- Strong Q1 performance with EPS and revenue exceeding expectations for Sterling Infrastructure.

- Analyst price targets suggest potential upside of 19% from current levels.

- GuruFocus metrics indicate a significant downside risk based on GF Value estimates.

Sterling Infrastructure (STRL, Financial) has captured investor attention with its impressive Q1 results. The company reported a Non-GAAP EPS of $1.63, beating expectations by $0.18. Revenue for the quarter reached $430.9 million, surpassing projections by $21.85 million. With a robust backlog of $2.23 billion as of March 31, 2025, Sterling Infrastructure sets the stage for promising growth and sustainability in the coming quarters.

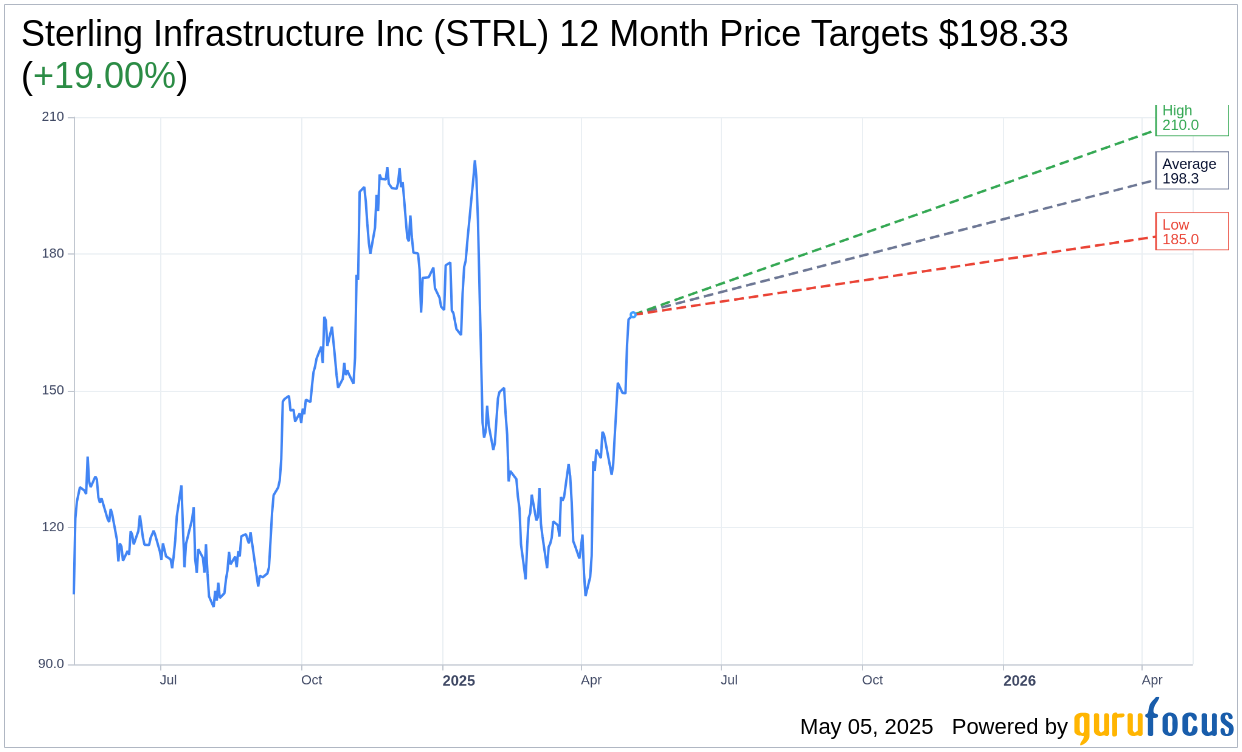

Wall Street Analysts Forecast

Stock analysts have given Sterling Infrastructure Inc (STRL, Financial) a positive outlook with one-year price targets from three analysts averaging $198.33. This forecast includes a high estimate of $210.00 and a low estimate of $185.00. Such figures imply a potential upside of 19.00% from the current share price of $166.66. Investors looking for more detailed price target information can visit the Sterling Infrastructure Inc (STRL) Forecast page.

Brokerage Recommendations

Analysts' recommendations are optimistic, with Sterling Infrastructure Inc (STRL, Financial) receiving an average brokerage rating of 1.3, which falls within the "Buy" category. The rating scale used ranges from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell. Such endorsements highlight the positive sentiment surrounding the stock's future performance.

GuruFocus Valuation Insights

Despite the bullish sentiment, GuruFocus estimates suggest caution with an estimated GF Value of $70.44 for Sterling Infrastructure Inc (STRL, Financial) in one year. This indicates a potential downside of 57.73% from the current market price of $166.66. The GF Value is a proprietary metric by GuruFocus, calculated from historical multiples and growth trends, offering a comprehensive view of fair value. Additional insights can be explored on the Sterling Infrastructure Inc (STRL) Summary page.

This combination of strong earnings, positive analyst sentiment, and cautions regarding valuation highlights the complexity of investment decisions in Sterling Infrastructure. Investors should weigh these factors carefully in the context of their own financial strategies and risk tolerance.