On May 5, 2025, Primoris Services Corp (PRIM, Financial) released its 8-K filing detailing its financial results for the first quarter ended March 31, 2025. The company, a leading provider of infrastructure services in the United States and Canada, reported significant growth in both revenue and net income, exceeding analyst expectations.

Company Overview

Primoris Services Corp is a prominent infrastructure services provider, operating primarily in the United States and Canada. The company offers a comprehensive range of construction, maintenance, replacement, fabrication, and engineering services to a diverse customer base. Its operations are divided into two main segments: Utilities and Energy. The Utilities segment focuses on the installation and maintenance of natural gas, electric utility distribution, transmission systems, and communication systems. The Energy segment provides services such as engineering, procurement, construction, retrofits, and pipeline construction and maintenance.

Financial Performance Highlights

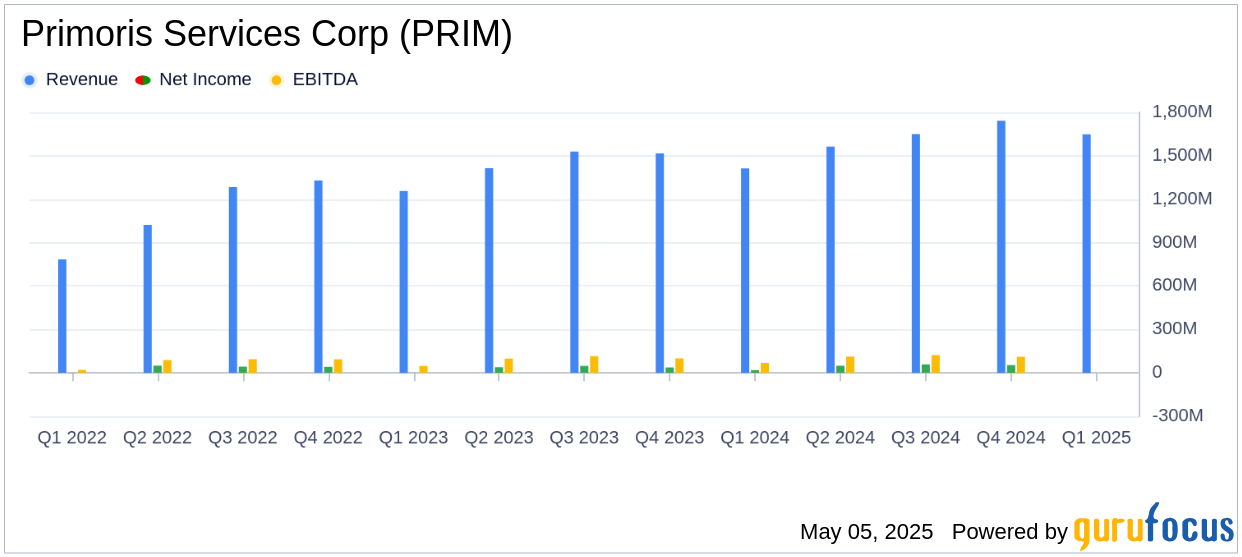

Primoris reported a revenue of $1,648.1 million for Q1 2025, marking a 16.7% increase from the same period in 2024. This figure surpassed the analyst estimate of $1,490.27 million. The growth was primarily driven by strong performances in both the Energy and Utilities segments.

The company's net income for the quarter was $44.2 million, or $0.81 per diluted share, significantly higher than the $0.49 estimated earnings per share. Adjusted net income was $53.5 million, or $0.98 per diluted share, reflecting a substantial increase from the previous year.

Segment Performance and Challenges

The Utilities segment experienced a revenue increase of 15.5%, driven by heightened activity in power delivery, communications, and gas operations. Operating income for this segment rose by $17.9 million due to revenue growth and improved gross margins, which increased to 9.2% from 6.0% in the previous year.

The Energy segment also saw a revenue increase of 17.0%, primarily due to increased renewable energy activity. However, the gross profit margin slightly decreased to 10.7% from 11.0% in the previous year, indicating potential challenges in maintaining profitability amidst rapid growth.

Key Financial Metrics

Primoris reported an adjusted EBITDA of $99.4 million for Q1 2025, a 34.8% increase from the previous year. This improvement highlights the company's effective cost management and operational efficiency. The total backlog stood at $11.4 billion, with a slight decrease from the previous quarter, indicating a robust pipeline of future projects.

Commentary and Strategic Outlook

“Primoris had another great quarter to start 2025, delivering solid execution on our strategy to expand margins and increase cash flow generation,” said David King, Chairman and Interim President and Chief Executive Officer of Primoris.

The company remains optimistic about its future prospects, citing strong demand for infrastructure services in North America. Despite uncertainties in the regulatory and economic environments, Primoris is confident in its ability to meet its full-year 2025 goals.

Conclusion

Primoris Services Corp's strong Q1 2025 performance, driven by significant growth in its core segments, positions the company well for continued success. The ability to exceed analyst estimates in both revenue and earnings per share underscores its strategic execution and market demand. However, maintaining profitability amidst rapid growth and navigating economic uncertainties will be crucial for sustaining this momentum.

Explore the complete 8-K earnings release (here) from Primoris Services Corp for further details.