Key Takeaways:

- Opendoor Technologies is set to announce its first-quarter earnings with expectations of slight declines in EPS and revenue.

- Analyst forecasts suggest substantial potential upside from current price levels.

- Current brokerage recommendations indicate a "Hold" status for the stock.

Opendoor Technologies Earnings Preview

Opendoor Technologies (OPEN, Financial) is gearing up to report its first-quarter earnings on May 6th after the market closes. Analysts are forecasting an earnings per share (EPS) of -$0.10 alongside a revenue of $1.06 billion, marking an 11.7% decrease year-over-year. Interestingly, despite recent downward revisions, Opendoor has outperformed EPS and revenue expectations 75% of the time over the past year.

Wall Street Analysts Forecast

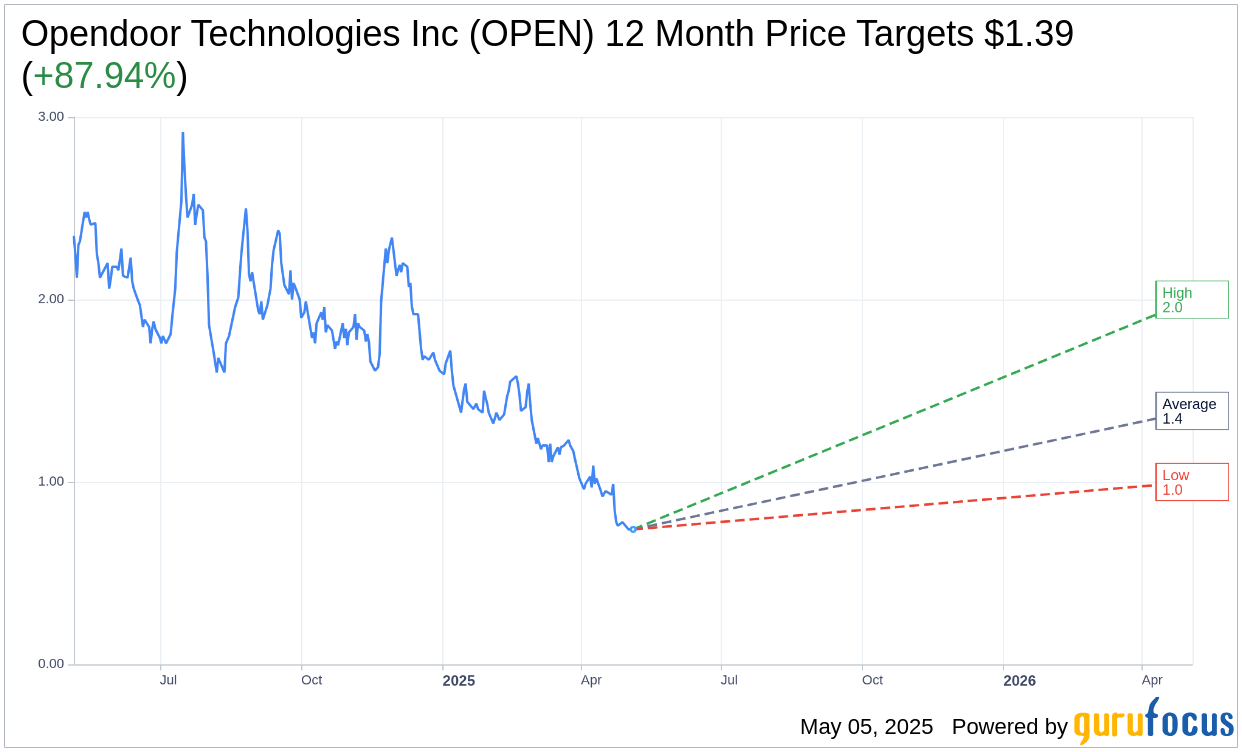

According to the latest analysis by nine industry experts, the average price target for Opendoor Technologies Inc (OPEN, Financial) stands at $1.39. With projections ranging from a high of $2.00 to a low of $1.00, the average target signifies a potential upside of 87.94% from the current stock price of $0.74. Investors seeking more detailed forecasts can find additional insights on the Opendoor Technologies Inc (OPEN) Forecast page.

The stock's consensus recommendation from 11 brokerage firms is currently pegged at 3.0, equating to a "Hold" rating. This rating system operates on a scale where 1 denotes a Strong Buy and 5 represents a Sell.

According to GuruFocus metrics, the projected GF Value for Opendoor Technologies Inc (OPEN, Financial) over the next year is $1.80, indicating a promising upside of 143.57% from the present price of $0.739. The GF Value represents GuruFocus’ assessment of the stock's fair trading value, calculated through historical trading multiples, past business growth, and future performance estimates. For a comprehensive overview, visit the Opendoor Technologies Inc (OPEN) Summary page.