Key Takeaways:

- Diversified Healthcare Trust (DHC, Financial) exceeds first-quarter FFO expectations by $0.03.

- Revenue rises 4.3% year-over-year, with significant improvements in SHOP revenues and occupancy rates.

- Analysts forecast an average price target of $3.25, suggesting strong potential upside.

Diversified Healthcare Trust (DHC) has reported a notable first-quarter performance, achieving funds from operations (FFO) of $0.06, thereby surpassing expectations by $0.03. This is indicative of the company's strategic positioning and operational efficiency. The revenue saw an impressive 4.3% increase year-over-year, reaching $386.86 million, which exceeded estimates by $3.69 million. Although there was a minor 1.38% dip in share price, DHC's SHOP (Senior Housing Operating Portfolio) revenues grew by 6.5%, with occupancy rates climbing to 80.2%, and monthly rates increased by 4.8%.

Strategic Developments and Financial Strength

The strategic initiatives undertaken by DHC were pivotal in enhancing its consolidated SHOP Net Operating Income (NOI) by a remarkable 49% to $36.8 million. Moreover, executing mortgage loans totaling $248.9 million, secured by senior living communities, facilitated the partial redemption of its senior unsecured notes, fortifying its financial position.

Wall Street Analysts Forecast

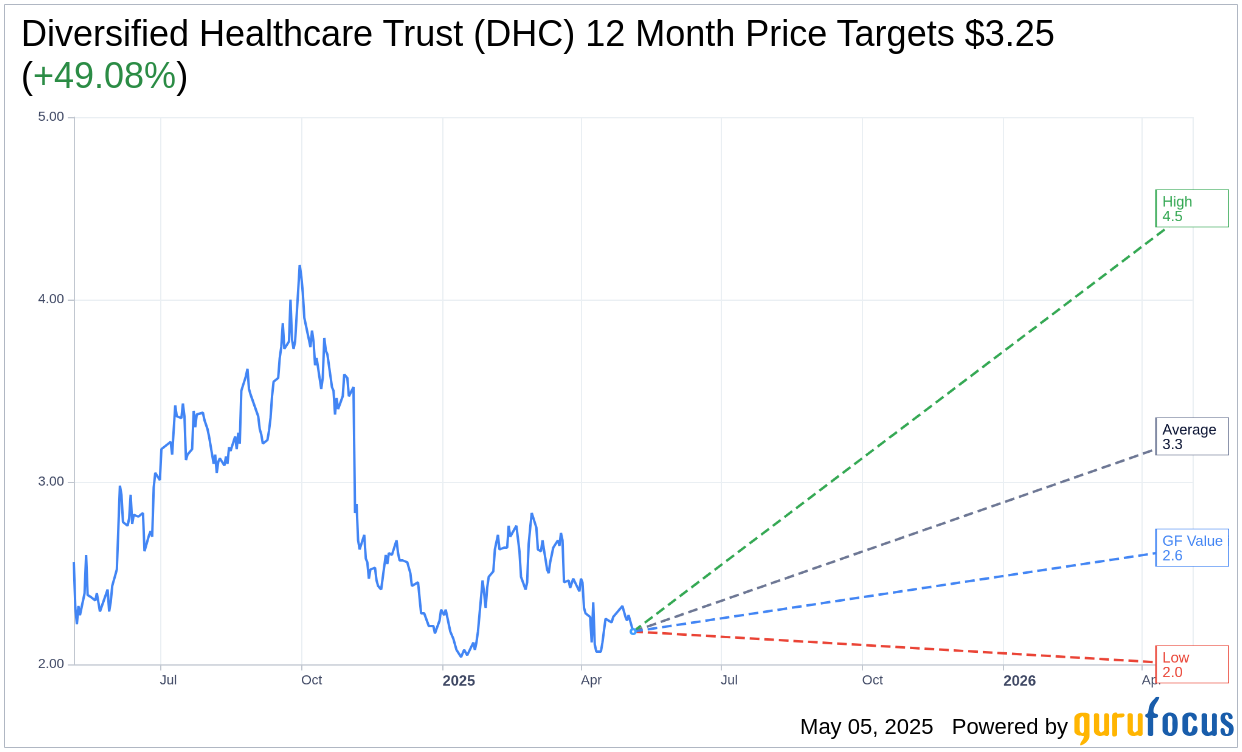

The investment horizon looks promising, with analysts providing a one-year average target price for Diversified Healthcare Trust (DHC, Financial) at $3.25, with estimates ranging from a high of $4.50 to a low of $2.00. This average target implies a substantial upside of 49.08% from the current price of $2.18. For more comprehensive estimate data, visit the Diversified Healthcare Trust (DHC) Forecast page.

The consensus recommendation from three brokerage firms positions Diversified Healthcare Trust (DHC, Financial) at a 3.0, corresponding to a "Hold" status. This recommendation is based on a scale of 1 to 5, where 1 signifies a Strong Buy, and 5 indicates Sell.

GF Value Estimation and Investment Outlook

According to GuruFocus estimates, the projected GF Value for Diversified Healthcare Trust (DHC, Financial) in the upcoming year is $2.64. This suggests a potential upside of 21.1% from the current stock price of $2.18. The GF Value is GuruFocus' calculation of a stock's fair trading value, determined through historical trading multiples, past growth, and future performance projections. Further details are accessible on the Diversified Healthcare Trust (DHC) Summary page.