Summary:

- Primoris Services (PRIM, Financial) has exceeded Q1 expectations with robust revenue and earnings growth.

- The company is set to return value to shareholders with a $150 million share buyback plan.

- Analysts see significant upside potential, despite GuruFocus estimates suggesting a downside risk.

In a remarkable first quarter, Primoris Services Corp (NASDAQ: PRIM) has reported stellar financial results. The company posted an adjusted EPS of $0.98, exceeding analyst predictions by $0.32, and achieved a revenue milestone of $1.65 billion, a 17% improvement compared to the same period last year. This performance surpassed revenue forecasts by $160 million. Reinforcing confidence in its growth strategy, Primoris also announced a robust $150 million share buyback plan while maintaining its financial outlook for 2025.

Wall Street Analysts Forecast

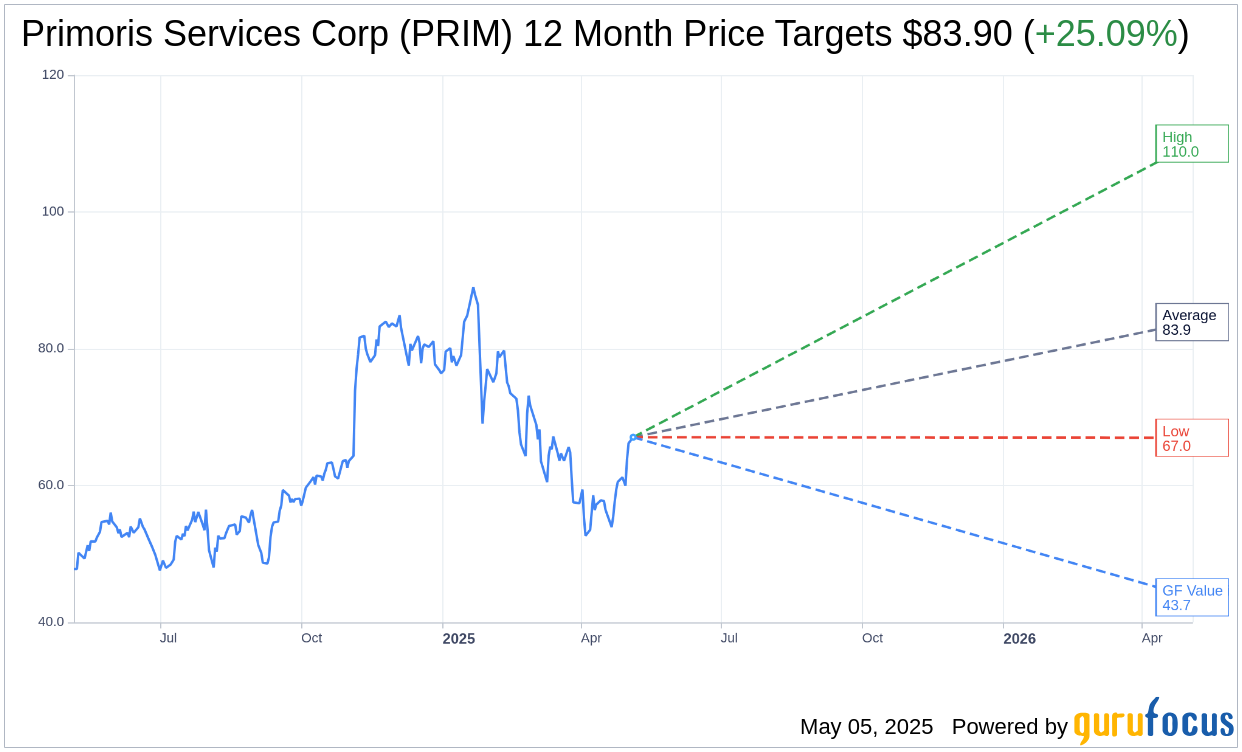

According to projections from 10 analysts, the average target price for Primoris Services Corp (PRIM, Financial) over the next year stands at $83.90, with estimates ranging from a high of $110.00 to a low of $67.00. This average target suggests a potential upside of 25.09% from its current trading price of $67.07. Investors can access more detailed forecast data on the Primoris Services Corp (PRIM) Forecast page.

The consensus from 11 brokerage firms ranks Primoris with an average recommendation of 1.7, categorizing it as "Outperform." The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), reflecting a general bullish sentiment towards Primoris' stock.

However, on a more cautious note, GuruFocus' proprietary estimates suggest a GF Value for Primoris Services Corp (PRIM, Financial) of $43.66 in one year, indicating a potential downside of 34.9% from the current price of $67.07. The GF Value metric offers an estimate of the fair value based on historical multiples, previous growth trajectories, and expected future performance. For a deeper insight into these estimations, visit the Primoris Services Corp (PRIM) Summary page.