Key Points:

- Arista Networks (ANET, Financial) is anticipated to report first-quarter earnings on May 6th, with analysts forecasting a significant decline in EPS but strong revenue growth.

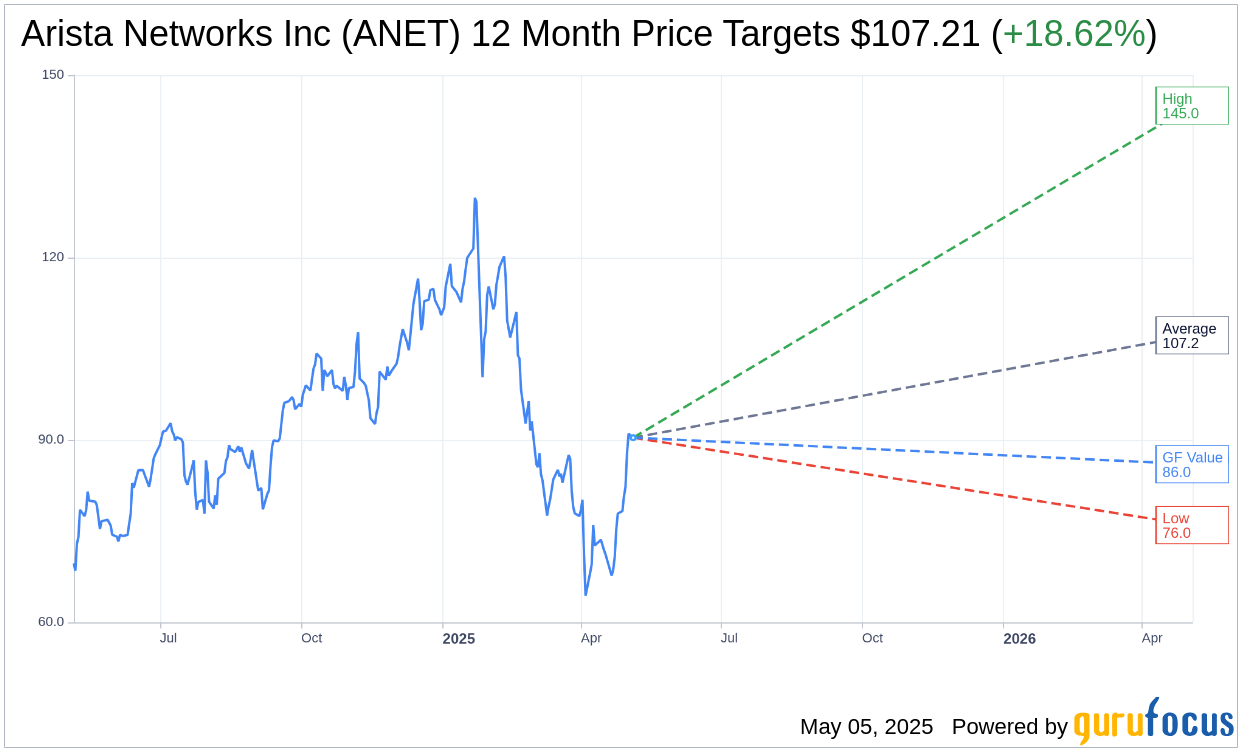

- Wall Street sees potential upside in ANET's stock with an average target price of $107.21, suggesting an 18.62% increase from its current value.

- GuruFocus rates ANET's GF Value at $86.01, indicating a slight downside from the current price.

Anticipated Earnings and Revenue Projections

As Arista Networks (ANET) prepares to announce its first-quarter earnings post-market close on May 6th, investors are keenly watching the expected financial performance. Analysts project a substantial 70.4% year-over-year drop in EPS to $0.59, while forecasting a robust revenue increase of 25.5% to reach $1.97 billion. Historically, ANET has consistently exceeded both EPS and revenue forecasts, adding to the anticipation of its upcoming financial results.

Wall Street Analysts' Outlook

Wall Street analysts provide a one-year price target range for Arista Networks Inc (ANET, Financial), averaging at $107.21. This target ranges from a high estimate of $145.00 to a low estimate of $76.00. Given the current stock price of $90.38, the average projection suggests a potential upside of 18.62%. For detailed estimates, visit the Arista Networks Inc (ANET) Forecast page.

Brokerage Recommendations and GF Value

The consensus rating from 25 brokerage firms positions Arista Networks Inc's (ANET, Financial) stock at an "Outperform" status, with an average recommendation score of 1.9. This rating is derived from a scale of 1 to 5, where 1 is a Strong Buy and 5 represents a Sell. Meanwhile, GuruFocus' GF Value metric estimates ANET's fair value at $86.01, suggesting a 4.84% downside from the stock's current price. The GF Value is calculated based on historical trading multiples and future business performance projections. For more details, view the Arista Networks Inc (ANET) Summary page.