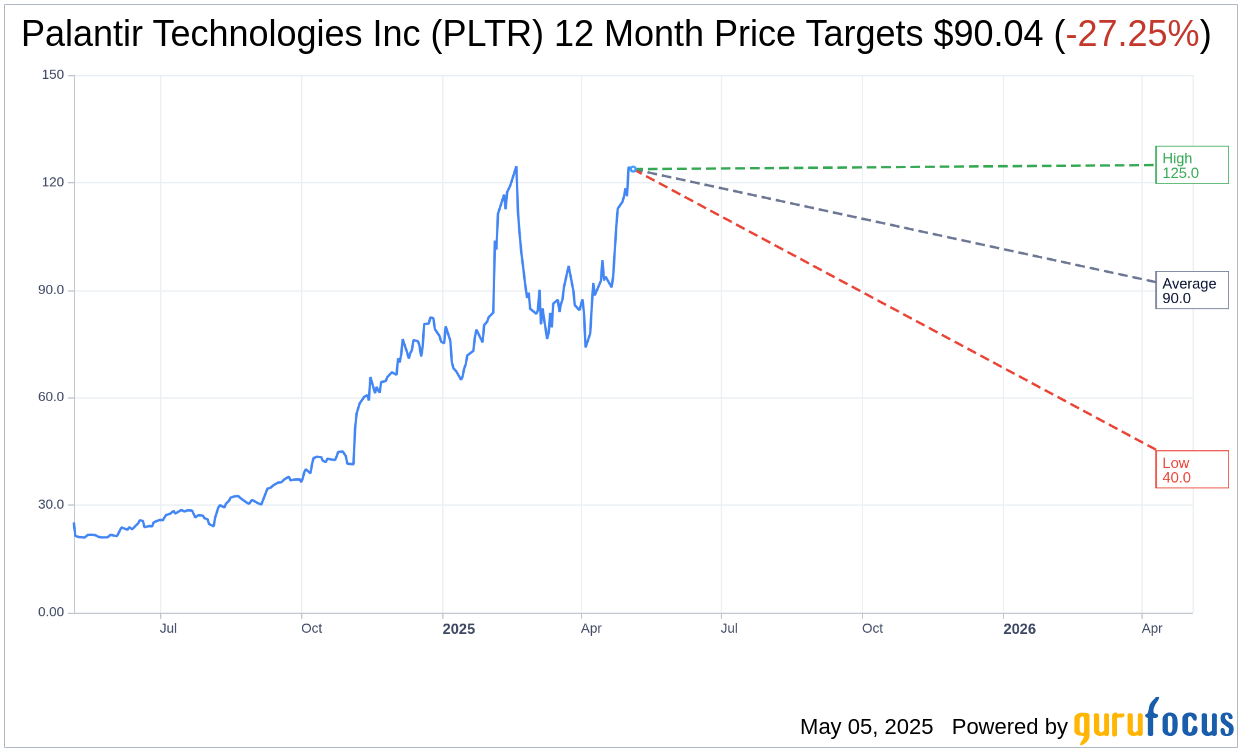

Wall Street Analysts Forecast

According to forecasts from 20 financial analysts, the average one-year price target for Palantir Technologies Inc (PLTR, Financial) stands at $90.04. This median target includes a high estimate of $125.00 and a low estimate of $40.00. Based on the current stock price of $123.77, these projections suggest a potential downside of 27.25%. For more in-depth insights, visit the Palantir Technologies Inc (PLTR) Forecast page.

The consensus recommendation from 24 brokerage firms rates Palantir Technologies Inc (PLTR, Financial) at an average of 2.9, which equates to a "Hold" rating. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), providing a nuanced view of analyst sentiment.

In terms of the estimated GF Value metric from GuruFocus, Palantir's one-year projection is set at $27.12. This implies a potential downside of 78.09% from its current trading price of $123.77. The GF Value is a proprietary metric that represents the calculated fair value of the stock, derived from historical trading multiples, past business growth, and future performance estimates. For a detailed breakdown, visit the Palantir Technologies Inc (PLTR, Financial) Summary page.