Corebridge (CRBG, Financial) has reported strong financial outcomes for the first quarter, reflecting its strategic execution and solid market positioning. The company achieved operating earnings per share of $1.16, marking a 5% improvement from the previous year. This growth underscores the advantages of Corebridge's diversified operations, solid financial foundation, and disciplined approach.

Additionally, Corebridge successfully returned $454 million in capital to its shareholders, which represents an 18% increase from the previous year and equates to a 70% payout ratio. The leadership at Corebridge emphasized their commitment to creating substantial value for both shareholders and clients, especially in uncertain market conditions, by partnering with individuals and financial entities to empower financial decision-making.

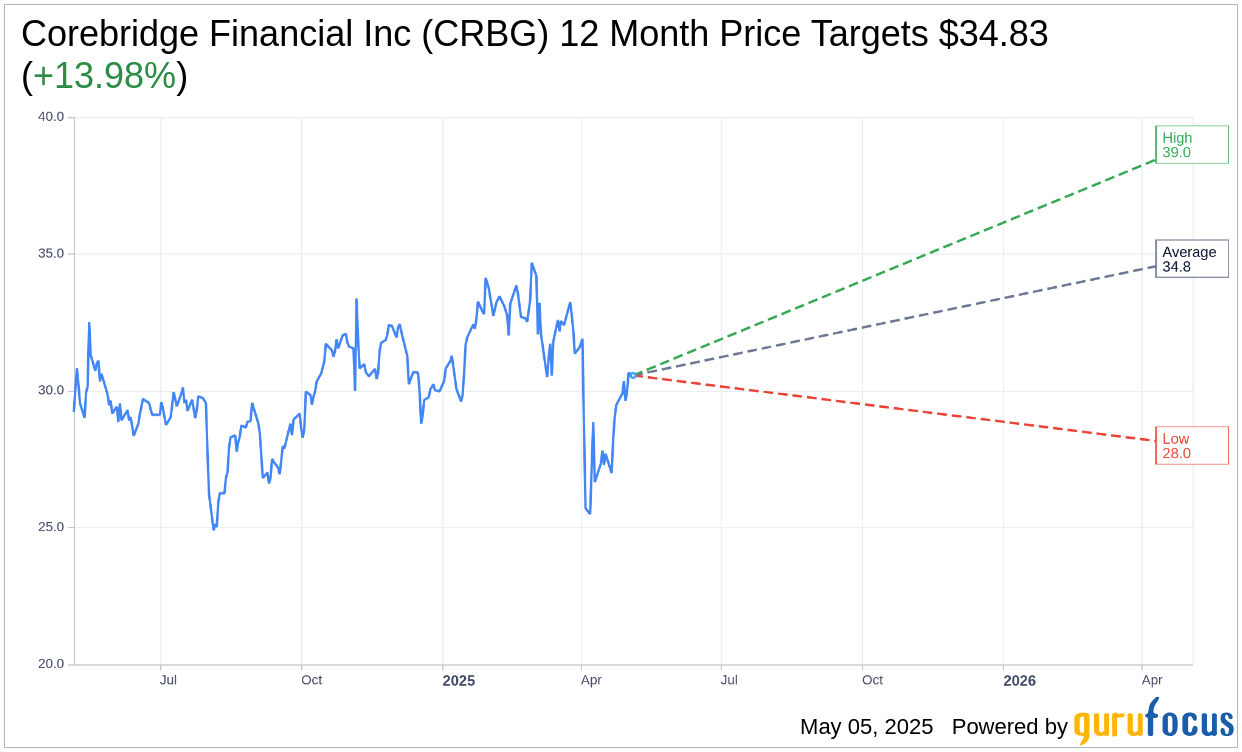

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Corebridge Financial Inc (CRBG, Financial) is $34.83 with a high estimate of $39.00 and a low estimate of $28.00. The average target implies an upside of 13.98% from the current price of $30.56. More detailed estimate data can be found on the Corebridge Financial Inc (CRBG) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Corebridge Financial Inc's (CRBG, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

CRBG Key Business Developments

Release Date: February 13, 2025

- Adjusted ROE: Achieved 12% to 14%, with a run rate ROE improvement of over 300 basis points.

- Payout Ratio: Exceeded target with a cumulative payout ratio of 73%, returning $4.9 billion to shareholders.

- Run Rate Operating EPS: Improved by 35%, with a quarterly run rate operating EPS increase of 11% year over year to $1.28.

- Full-Year Operating EPS: Increased by 18% year over year to $4.83.

- Premiums and Deposits: $41.7 billion in 2024, a 5% increase over 2023.

- Expense Reduction: Achieved $400 million in run rate savings, reducing expenses by 13% over two years.

- Fourth-Quarter Adjusted Pretax Operating Income: $878 million, with operating EPS of $1.23, an 18% increase year over year.

- Fee Income: Improved 10% year over year.

- Underwriting Margin: Improved 22% year over year.

- Base Spread Income: Declined 5% year over year.

- General Account Net Inflows: $1.6 billion in the fourth quarter, with full-year net inflows of $6.9 billion.

- Group Retirement Net Outflows: $3.5 billion in the fourth quarter.

- Life Insurance Operating Income: Increased more than 100% year over year.

- Institutional Markets Full-Year Earnings: Increased 17% year over year.

- Holding Company Liquidity: $2.2 billion at year-end.

- Life Fleet RBC Ratio: Estimated to be in the range of 420% to 430% at the end of 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Corebridge Financial Inc (CRBG, Financial) achieved or exceeded its financial goals, including an adjusted ROE of 12% to 14% and a payout ratio of 60% to 65%, supported by the Corebridge Forward efficiency program.

- The company reported a 35% improvement in quarterly run rate operating earnings per share, driven by earnings growth and capital management.

- Corebridge Financial Inc (CRBG) returned $4.9 billion to shareholders since its IPO, with a cumulative payout ratio of 73%, and repurchased 14% of its outstanding shares.

- The company achieved $400 million in run rate savings ahead of schedule, reducing expenses by 13% on a comparable basis.

- Corebridge Financial Inc (CRBG) increased full-year operating earnings per share by 18% year over year to $4.83, with a run rate ROE improvement of over 100 basis points to 13.2%.

Negative Points

- Base spread income declined by 5% due to net outflows in the Group Retirement business and changes in short-term interest rates.

- The Individual Retirement segment experienced a 7% decline in adjusted pretax operating income due to base spread compression.

- The company anticipates near-term headwinds from changes in short-term interest rates and related hedging activities.

- Corebridge Financial Inc (CRBG) expects EPS growth to be less than 10% in 2025 due to spread pressures and other dynamics.

- The company faces potential challenges with increased surrender rates in Individual Retirement as large lots of fixed and fixed index annuities exit their surrender charge period.