Key Highlights:

- Inspire Medical Systems (INSP, Financial) reports a remarkable 23% increase in Q1 2025 revenue.

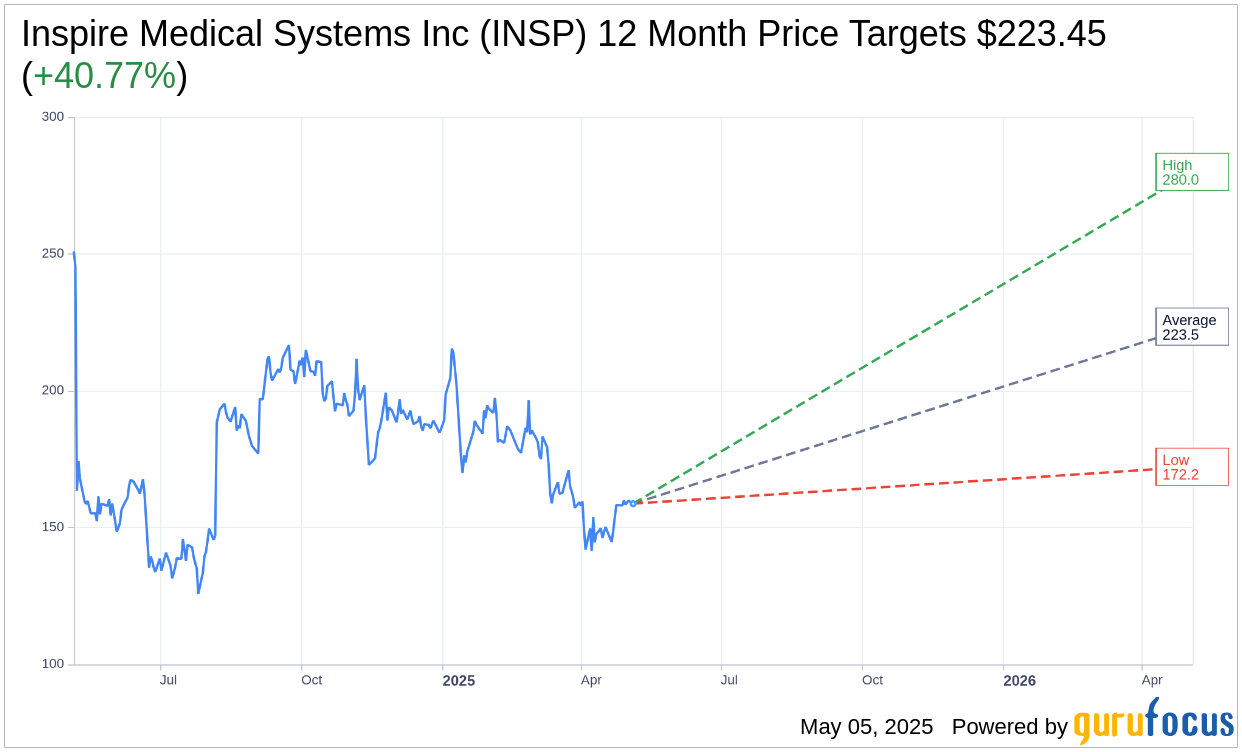

- Analysts forecast a potential price surge, expecting the stock to hit an average of $223.45.

- GuruFocus estimates a substantial upside of 176.28%, predicting a fair value of $438.57.

Inspire Medical Systems Inc. (INSP) has released its impressive first-quarter financial results for 2025. The company achieved a revenue of $201.3 million, marking a robust 23% growth compared to the same period last year. Notably, Inspire Medical Systems transitioned into profitability, posting a net income of $3 million, a turnaround from the net loss encountered in Q1 2024. CEO Tim Herbert attributed this success to the U.S. launch of the Inspire V system and anticipates continued solid growth prospects.

Wall Street Analysts Forecast

According to the one-year price targets provided by 16 analysts, Inspire Medical Systems Inc. (INSP, Financial) is projected to reach an average price of $223.45. The analysts' estimates range from a high of $280.00 to a low of $172.22, implying a potential upside of 40.77% from the current price of $158.74. For further detailed estimates, visit the Inspire Medical Systems Inc (INSP) Forecast page.

The consensus among 20 brokerage firms is an "Outperform" status for Inspire Medical Systems Inc. (INSP, Financial), with an average brokerage recommendation of 2.1. This rating is derived from a scale where 1 indicates a Strong Buy and 5 suggests a Sell, showcasing investor confidence in the stock.

Looking at the estimates from GuruFocus, the GF Value for Inspire Medical Systems Inc (INSP, Financial) in the coming year is projected to be $438.57. This indicates a significant upside potential of 176.28% from the current price of $158.74. The GF Value, a metric developed by GuruFocus, calculates the fair trading value of a stock based on its historical trading multiples, past business growth, and future performance estimates. More comprehensive data is accessible on the Inspire Medical Systems Inc (INSP) Summary page.