PLOW reported first-quarter revenue of $115.1 million, surpassing analysts' expectations of $107.8 million. The company, known for its extensive industry experience and long-standing history, demonstrated robust performance across both its operational segments, contributing to an overall successful quarter.

Under the leadership of President and CEO Mark Van Genderen, PLOW is committed to driving sustainable and profitable growth. The focus remains on enhancing brand strength and creating long-term value for stakeholders, reflecting the company's dedication to continuous improvement.

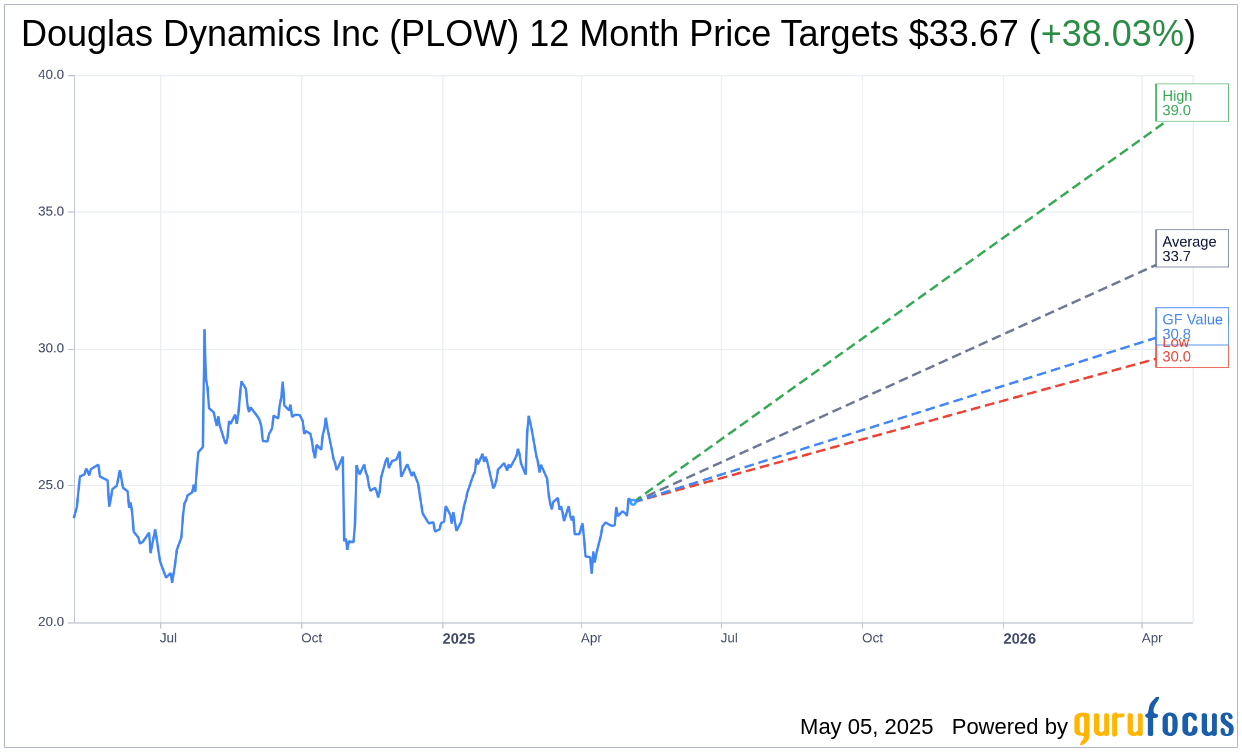

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Douglas Dynamics Inc (PLOW, Financial) is $33.67 with a high estimate of $39.00 and a low estimate of $30.00. The average target implies an upside of 38.03% from the current price of $24.39. More detailed estimate data can be found on the Douglas Dynamics Inc (PLOW) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Douglas Dynamics Inc's (PLOW, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Douglas Dynamics Inc (PLOW, Financial) in one year is $30.82, suggesting a upside of 26.36% from the current price of $24.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Douglas Dynamics Inc (PLOW) Summary page.

PLOW Key Business Developments

Release Date: February 25, 2025

- Net Sales: $568.5 million, essentially flat compared to the previous year.

- Gross Profit: $146.8 million, a 9% increase.

- Gross Margin: Increased by 220 basis points to 25.8%.

- Cost Savings Program: Pre-tax savings of more than $10 million in 2024, with expected annualized savings of $11 million to $12 million.

- Selling, General and Administrative Expenses: Increased by 16% to $91.7 million.

- Net Income: $56.2 million, up from $23.7 million, influenced by a one-time gain from a sale leaseback transaction.

- Adjusted EBITDA: Increased 16% to $79.3 million.

- Adjusted EBITDA Margin: Improved by 200 basis points to approximately 14%.

- Adjusted Net Income: $35.2 million, a 45% increase.

- Adjusted Earnings Per Share: $1.47, a 45% increase.

- Total Backlog: $348 million, an increase of $52 million.

- Work Truck Attachments Sales: Down 12% to $256 million.

- Work Truck Attachments Adjusted EBITDA: $48.5 million, a 4% decline.

- Work Truck Attachments Adjusted EBITDA Margin: Improved by 160 basis points to 18.9%.

- Work Truck Solutions Sales: Grew 13% to $312.5 million.

- Work Truck Solutions Adjusted EBITDA: Increased 76% to $30.9 million.

- Work Truck Solutions Adjusted EBITDA Margin: Improved by 350 basis points to 9.9%.

- Net Cash Provided by Operating Activities: Increased 229% to $41.1 million.

- Free Cash Flow: $33.3 million, an increase of $31.4 million.

- 2025 Net Sales Guidance: Expected to be between $610 million and $650 million.

- 2025 Adjusted EBITDA Guidance: Predicted to range from $75 million to $95 million.

- 2025 Adjusted Earnings Per Share Guidance: Expected to be in the range of $1.30 to $2.10 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Douglas Dynamics Inc (PLOW, Financial) reported improved consolidated results across all metrics compared to the prior year, driven by strong growth in the solution segment and increased margins in the attachment segment.

- The company successfully implemented a cost savings program in 2024, exceeding expectations and resulting in pre-tax savings of over $10 million.

- The Work Truck Solutions segment delivered a record year with impressive top and bottom line growth, driven by strong municipal performance and improved operating performance.

- Douglas Dynamics Inc (PLOW) maintained a strong balance sheet, providing additional options for potential small and medium-sized acquisitions.

- The company appointed a highly qualified new President of Work Truck Attachments, Chris Bernauer, bringing extensive experience and a strong reputation for creating positive and collaborative cultures.

Negative Points

- The Work Truck Attachments segment faced challenging market conditions due to lower than average snowfall, resulting in a 12% decline in sales.

- Selling, general, and administrative expenses increased by approximately 16% due to one-time items, including costs for a sale leaseback transaction and CEO transition costs.

- The effective tax rate for 2024 increased to 24% from 18.9% in the previous year, impacting net income.

- The company experienced softness in the commercial side of the Work Truck Solutions segment, with growth primarily focused on municipal customers.

- Douglas Dynamics Inc (PLOW) remains cautious about the elongated equipment replacement cycle due to lower snowfall in recent years, impacting near-term demand.