Boot Barn, under the ticker BOOT, has officially named John Hazen as the Chief Executive Officer, a role he will assume starting May 5, 2025. Prior to this appointment, Hazen was fulfilling the responsibilities of Interim CEO from November 2024.

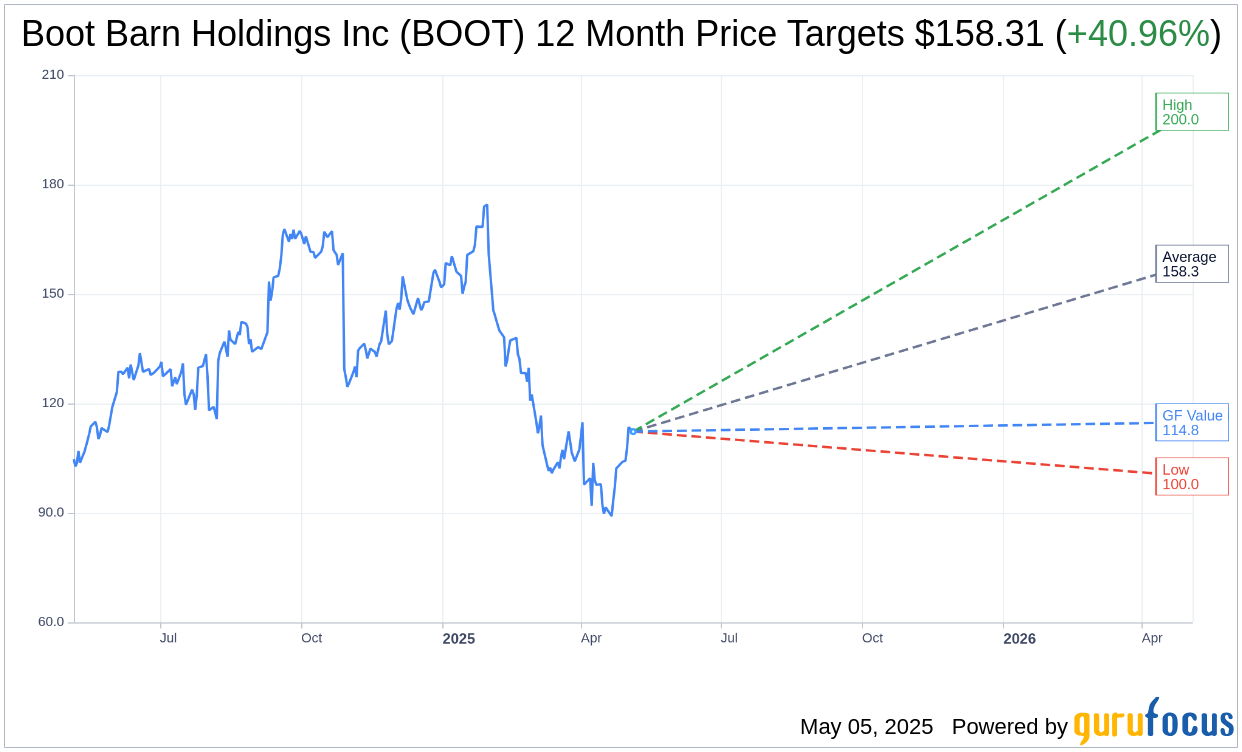

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Boot Barn Holdings Inc (BOOT, Financial) is $158.31 with a high estimate of $200.00 and a low estimate of $100.00. The average target implies an upside of 40.96% from the current price of $112.31. More detailed estimate data can be found on the Boot Barn Holdings Inc (BOOT) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Boot Barn Holdings Inc's (BOOT, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Boot Barn Holdings Inc (BOOT, Financial) in one year is $114.84, suggesting a upside of 2.25% from the current price of $112.31. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Boot Barn Holdings Inc (BOOT) Summary page.

- CEO Buys, CFO Buys: Stocks that are bought by their CEO/CFOs.

- Insider Cluster Buys: Stocks that multiple company officers and directors have bought.

- Double Buys: Companies that both Gurus and Insiders are buying

- Triple Buys: Companies that both Gurus and Insiders are buying, and Company is buying back.