- Coterra Energy (CTRA, Financial) beats Q1 EPS expectations but misses on revenue.

- Average analyst price target suggests a significant potential upside.

- Company revises 2025 capital spending, maintaining strong cash flow projections.

Coterra Energy (CTRA) recently announced its first-quarter financial results, revealing a Non-GAAP EPS of $0.80, exceeding market expectations. However, the company reported $1.9 billion in revenue, which did not meet analyst predictions. Despite this mixed performance, Coterra Energy has revised its 2025 capital expenditure budget to a range of $2.0 to $2.3 billion, indicating a strategic decision to scale back on the number of operational rigs. Notably, the company's projected cash flow and free cash flow remain robust, offering reassurance to investors.

Wall Street Analysts Forecast

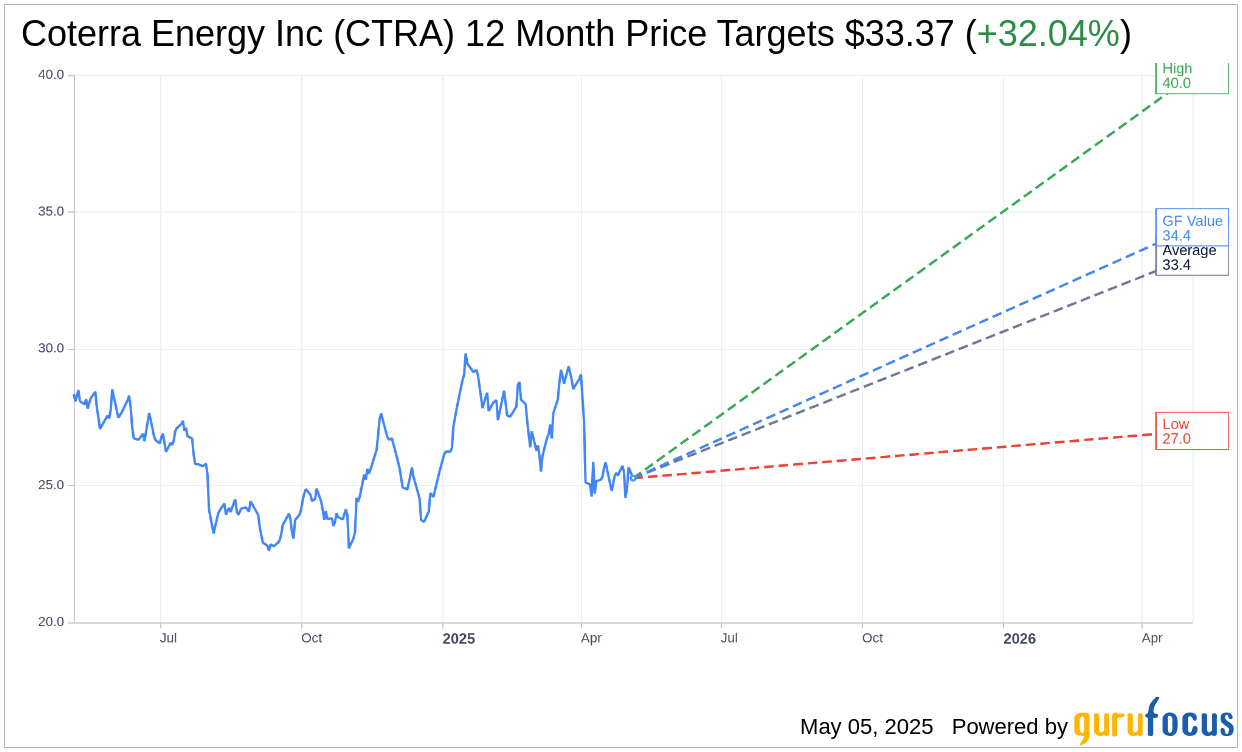

The investment community holds a positive outlook on Coterra Energy Inc (CTRA, Financial). Analysts' one-year price targets from 26 experts average at $33.37, ranging from a high of $40.00 to a low of $27.00. This average target suggests a potential upside of 32.04% from the current trading price of $25.27. For a detailed view of these projections, visit the Coterra Energy Inc (CTRA) Forecast page.

The consensus among 26 brokerage firms rates Coterra Energy Inc (CTRA, Financial) with an average recommendation of 1.9, reflecting an "Outperform" status. On the rating scale of 1 to 5, a score of 1 represents a Strong Buy, while 5 indicates a Sell, positioning Coterra favorably within analyst assessments.

Moreover, GuruFocus' GF Value estimate for Coterra Energy Inc (CTRA, Financial) over the next year is $34.44, implying a substantial upside of 36.29% from its current stock price of $25.27. The GF Value is an esteemed GuruFocus metric that estimates a stock's fair value, derived from its historical trading multiples, past growth trajectories, and projected business performance. Investors seeking more comprehensive analytical data are encouraged to visit the Coterra Energy Inc (CTRA) Summary page.